Bitcoin Rebounds From $83k Low Amid MSCI Threat to Crypto Treasuries 📈

0

0

👋 Welcome to the CoinStats Scoop, your weekly newsletter bringing you the most groundbreaking Web3 innovations and market-moving headlines in the crypto space.

Stay in the loop with all the key market moves, emerging trends, and exciting developments from the past week 📈.

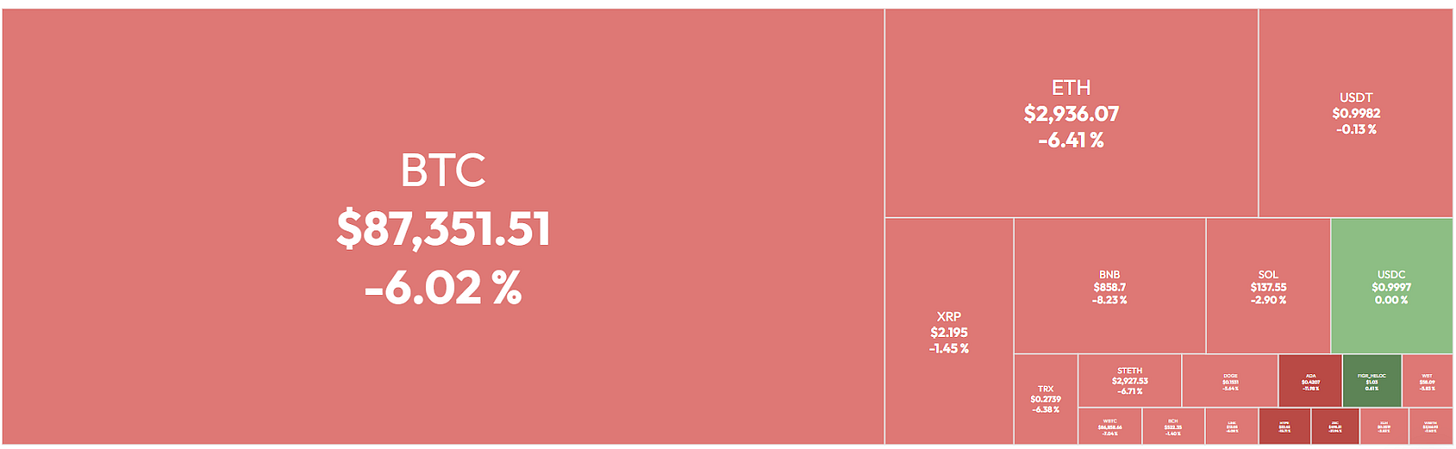

Cryptocurrency markets continued the previous week’s decline, after Bitcoin’s slide below $90,000 inspired a new wave of panic selling among retail participants and investment products.

Bitcoin fell to a 7-month low of $83,600 earlier this week, but saw a sharp recovery rally that stopped just shy of the $90,000 psychological mark.

Leading analysts, including Arthur Hayes, said the decline to the low $80,000 range marked the local bottom for Bitcoin, which will start recovering after recapturing the $90,000 level 📊.

However, mass selling of Bitcoin exchange-traded funds (ETFs) is presenting a massive challenge for Bitcoin’s momentum, as the ETFs sold $900 million BTC in a single day on November 20.

As for Bitcoin’s year-end performance, it may very well depend on the outcome of December’s interest rate decision from the Federal Reserve.

In this week’s CoinStats Scoop, you’ll find:

📊 Crypto market analysis and the most important news in Web3

⚠️ MSCI index threat to kick out crypto treasuries was the catalyst for $20B liquidation in October

💥 Crypto markets face $530 million token emission wave, with a giant $320 million HYPE unlock

💼 Millionaire “Rich Dad, Poor Dad” author Robert Kiyosaki sells all $2.25 million in Bitcoin

⚡ Bitmine prepares 2026 ETH staking strategy despite crypto market correction

🔮 Analysis and key events that will shape the crypto market next week

The MSCI index Threat to Kick Out Crypto Treasuries Was the Catalyst for $20B Liquidation in October ⚠️

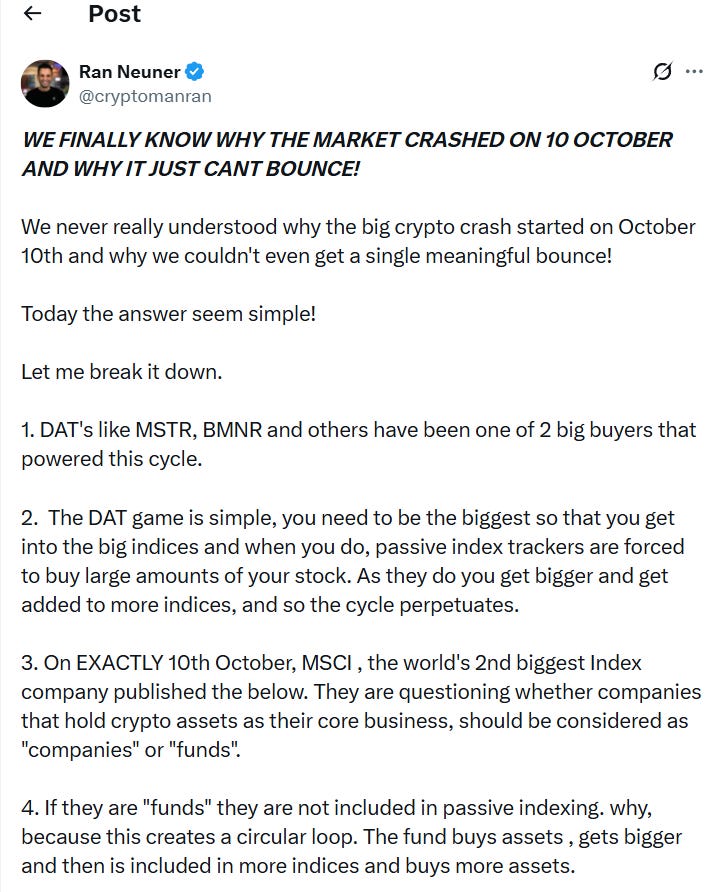

Analysts are still piecing together the reason behind the record $20 billion liquidation at the beginning of October, but some strong signals are pointing to a bearish announcement from the MSCI index as the main catalyst 📉.

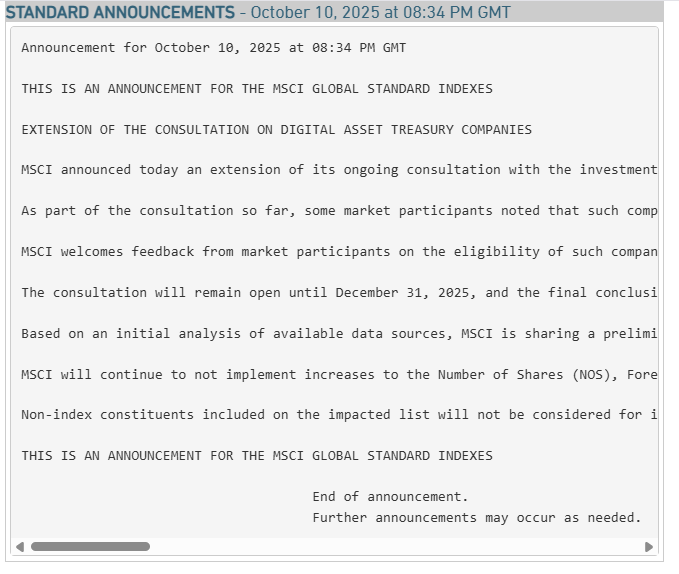

On October 10, the MSCI Index announced a new consultation exploring the exclusion of Bitcoin and crypto treasury companies with a balance sheet that exceeds 50% in cryptocurrency.

The consultation period will conclude on December 31, with the results scheduled to be announced on January 15 📅.

The announcement came as a shock to large crypto investors, particularly after the recent wave of institutional crypto adoption in the US.

The preliminary list included 38 crypto companies, including the world’s largest corporate Bitcoin holder, Michael Saylor’s Strategy, Sharplink Gaming, and crypto mining companies Riot Platforms and Marathon Digital Holdings.

A day after the announcement, crypto markets saw nearly $20 billion in liquidations, hitting 1.6 million traders on October 11 💥.

Despite earlier analysis attributing this to Trump’s tariff hike threat on China, others are pointing to the MSCI Index announcement as the main black swan 🦢.

“On EXACTLY 10th October, MSCI, the world’s 2nd biggest Index company, published the below. They are questioning whether companies that hold crypto assets as their core business should be considered as “companies” or “funds,” wrote Ran Neuner, analyst and crypto trader at CNBC.

“The 10TH of October wasn’t a coincidence after all - it was smart money seeing a big risk to crypto and the current market structure. The market will probably continue to dump until around the end of December, and if the announcement is negative, we will get a huge dump in preparation for the removal from the indices.”

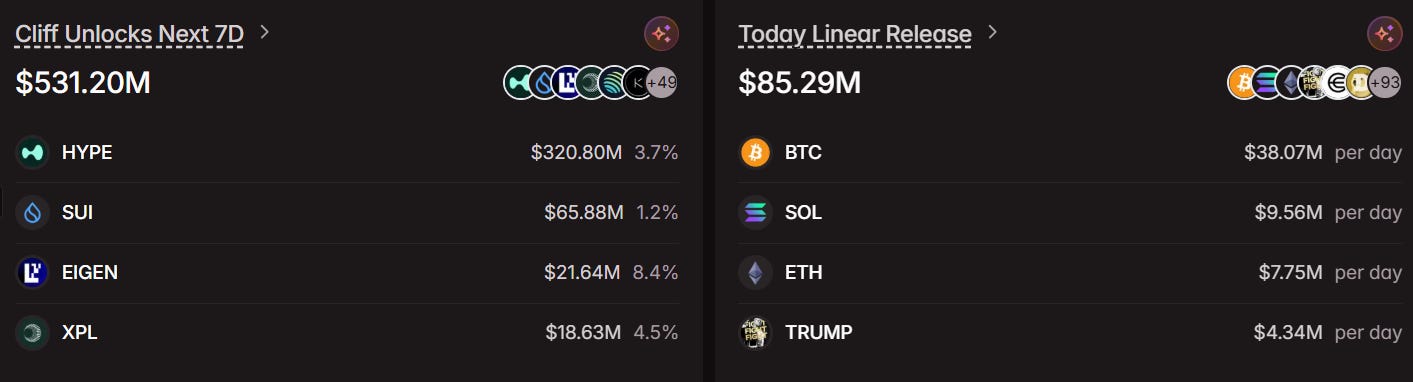

Crypto Markets Face $530 Million Token Emission Wave, With a Giant $320 Million HYPE Unlock 💥

Cryptocurrency markets are facing over half a billion dollars worth of token unlocks during the following week, which may lead to large-scale selling due to the ongoing market correction and poor retail sentiment.

The incoming vesting schedule of some of the leading cryptocurrencies will release a total of $531 million worth of new tokens on the market 💰.

Hyperliquid faces the largest unlock of the week, set to issue $320 million in HYPE tokens, or over 2.6% of the token supply, on Nov. 29, signaling more potential selling due to market jitters 📊.

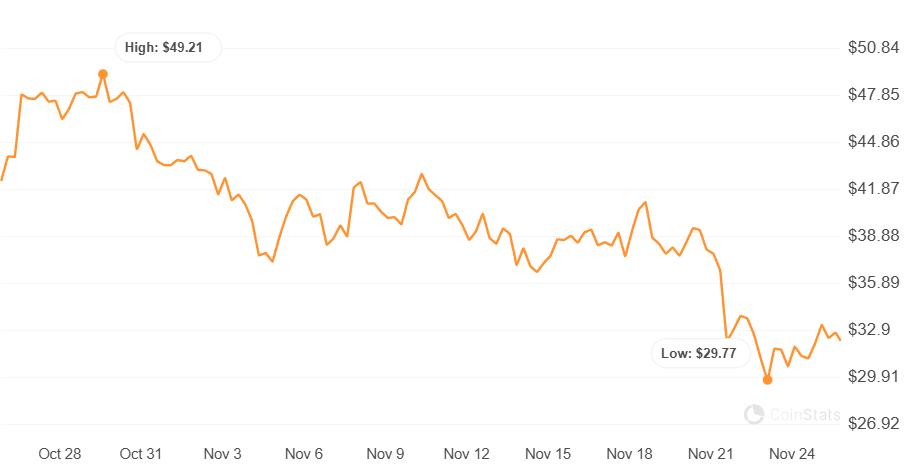

The HYPE token has already declined by 16% over the past week and has fallen by over 23% on the monthly chart, currently trading just above the $32 mark, according to CoinStats data.

However, the token is still up over 650% since launch, meaning that long-term holders awaiting their tokens could expect more upside and opt to hold their allocation 🚀.

The SUI token is facing the 2nd largest unlock of $65 million, while the EIGEN coin is set to unlock $21.6 million. Lastly, the XPL coin is also set to issue $18.6 million worth of new tokens into circulation.

Large token releases can lead to selling from large holders, particularly during poor crypto market conditions, adding more downside pressure on the market.

Millionaire “Rich Dad, Poor Dad” Author Robert Kiyosaki Sells All $2.25 Million in Bitcoin 💼

Robert Kiyosaki, a millionaire investor and author of “Rich Dad, Poor Dad,” has sold all his Bitcoin holdings after years of holding, signaling mounting concerns over the extension of the bull market cycle.

The famous investor sold $2.25 million worth of Bitcoin around the $90,000 level last week on Nov. 21.

Kiyosaki has been a long-term Bitcoin holder who bought his holdings at just $6,000 per BTC years ago, realizing a giant 2,400% return on investment (ROI), which multiplied his capital by over 25x 🚀.

The author sold the Bitcoin to invest in other businesses, including purchasing two surgery centers and a billboard business, Kiyosaki announced on Nov. 21, adding:

🗣️ “I estimate my $2.25 million Bitcoin investment into the surgery centers, and billboard business will be positive cash flowing, approximately $27,500 a month income by next February…. tax-free…. I am still very bullish and optimistic on Bitcoin and will begin acquiring more with my positive cash flow.” 📈

Bitmine Prepares 2026 ETH Staking Strategy Despite Crypto Market Correction ⚡

In spite of the crypto market drawdown, large institutional players like BitMine continue exploring digital asset strategies, as corporate capital continues betting on the growth of the Web3 industry 🌐.

BitMine Immersion Technologies, the world’s largest corporate Ethereum holder, announced plans to launch a new Ether staking setup called the Made in America Validator Network (MAVAN).

The firm will launch MAVAN in the first quarter of 2026, aiming to stake its tokens in Ethereum’s proof-of-stake blockchain network, which will generate additional passive income for the company’s holdings.

The staking ambitions follow a significant market downturn that saw BitMine’s unrealized losses reach nearly $4 billion earlier this week. The development will set a standard for corporations that put crypto plans on hold due to downside volatility 📉.

Yet despite the paper loss, BitMine continues pushing ahead with its corporate crypto ambitions and plans to acquire 5% of the total Ether supply.

🗣️ “BitMine continues to execute at the highest level. The company is well-positioned in 2026, and we look forward to commencing ETH staking with our MAVAN, or Made in America Validator Network, in early calendar 2026,” said Thomas “Tom” Lee, Chairman of BitMine.

BitMine currently holds $10.6 billion in Ether, or 3% of the total token supply, as the largest corporate holder.

Market Overview: Bitcoin Recovers to $89k, as Analysts Call $80K BTC Bottom 📈

Bitcoin’s price staged a strong recovery this week, flashing an early sign of a potential reversal, after investor optimism grew over interest rate cut expectations in the United States🇺🇸.

After a weekly low of $82,000, Bitcoin staged a relief rally to recover above $89,000 by Nov. 24, but lacked the buying pressure to touch the all-important $90,000 psychological mark, according to CoinStats data.

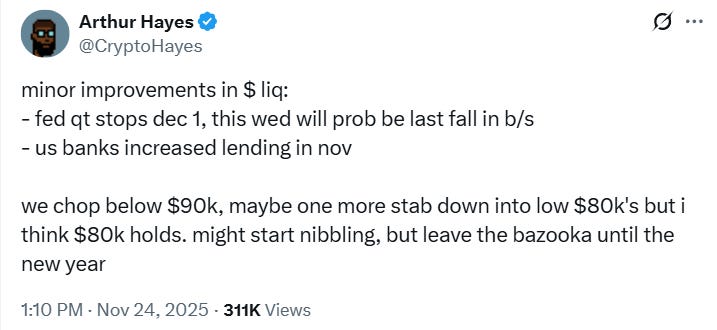

Adding to more bullish expectations, the $80,000 range has likely marked the local bottom for Bitcoin, according to popular analyst and BitMEX co-founder Arthur Hayes:

🗣️ “We chop below $90k, maybe one more stab down into low $80k’s, but I think $80k holds. Might start nibbling, but leave the bazooka until the new year.”

Meanwhile, investor expectations for an incoming US interest rate cut saw a sharp increase, rising over 25% during the past week, with 84% of investors now expecting a 25 basis point rate cut during the December 10 central bank meeting 🇺🇸.

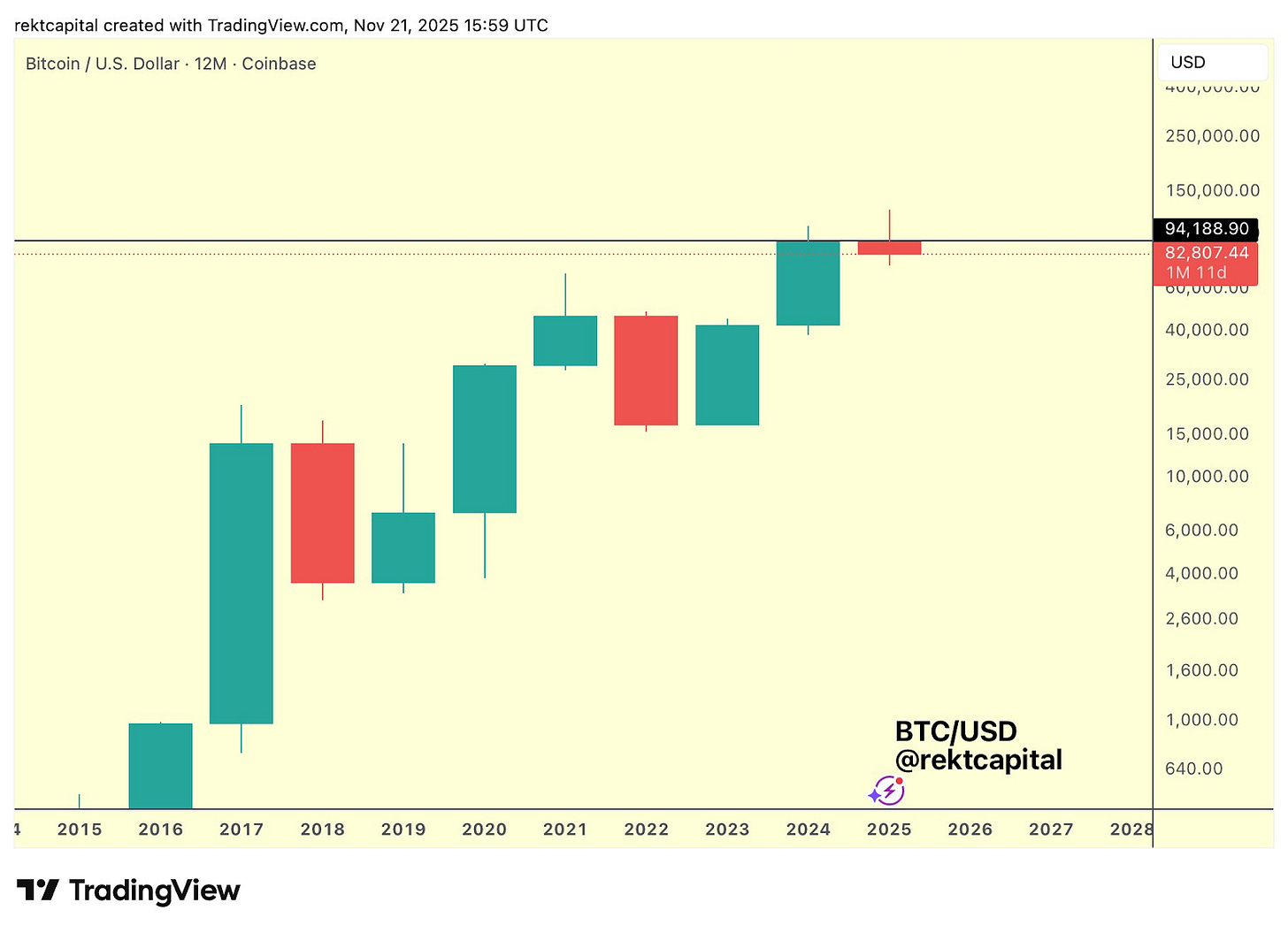

Beyond the macroeconomic expectations, Bitcoin’s fractal patterns suggest another rally above $93,000 based on historic data from previous cycles, according to analyst Rekt Capital.

“The fact that Bitcoin is now hovering below the Four Year Cycle level of ~$93k is likely an indication of how overextended this current retrace really is. History suggests price should be able to end 2025 with a green candle, by closing above $93k, before lapsing completely in 2026.” 📈

Tweets & Memes

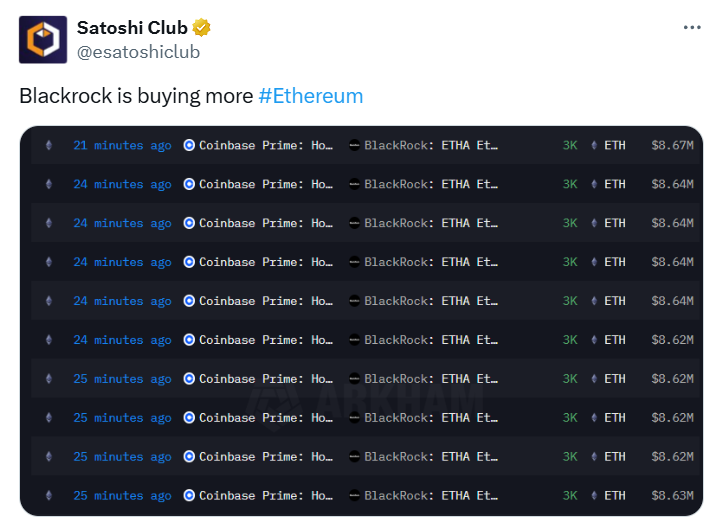

$13.5 trillion asset manager BlackRock is buying the Ether dip for millions 🐋!

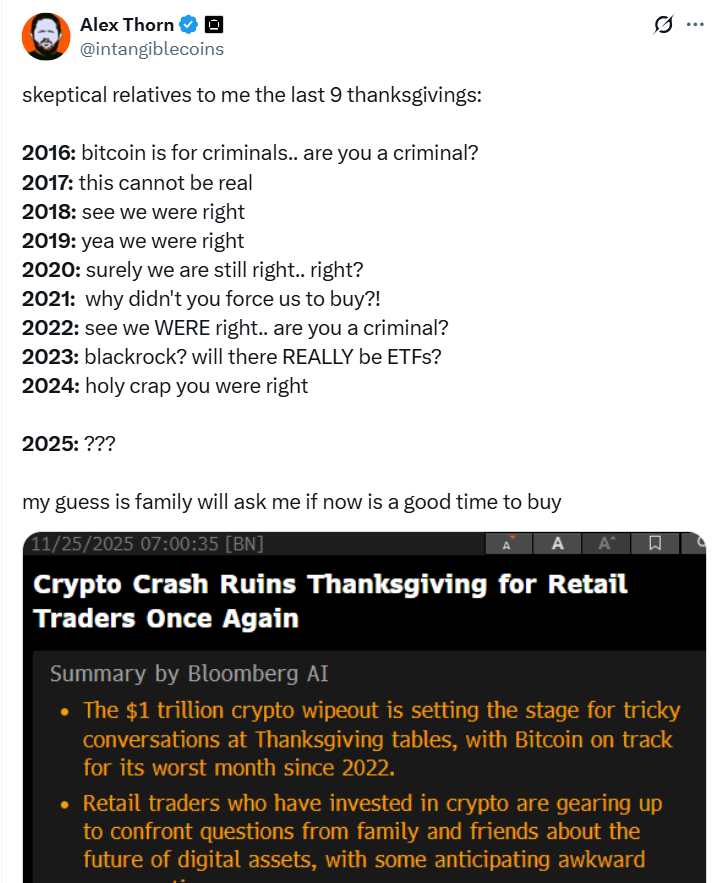

It’s going to be another awkward Thanksgiving for us crypto enthusiasts, so hold on tight… 🦃

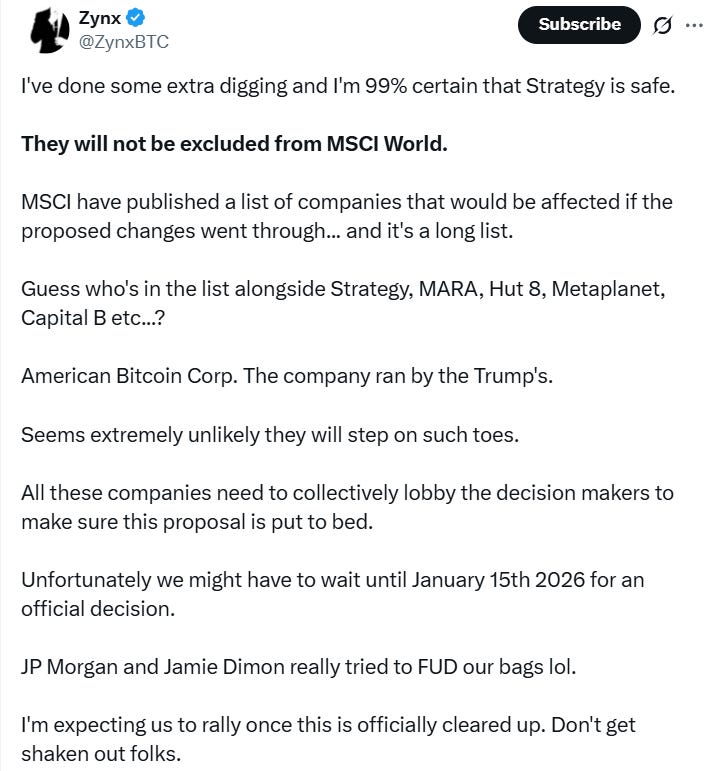

Michael Saylor’s Strategy is safe, don’t get shaken out by the FUD… 🔒

Buy when markets are fearful and sell when greedy, it really is that simple🎢.

Thank you for reading the weekly CoinStats Scoop Newsletter.

CoinStats will continue to guide you through the world of crypto and DeFi. We’ll see you next week for another edition of CoinStats Scoop! 😎

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.