Benchmark noted that MicroStrategy currently utilizes the existing FASB rule ASC 350, resulting in adverse effects on the firm’s unadjusted earnings during quarters when the value of its bitcoin holdings decreases.

According to Benchmark’s research note, several dozen companies holding Bitcoin have opted for the early adoption of the new ASU 2023-08 guidance. To be considered for inclusion in the S&P 500 by the index committee, a company must report positive earnings in its most recent quarter. However, the latest reports suggest that MicroStrategy could be reporting losses during Q1 2024.

Benchmark highlighted that although MicroStrategy has reported losses in 10 out of the past 14 quarters, early adoption of the new accounting standards could potentially allow the software company to meet this final criterion. However, the Benchmark analyst pointed out that investors hold divergent views on whether MicroStrategy will choose early adoption.

In a recent analysis note from Benchmark on Wednesday, MicroStrategy Executive Chairman Michael Saylor criticized the FASB’s cost-less-impairment model as “punitive.” The company is pushing for the adoption of new accounting guidance by the FASB, which it believes would allow for a more accurate reflection of the value of its Bitcoin holdings.

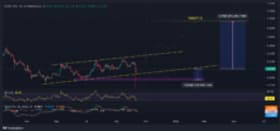

MSTR Stock Surge to $1,800?

Benchmark projects that should MicroStrategy opt for early adoption of the Financial Accounting Standards Board’s (FASB) new ASU 2023-08 standard, it could potentially announce a gain exceeding $300 per share for the first quarter of 2024.

Benchmark’s analysis illustrates that MicroStrategy’s share price has surged tenfold since implementing its Bitcoin acquisition strategy in August 2020. The Benchmark analysis noted:

“MicroStrategy’s performance during that span significantly outpaced the returns of bitcoin, the major stock indices, commodities such as gold, and big tech stocks”.

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one place