Kaito Airdrops Over $74 Million Amid Rise of Attention Capital in Crypto

0

0

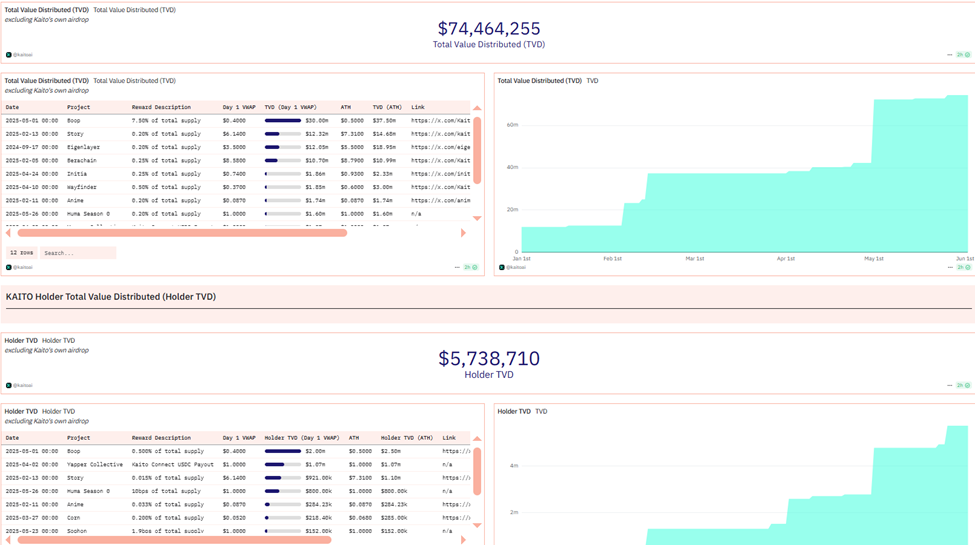

Web3 AI platform Kaito has quietly become one of the largest distributors of on-chain incentives. According to Dune Analytics data, it has surpassed $74 million in total value distributed, airdropped to over 5.7 million wallet holders.

It comes amid the emergence of a new narrative in crypto: Attention Capital Markets, a niche term loosely derived from Solana’s Internet Capital Markets.

Kaito’s Attention Economy: Airdrops, Incentives, and Network Effects

Data on Dune shows Kaito has distributed over $74 million in airdrops to 5.7 million wallets. Meanwhile, the platform’s token, KAITO, has rebounded over 150% since the start of May.

Key drivers include increased staking participation and alignment with a new attention-based economy.

KAITO tokens’ total value and the holder count are distributed. Source: Dune dashboard

KAITO tokens’ total value and the holder count are distributed. Source: Dune dashboard

Meanwhile, more than 28 million KAITO tokens are now staked, representing over 10% of the circulating supply. These stakers or platform users seek further airdrop exposure and yield through Kaito’s staking and farming programs.

The numbers position Kaito at the forefront of an emerging trend, monetizing social attention in crypto through incentivized content creation and identity-building.

One of Kaito’s most vocal power users is Simon Dedic, CEO and Partner at Moonrock Capital. In a post on X (Twitter), he credited the platform with changing how he earns and engages online.

“I’ve been using Kaito AI for almost a year now, and I can honestly say it’s one of the most impactful tools I’ve ever adopted in crypto. Not just because it’s helped me earn close to $200,000 for doing nothing, because it’s fundamentally changed how I create, how I engage, and where my career is headed,” Dedic said.

By connecting his X account and contributing to Kaito’s “Yap” system—a social layer built around high-signal commentary—Dedic earned a massive KAITO airdrop.

He then staked it to farm additional rewards from projects like Wayfinder, Boop.fun, and Huma Finance. Beyond financial upside, Dedic also emphasized Kaito’s behavioral impact.

“Kaito’s launch — with yaps, leaderboards, and visibility metrics — gave me a real reason to become more consistent, intentional, and thoughtful in how I tweet. That alone kicked off a massive growth flywheel… founders realized I wasn’t just throwing bags around — I was actually helping build attention,” he added.

From Passive Income to Influence: How Kaito Rewards Participation

Kaito Founder Yu Hu has framed this movement as part of a deeper “InfoFi” vision, arguing that attention is now a core driver of value and valuation in crypto.

“In an attention economy, attention is inherently valuable. The nuanced take is the value of attention depends on the retention, the consensus, the underlying subject (i.e. product), the quality, and many other factors,” Hu explained.

He also explained how Kaito’s infrastructure bridges attention to action. Specifically, features like Kaito Earn enable user conversion, while the upcoming Capital Launchpad is for capital formation.

The goal is to turn high-quality content and engagement into network growth and investment opportunities.

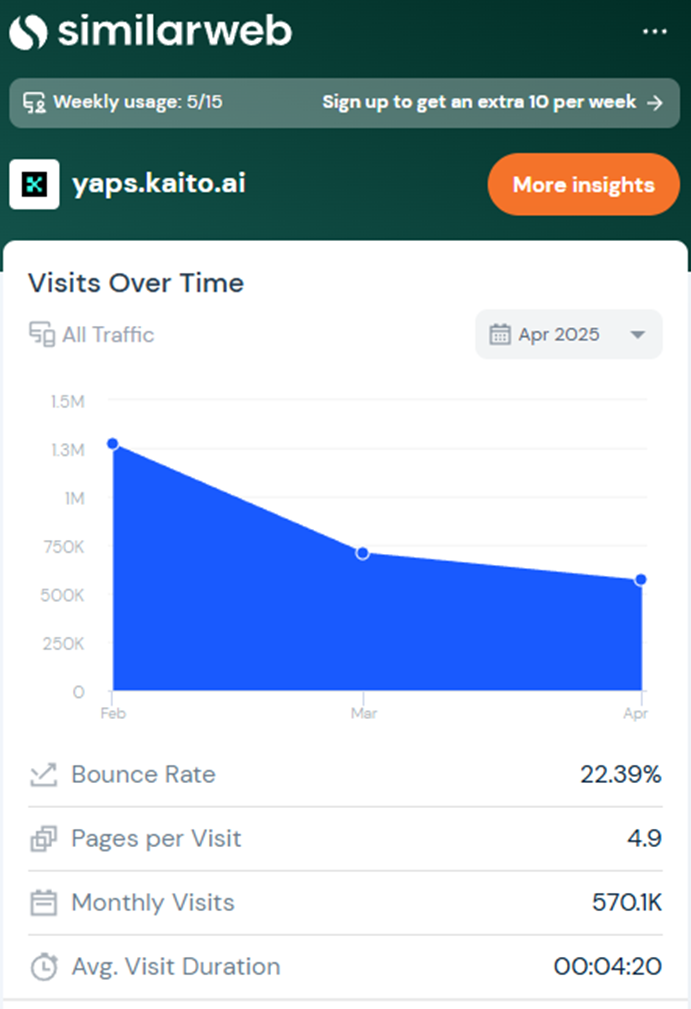

Still, not all the metrics paint a rosy picture. According to Similarweb data, Kaito’s traffic fell from 1.3 million monthly visits in February to 570,000 in April. The 56% drop suggests waning interest or a shift in user behavior.

Kaito platform visits. Source: Similarweb

Kaito platform visits. Source: Similarweb

Additionally, with KAITO’s token unlocks paused until August, analysts caution that selling pressure could return later this summer.

Nevertheless, as attention becomes increasingly commoditized in Web3, Kaito’s growth signals a new meta about yield, on-chain identity, influence, and long-term alignment.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.