Historic XRP ETF Launch Triggers 7% Price Spike and Whale Frenzy

0

0

development for the XRP community, Canada has officially launched the world’s first spot XRP ETFs. This bold financial move, which includes offerings from 3iQ and Purpose Investments, has not only intensified institutional interest in XRP but also sparked a dramatic surge in network activity across the XRP Ledger.

With the Toronto Stock Exchange now hosting two separate spot XRP funds, XRPP by Purpose Investments and XRPQ by 3iQ, investors in Canada can gain direct exposure to the cryptocurrency without needing to custody the asset themselves. The launches were approved and listed on June 18, 2025, making Canada the first country to bring regulated, spot-backed XRP exchange-traded funds to the mainstream market.

XRP Ledger Metrics Explode as Whales Accumulate

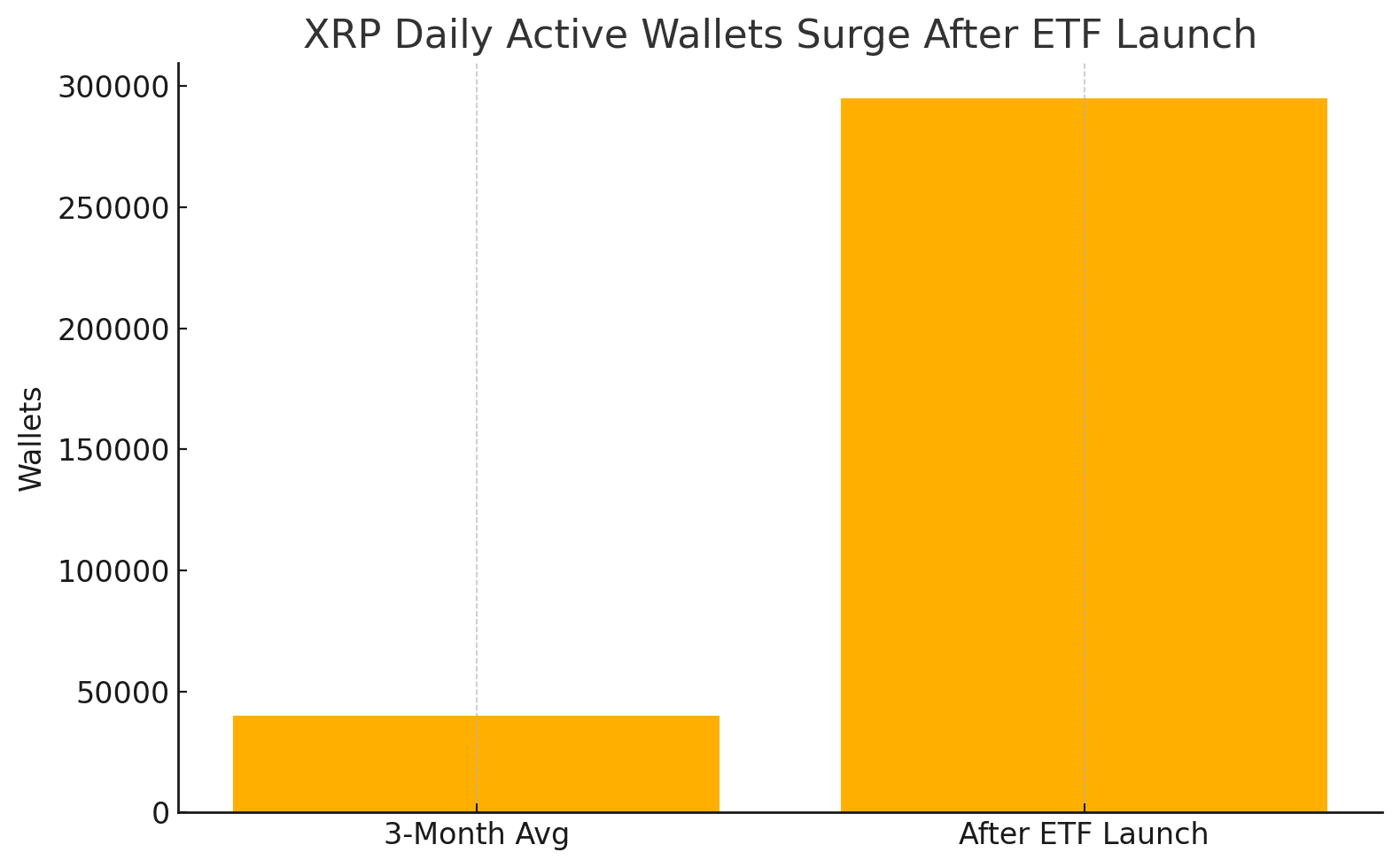

Almost immediately following the announcement, on-chain activity on the XRP Ledger saw a seismic shift. Daily active addresses surged to nearly 295,000, far outpacing the prior three-month average of around 40,000. This metric alone reflects renewed investor engagement, fueled by the legitimacy and accessibility these ETFs now offer.

Equally notable is the rise in whale activity. According to on-chain analytics, the number of wallets holding over 1 million XRP reached an all-time high of approximately 2,700. Each of these wallets now holds the equivalent of over $2.25 million. This signals increasing confidence among large investors who view XRP as a long-term strategic asset.

Inside the Two New XRP ETF

The two ETFs differ in structure but share the goal of bridging traditional finance with the crypto space.

3iQ’s XRPQ ETF provides investors exposure to spot XRP, with all assets held in cold storage. The fund is backed by regulated custodians and sources its XRP from compliant exchanges and over-the-counter desks. Ripple Labs, the company behind XRP, is also reportedly an early stakeholder in the initiative, adding further credibility.

Purpose Investments’ XRPP comes in three flavors: CAD-hedged, CAD-unhedged, and USD. The ETF is eligible for inclusion in popular Canadian tax-advantaged accounts like RRSPs and TFSAs, giving retail and institutional investors alike a convenient path to XRP ownership. As a promotional incentive, both ETFs will operate with zero management fees for the first six months.

U.S. Still Behind as SEC vs Ripple Legal Case Drags On

While Canada races ahead with innovation, the United States continues to lag in regulatory clarity. Despite numerous applications for spot XRP ETFs, including one from asset management giant Franklin Templeton, the U.S. Securities and Exchange Commission has yet to approve any.

The SEC is currently embroiled in a legal battle with Ripple over whether XRP constitutes a security. As of now, both sides have requested a pause in proceedings, with updates expected by August 15. This legal fog continues to stall innovation in the U.S. market, allowing Canada to dominate the XRP ETF narrative.

XRP Price Reaction and Future Potential

Following the ETF news, XRP’s price jumped 7 to 8 percent, pushing the token into the $2.10 to $2.25 range. Analysts see this momentum as the beginning of a broader uptrend, with some projecting XRP to reach $5 to $8 by the end of 2025.

However, the XRP Ledger’s DeFi infrastructure remains underdeveloped. Current total value locked (TVL) is just over $60 million, with decentralized exchange volumes averaging only $100,000 per day. This presents both a challenge and an opportunity. As capital flows into these ETFs, there’s room for new decentralized products to flourish on XRPL.

Final Thoughts: A Turning Point for XRP?

Canada’s approval and launch of spot XRP ETFs could mark a critical inflection point for the token. The move legitimizes XRP in the eyes of traditional investors, encourages institutional accumulation, and brings XRP one step closer to mass-market adoption.

If the U.S. follows suit in the coming months, XRP’s global financial relevance could accelerate dramatically. Until then, all eyes remain on the north, where Canada is quietly leading the next chapter in XRP’s story.

FAQs

What is a spot XRP ETF?

A spot XRP ETF is an exchange-traded fund that holds actual XRP tokens as its underlying asset. Investors gain direct exposure to XRP without buying or storing the cryptocurrency themselves.

Why is Canada’s XRP ETF launch significant?

Canada is the first country to approve and launch a regulated spot XRP ETF. This opens institutional investment channels and boosts credibility for XRP in traditional finance.

How has the XRP network reacted to the ETF launch?

The XRP Ledger saw a surge in activity, with daily active wallets hitting nearly 295,000. Whale wallet accumulation also increased, signaling strong investor confidence.

Glossary of Key Terms

Spot ETF

A financial product that holds the underlying asset (in this case, XRP) rather than futures or derivatives.

Whale Wallet

A crypto wallet that holds a very large amount of tokens, typically enough to impact market prices. For XRP, this refers to wallets with 1 million or more tokens.

XRP Ledger (XRPL)

A decentralized blockchain network developed by Ripple for fast and low-cost cross-border transactions.

Cold Storage

A security measure in which crypto assets are kept offline to reduce the risk of hacks or breaches.

Total Value Locked (TVL)

A metric showing the total capital deposited in a blockchain’s DeFi ecosystem, indicating platform usage and liquidity.

Sources and References

Read More: Historic XRP ETF Launch Triggers 7% Price Spike and Whale Frenzy">Historic XRP ETF Launch Triggers 7% Price Spike and Whale Frenzy

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.