ARK Invest Backs BitMine as Treasury Surpasses 2 Million Ethereum

0

0

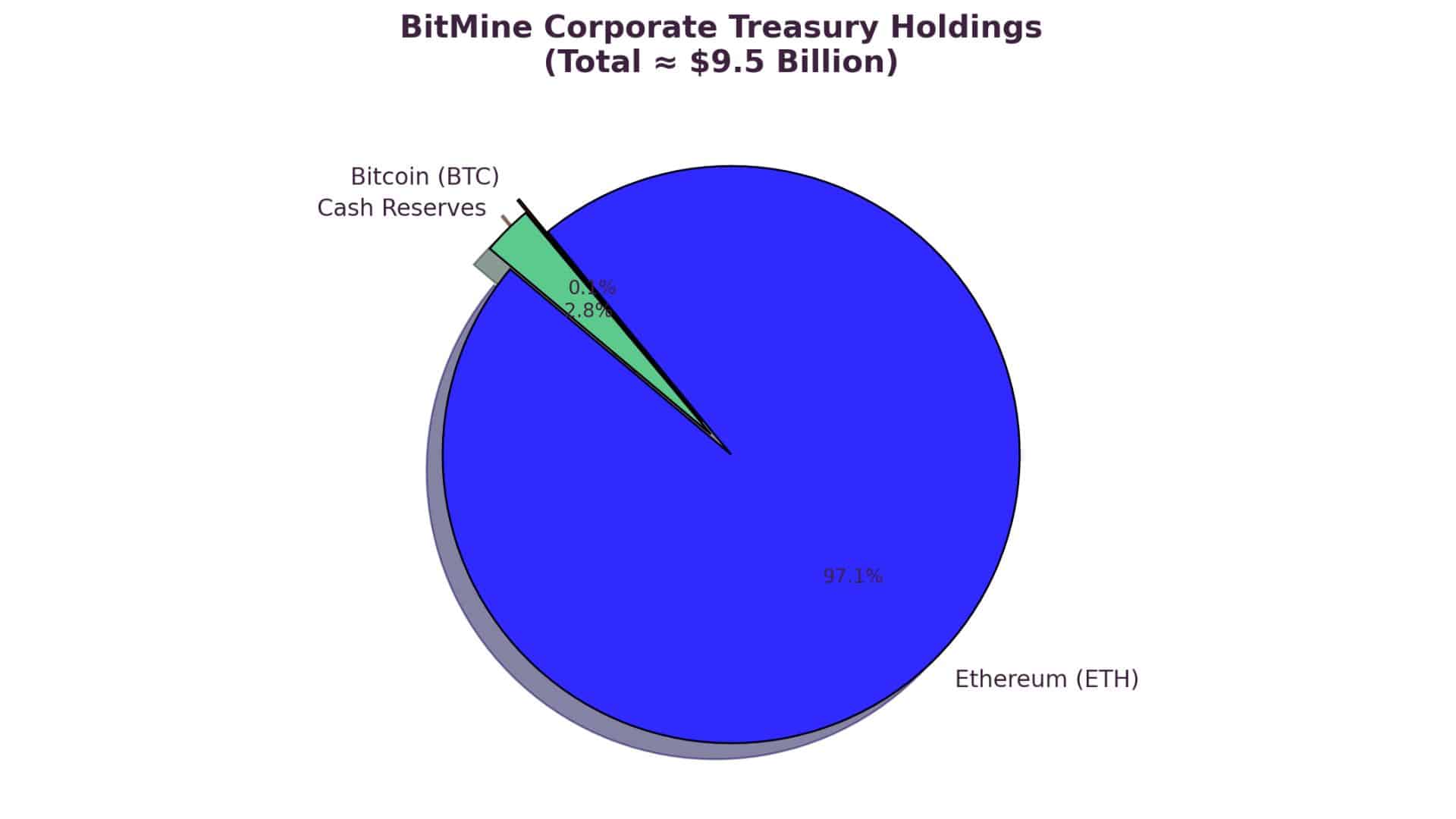

As per recent reports, BitMine 2 million ETH has turned into a headline milestone in the corporate crypto race. The company now holds more than two million Ethereum, placing its treasury at a value exceeding $9 billion.

Analysts say this achievement may redefine how companies approach digital assets as part of long-term balance sheet strategies.

ARK Invest Strengthens Its Position

Investment firm ARK Invest has steadily increased its exposure to BitMine this summer. On July 22, ARK purchased 4.77 million shares, valued at approximately $182 million, with the majority of the funds allocated toward ETH acquisitions.

ARK followed up with several smaller buys, including a $15.6 million purchase in late August and another $16 million round in early September. In its most recent move, the firm added about 102,000 shares after BitMine confirmed its new milestone.

ARK founder Cathie Wood has long supported Ethereum, saying earlier this year that ETH could become “a reserve currency for the decentralized economy”.

Read more: Is Ethereum Ready for a $5K Breakout? BitMine Treasury Buys Signal Market Bottom

Why BitMine 2 Million ETH Matters

Crossing this mark puts BitMine in the lead as the largest corporate holder of Ethereum worldwide. The treasury now includes:

- 2.07 million ETH

- 192 Bitcoin

- $266 million in cash

Market strategists compare this to the early days of Bitcoin, when corporate treasuries were involved. Only this time, Ethereum sits at the center of a new trend.

Moonshot Strategy and Market Sentiment

BitMine also launched a $20 million “Moonshot” initiative to support digital identity projects, including Worldcoin. This allocation represents approximately 1% of its balance sheet and aims to fund ventures within the Ethereum-based ecosystem.

Screenshots circulating on X show traders discussing how BitMine’s accumulation may reduce ETH’s liquid supply. One post read that “institutional holding of ETH has the same price-flooring effect as Bitcoin once did for corporate treasuries”.

Broader Market Impact

Analysts believe the ripple effect of BitMine 2 million ETH could go beyond one company. If more corporations adopt ETH reserves, the reduced float could influence long-term price action.

According to Daniel Ivanov, senior analyst at The Financial Analyst, “corporate treasuries are beginning to view ether not just as ‘gas’ for decentralized applications but as a strategic reserve asset.”

That shift may soon be tested by competitors watching BitMine’s performance closely.

Conclusion

Based on the latest research, BitMine 2 million ETH is not just a milestone but a signal of Ethereum’s shift into corporate finance. Backed by ARK Invest and fueled by strategic Moonshot projects, BitMine has revolutionized how companies approach their treasuries.

As Ethereum gains a stronger foothold in balance sheets, this milestone may mark the beginning of a new chapter where ETH joins the ranks of global reserve assets.

Read more: Crypto Whales Spark Chaos with Billions in Bitcoin Ethereum and Altcoin Moves

Summary

BitMine, with 2 million ETH, has reshaped corporate crypto strategy, securing its place as the top Ethereum treasury. With ARK Invest support and fresh ecosystem bets, BitMine set the pace for Ethereum’s role in global treasuries. For readers, this milestone signals a decisive shift in how companies value ETH in the digital economy.

Glossary of Key Terms

- ETH: Native token of the Ethereum blockchain.

- Treasury: Corporate reserves of assets, both digital and traditional.

- Moonshot Strategy: A high-risk, high-reward investment allocation.

- Web3: A decentralized internet built on blockchain infrastructure.

FAQs for BitMine 2 million ETH

Q1: Why is BitMine 2 million ETH significant?

It makes BitMine the largest corporate holder of Ethereum, signaling stronger institutional trust.

Q2: How much is BitMine’s ETH worth today?

The holdings equal about $9.2 billion at current prices.

Q3: What role did ARK Invest play?

ARK provided more than $300 million in funding through equity purchases, fueling ETH buys.

Q4: Does BitMine hold other assets?

Yes, including Bitcoin, cash reserves, and a Moonshot fund.

Read More: ARK Invest Backs BitMine as Treasury Surpasses 2 Million Ethereum">ARK Invest Backs BitMine as Treasury Surpasses 2 Million Ethereum

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.