Hyperliquid price drops 11% after JELLY manipulation controversy

0

0

Hyperliquid price, currently at $14.43, is down 11.1% over the past 24 hours following the JELLY memecoin fiasco that forced Hyperliquid DEX to delist the meme coin.

The JELLY token incident not only exposed vulnerabilities in Hyperliquid’s system but also drew sharp criticism from figures like the Bitget CEO and blockchain sleuth ZachXBT, putting Hyperliquid’s decentralized ethos under a microscope.

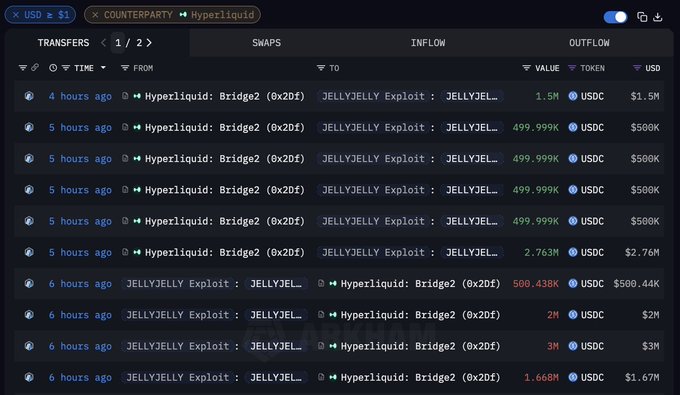

As Hyperliquid scrambles to address the fallout, the HYPE token price continues to reel, with significant USDC outflows signaling a loss of trust among users.

How the JELLY manipulation on Hyperliquid unraveled

The trouble started when a Hyperliquid whale, now dubbed the Hyperliquid JELLY ‘exploiter,’ deposited $7.167M on 3 separate Hyperliquid accounts within 5 minutes of each other and then made leveraged trades on the JELLY memecoin.

The trader then deliberately removed the margin collateral needed to sustain the positions, triggering Hyperliquid’s automatic liquidation mechanism.

This cunning move shifted the burden onto the Hyperliquidity Provider vault, setting the stage for the exploiter’s next play.

With the trap primed, the whale began aggressively buying JELLY tokens in the spot market, sending JELLY JELLY’s price soaring by nearly 500%.

This sudden spike caused a cascade of liquidations, putting Hyperliquid’s vault at risk of losing $12 million.

To maximize profits, the Hyperliquid JELLY ‘exploiter’—likely using a second wallet—opened a massive long position, raking in $8.2 million as JELLY’s price peaked.

However, Hyperliquid was quick to act, catching the exploiter on his tracks.

The exploiter now faces a $1 million loss according to Arkham, which he can’t withdraw at the moment

In total, the exploiter deposited $7.17M to 3 Hyperliquid accounts and withdrew $6.26M, with ~$900K balance on Hyperliquid across two accounts which he is currently unable to withdraw. Assuming he can withdraw this at some point in the future, his actions on Hyperliquid have

Analysts estimate that if JELLY’s market cap had climbed to $150 million, Hyperliquid DEX could have faced insolvency.

The manipulation was a masterstroke of exploitation, targeting the platform’s leverage system and low-liquidity token dynamics.

Hyperliquid’s controversial counterstrike

In response to the escalating JELLY token incident, Hyperliquid DEX acted decisively.

The platform’s validator group convened an emergency meeting and voted to delist JELLY perpetual futures, forcibly closing all related positions.

The validators also reset JELLY JELLY’s price to $0.0095 and liquidated 392 million JELLY tokens, turning a potential catastrophe into a $703,000 profit for the platform.

In addition, Hyperliquid promised to reimburse affected users, excluding those tied to the manipulation, while the Hyper Foundation stepped in to mitigate losses.

However, this swift intervention came at a cost to Hyperliquid’s reputation.

The Bitget CEO, Gracy Chen, lambasted the platform’s actions as “unethical” and “centralized,” arguing that resetting the oracle price undermined Hyperliquid’s decentralized claims.

Chen warned that Hyperliquid risked becoming “FTX 2.0,” a stinging rebuke echoed by BitMEX co-founder Arthur Hayes.

Blockchain investigator ZachXBT piled on, highlighting inconsistencies in Hyperliquid’s governance.

ZachXBT noted that while the platform intervened in the JELLY memecoin crisis, it had previously pleaded powerlessness during larger incidents, casting doubt on its commitment to decentralization.

The Hyperliquid CEO, Jeff Yan, who once criticized Bitget for unethical practices, now faced a bitter irony as his platform drew similar accusations.

Critics also pointed to Hyperliquid’s small validator pool, just two sets of four validators, as evidence of centralized control, a stark contrast to networks like Ethereum or Solana.

Going by the unraveling criticism of how Hyperliquid responded to the debacle, the JELLY token incident has morphed from a financial exploit into a referendum on Hyperliquid’s core principles.

Market shockwaves and HYPE token fallout

The financial repercussions of the JELLY memecoin fiasco have hit Hyperliquid hard.

The Hyperliquid price has plummeted nearly 11.1%, trading below $15, while the platform’s total value locked dropped from $283 million to $190 million.

Within hours of the JELLY liquidation, the Hyperliquid DEX saw over $340 million in USDC outflows, a clear sign of shaken investor confidence.

The HYPE token’s decline reflects deeper market unease about Hyperliquid’s stability as the JELLY JELLY manipulation debacle continues to bite.

The post Hyperliquid price drops 11% after JELLY manipulation controversy appeared first on Invezz

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.