Trump’s World Liberty Financial Introduces Restaking for its USD1 Stablecoin

0

0

World Liberty Financial is integrating its USD1 stablecoin with Kernel DAO, enabling restaking to earn passive rewards. This will be the first time that USD1 can secure third-party apps in the blockchain ecosystem.

Neither company provided a lot of specific details about the restaking plan, but it seems straightforward for the most part. KERNEL’s value briefly spiked after the partnership announcement.

USD1 Restaking on Kernel DAO

President Trump has been involved in several crypto projects lately, and World Liberty Financial (WLFI) is gaining real prominence.

Its stablecoin, USD1, has achieved a high market cap and increased trade volume in recent weeks. Today, WLFI’s new partnership with Kernel DAO will enable USD1 restaking, opening up new possibilities:

WLFI’s partnership here builds on several prior developments. It has already partnered with StakeStone for USD1 staking and with Lista DAO for stable yield farming. Kernel DAO’s restaking will provide USD1 holders another way to gain passive rewards.

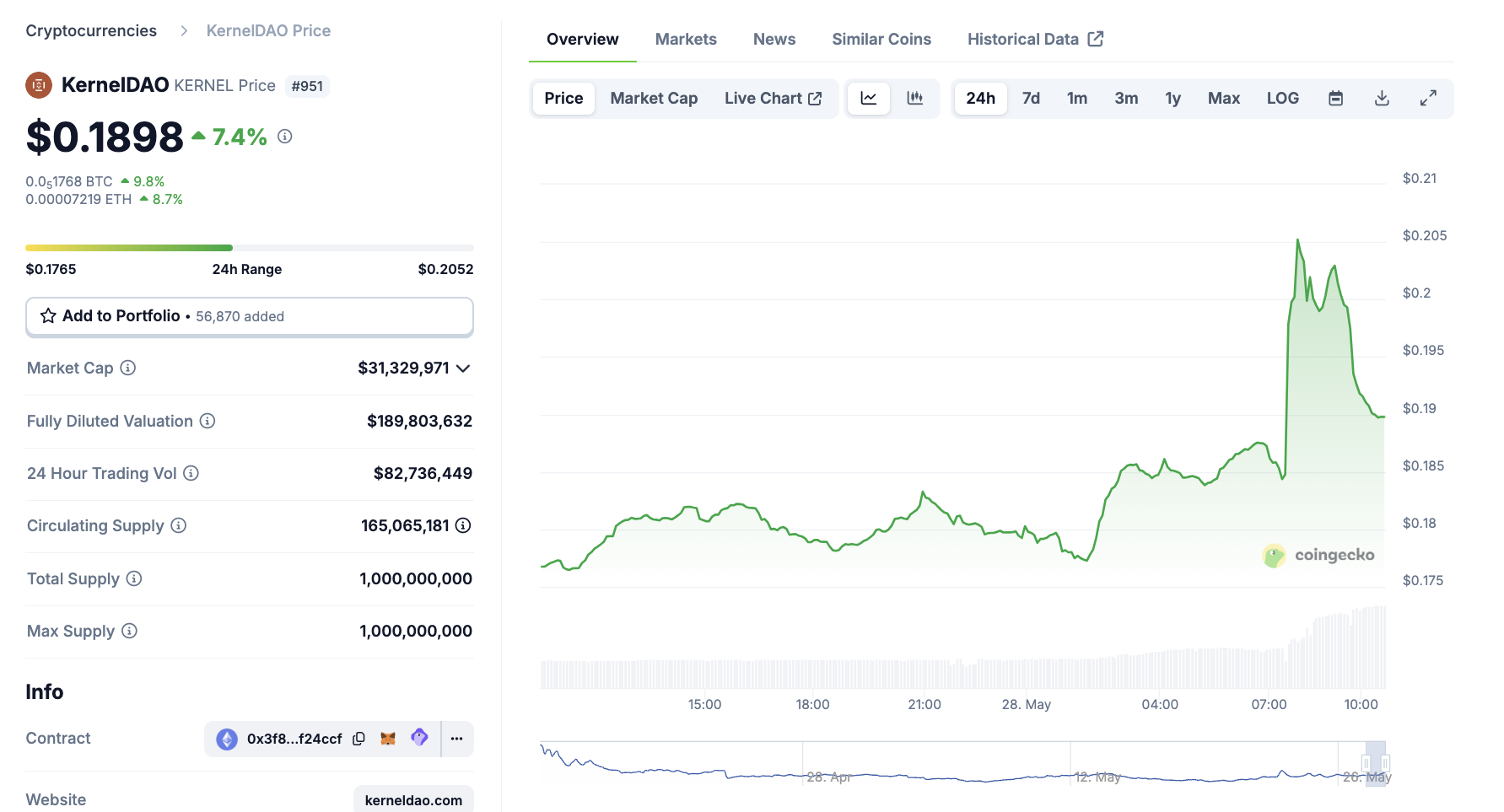

Additionally, WLFI stated that this is the first time its stablecoin will help secure third-party blockchain apps. After Kernel DAO announced this USD1 deal, its KERNEL token jumped over 7% in valuation.

KERNEL Price Performance. Source: CoinGecko

KERNEL Price Performance. Source: CoinGecko

For the most part, KERNEL’s price gains reflect the community’s enthusiasm about this new partnership.

Furthermore, these two firms have another thing in common. Kernel DAO, a popular DeFi protocol, has received major investment from Binance on several occasions.

WLFI, too, has business with Binance. It was the first major exchange to list USD1, and the two firms have allegedly conducted major negotiations, which may have put them in the same orbit.

Since its launch, USD1 has seen significant backlash from US democrats and policymakers. Regardless, the stablecoin has ramped up more than $2.1 billion in market cap within a month of launch.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.