Why is The Crypto Market Down Today?

0

0

Following yesterday’s positive start to the trading week, sentiment appears to have dampened slightly, with traders pulling back amid growing caution.

The total cryptocurrency market cap (TOTAL) and Bitcoin (BTC) have edged lower over the past 24 hours, confirming the dip in broader market momentum. Meme coin SPX leads with the most price decline during this period.

In the news today:

- Gate.io briefly announced a July 12 presale for Pump.fun’s PUMP token with a $600 million target, but quickly removed all references.

- Bit Digital (BTBT) has sold all its Bitcoin holdings and shifted its treasury entirely to Ethereum, becoming one of the largest publicly listed ETH holders with 100,603 ETH worth $254.8 million.

Crypto Market in Holding Pattern as TOTAL Struggles for Breakout

Over the past day, the total crypto market capitalization has dropped by $20 billion. TOTAL currently stands at $3.30 trillion, struggling to break out of the narrow range it has traded within since last week.

Readings from the one-day chart reveal that since July 3, TOTAL has faced resistance at $3.35 trillion and found support at $3.27 trillion.

This narrow trading band suggests a period of indecision among market participants, with neither bullish nor bearish forces gaining enough momentum to spark a breakout in either direction.

If buy-side momentum strengthens, a breakout above the $3.35 trillion resistance level is possible. Should this barrier be successfully flipped into a support zone, TOTAL could rally toward $3.44 trillion.

However, this would require a notable surge in buying activity to sustain upward pressure.

Total Crypto Market Cap Analysis. Source: TradingView

Total Crypto Market Cap Analysis. Source: TradingView

Conversely, if bearish sentiment intensifies and volatility increases, TOTAL risks a break below the $3.27 trillion support level. Such a move could open the door for further losses, potentially driving the market cap down toward $3.22 trillion.

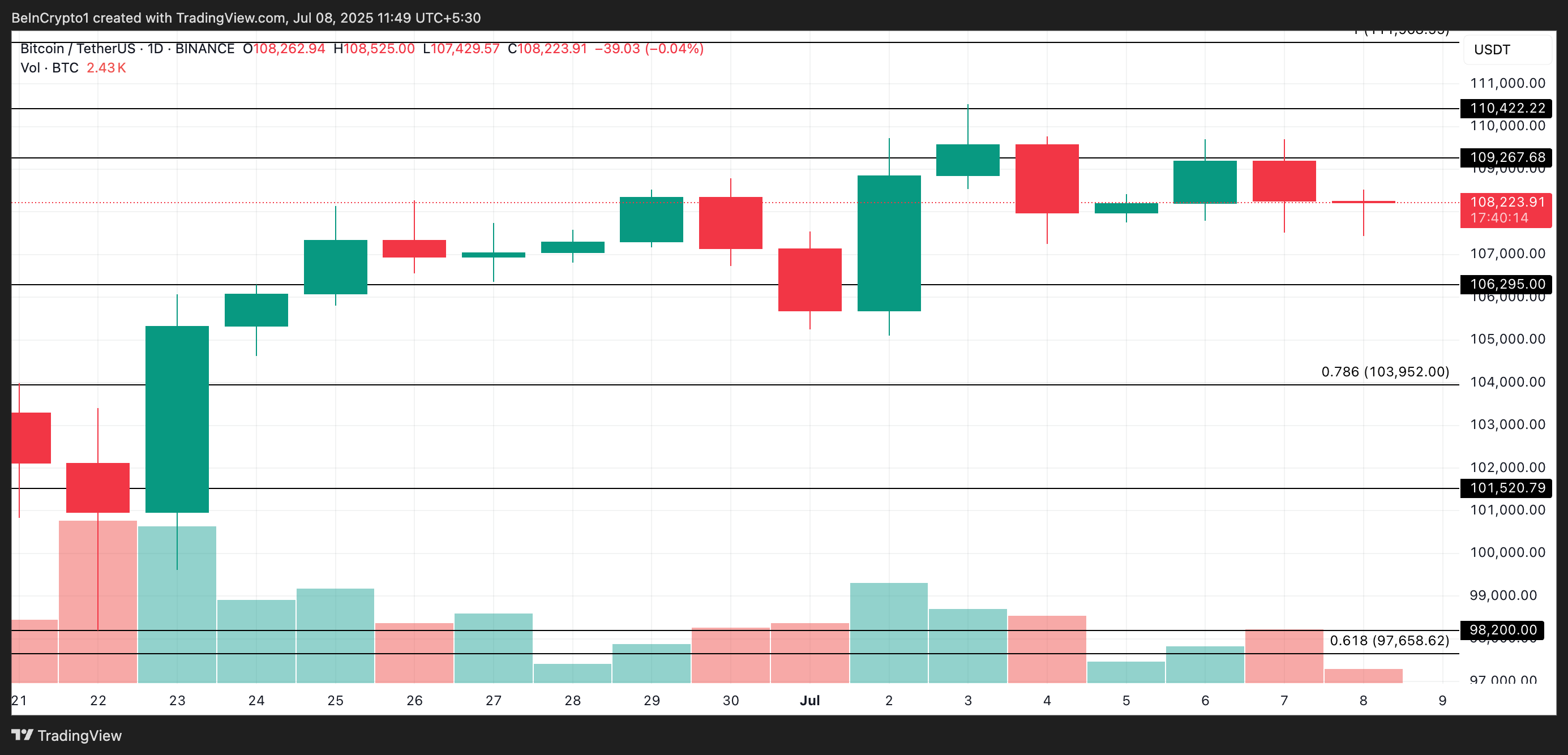

BTC Slides Amid Rising Sell Pressure

Leading coin Bitcoin trades at $108,206, down 1% today. Interestingly, its daily trading volume is up 15% and totals $44 billion, confirming the market’s heightened selling pressure.

When an asset’s price drops while its trading volume rises, it suggests that more traders are actively selling the asset due to negative sentiment, fear, or losses.

The king coin could slip further to $106,295 if selling pressure gains momentum.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

On the other hand, if buying activity soars, it could push BTC’s price to $109,267.

SPX6900 (SPX)

SPX’s price has dropped 8% in the past 24 hours, making it the altcoin with the most losses during that period.

On the daily chart, the token’s negative Balance of Power (BoP) hints at the likelihood of further declines. This indicator, which measures the strength of buyers versus sellers in a given market over a specific period, is below zero at press time, at -0.42.

When an asset’s BoP is negative, it suggests that sellers have more control over the market, pushing prices downward. If this trend continues, SPX risks extending its losses and plunging below $1.21.

SPX Price Analysis. Source: TradingView

SPX Price Analysis. Source: TradingView

However, if buying activity resumes, it could drive the altcoin’s price up to $1.35.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.