Bitcoin Eyes $95K as Trump Abandons Plan to Fire Fed Chair Powell and Hints at Tariff Cuts

0

0

Highlights:

- Bitcoin price surged past $94,000 after Trump’s remarks on Powell’s future.

- Donald Trump shifted his stance, backing Powell despite previous criticism and calls for dismissal.

- Trump hinted at reducing tariffs on Chinese imports, easing investor concerns over his policies.

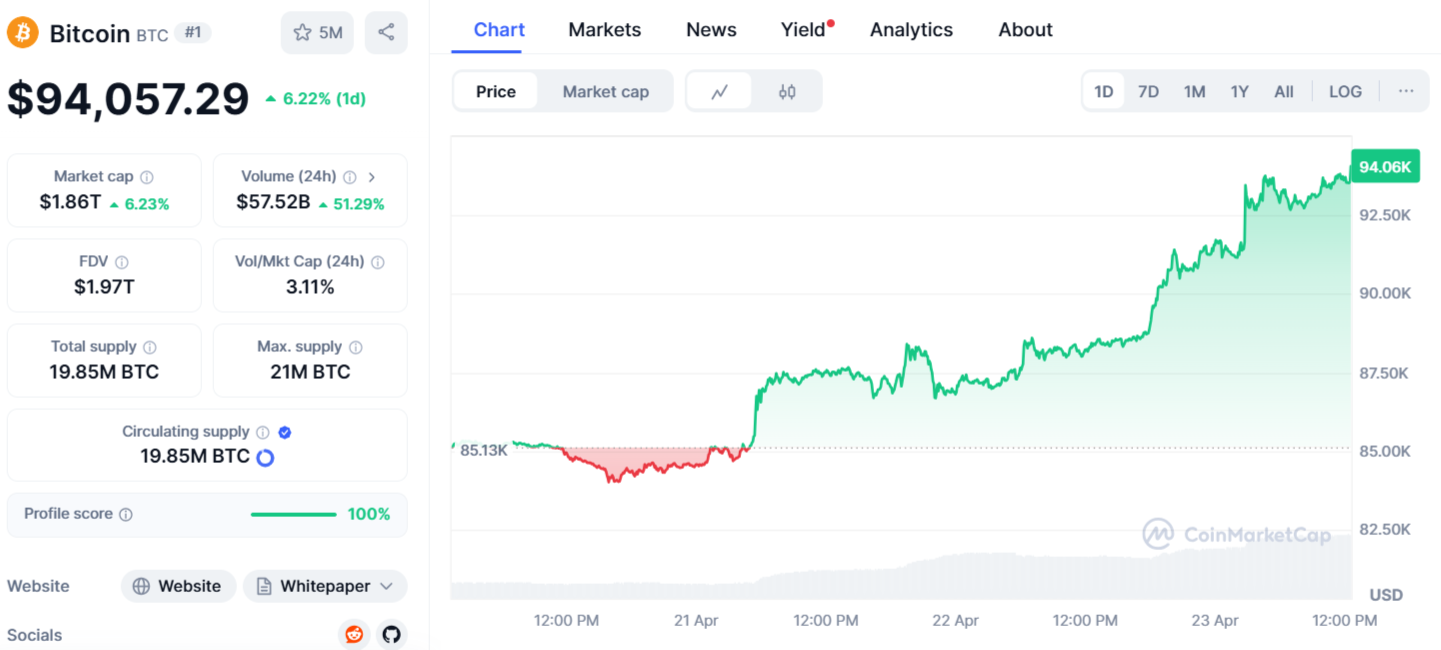

Bitcoin (BTC) surged past $94K on following President Donald Trump’s remarks that he had “no intention” of removing Federal Reserve Chair Jerome Powell. His comments represented a significant change in tone from earlier this week, when he called Powell a “major loser” and suggested firing him. The president has consistently criticized the Federal Reserve for not lowering interest rates quickly enough, even though he nominated Powell to lead the central bank in 2017.

Trump told reporters in the Oval Office, “I would like to see him be a little more active in terms of his idea to lower interest rates…but, no, I have no intention to fire him.”

Donald Trump also Hints at Tariff Cuts

Trump suggested that tariffs on Chinese imports might be reduced, easing concerns for investors. He called the 145% tariff on Chinese goods “very high” and said, “It won’t be that high. It will come down substantially. But it won’t be zero. It used to be zero.” The comments brought some stability to global markets, lifting U.S. stock futures and the dollar, while gold retreated from record highs.

.@POTUS on Fed Chair Jerome Powell: "I have no intention of firing him. I would like to see him be a little more active in terms of his idea to lower interest rates … but, no, I have no intention to fire him." pic.twitter.com/PoWuuCqUwT

— Rapid Response 47 (@RapidResponse47) April 22, 2025

Under the Federal Reserve Act, governors, including the chair, can only be removed “for cause.” This typically involves serious misconduct or failure to perform duties. Powell has said he believes the president cannot legally remove him and would fight any attempt to do so. Despite this, Trump has frequently criticized Powell. Last week, he told reporters, “If I want him out, he’ll be out of there real fast, believe me.” On Monday, he renewed his criticism online.

US Stocks, Dollar, BTC, ETH, and XRP Surge

Futures for the Dow Jones Industrial Average climbed 444 points, up 1.1%. Nasdaq 100 futures rose 1.6% and S&P 500 futures grew by 1.4%. This occurred just hours after the Dow had closed the day up more than 1,000 points, ending a four-day losing streak. Both the S&P 500 and Nasdaq Composite also saw gains above 2% on Tuesday, signaling that investors were directly responding to Trump’s comments about Powell.

Bitcoin surged about 6.22% overnight, reaching $94,057 on Wednesday following Trump’s press comments. Smaller tokens like Ether, XRP, and Solana also saw gains in the hours after Trump confirmed Powell’s position.

Despite the rally, some traders warned that the gains may not be sustained. Stefan von Haenisch, who heads over-the-counter trading in Asia-Pacific for Bitgo, expressed concerns that the market had moved too quickly. He mentioned, “The market has rallied relentlessly and feels a bit overbought.” He added that a decline to $88,000 for Bitcoin by week’s end wouldn’t be unexpected.

U.S. Bitcoin ETFs See $936 Million in Inflows

On Tuesday, U.S. Bitcoin exchange-traded funds (ETFs) saw $936 million in net inflows, the largest since Jan. 17. Ark & 21Shares led with $267.1 million, followed by Fidelity’s FBTC with $253.8 million, and BlackRock’s IBIT with $193.5 million. Over the last three days, BTC ETFs saw net inflows exceeding $1.4 billion.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.