One of the Largest Stablecoin Issuers Is Considering an IPO

0

0

Circle Internet Financial, the issuer of the USDC stablecoin, is reportedly exploring the possibility of going public in early 2024.

The company is allegedly in talks with advisors to prepare for a potential initial public offering (IPO).

Stablecoin Issuer Circle to Go Public

These discussions, as per the sources who preferred to remain anonymous, are still in the early stages. It also remains uncertain whether Circle will ultimately decide to proceed with the listing. The valuation Circle might seek in an IPO is also unclear.

It is noteworthy that the company was valued at $9 billion during its attempted public listing through a blank-check deal in 2022.

A representative for Circle commented on the matter. He stated, “Becoming a US-listed public company has long been part of Circle’s strategic aspirations. We don’t comment on rumors.” This statement reflects Circle’s long-term vision but maintains discretion on the specifics of their IPO plans.

The path to an IPO comes after Circle’s decision last year to terminate a merger agreement with Concord Acquisition, a blank-check company led by former Barclays CEO Bob Diamond. This move signaled Circle’s shifting strategies in its pursuit of going public.

Circle has notable financial backing, having raised funds from prominent investors. Some include Goldman Sachs, General Catalyst Partners, BlackRock, Fidelity, and Marshall Wace. Axios reported the company’s worth at $7.7 billion in a 2022 funding round.

The company plays a pivotal role in the cryptocurrency sector as the issuer of one of the world’s largest stablecoins. Stablecoins like USDC are crypto tokens pegged to a stable asset, such as the US dollar, and are primarily used by traders for transferring cryptos between exchanges.

Read more: What is a Stablecoin and How do They Work?

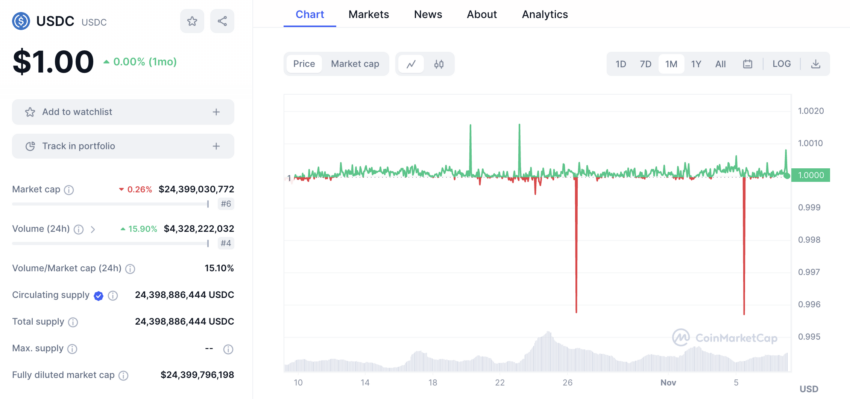

Earlier this year, Circle disclosed a $3.3 billion exposure to the collapsed Silicon Valley Bank, an event that temporarily destabilized the peg of the USDC.

USDC Price Performance. Source: CoinMarketCap

USDC Price Performance. Source: CoinMarketCap

Looking ahead, Circle has plans to maintain transparency in its financial operations. Indeed, the company intends to publish financial reports regularly and has appointed Deloitte as its auditor.

This move towards transparency could be pivotal as Circle navigates the complex US crypto regulation environment, which, according to CEO Jeremy Allaire, could soon see a major change.

“Having spearheaded these policy efforts on the global stage, the US government is right now looking at passing new laws for dollar stablecoins, which will have profound implications for the Internet financial system,” Allaire said.

0

0

Gerencie todo seu criptograma, NFT e DeFi de um só lugar

Gerencie todo seu criptograma, NFT e DeFi de um só lugarConecte com segurança o portfólio que você está usando para começar.