Ethereum (ETH) Reserves Hit All-Time Lows Yet the Price Stays Flat

0

0

Key Insights:

- Bit Digital dumped all Bitcoin holdings to buy over $250M worth of Ethereum

- ETH staking is at an all-time high, while exchange reserves have collapsed to just 18.9M

- Despite bullish supply dynamics, ETH price remains stuck in a narrow range near $2,517

While Ethereum (ETH) trades flat near $2,550, the fundamentals beneath the surface are changing fast. Institutional players are rotating in. The liquid supply is vanishing from exchanges. And the total staked value is hitting record highs. But the price refuses to follow through, and that’s raising new questions about whether whales are distributing quietly or if this is simply the calm before a major leg up.

Bit Digital Sells BTC for ETH

Bit Digital, a Nasdaq-listed digital mining and infrastructure company, has completely exited its Bitcoin position to focus solely on Ethereum. According to data, the company acquired approximately $192.9 million in ETH after raising ~$172 million from a public offering and selling ~$28 million worth of BTC. Its treasury now holds $254.8 million in Ethereum, placing Bit Digital among the largest publicly held companies globally with the largest ETH holdings.

Bit Digital mentioned that it would add more to its holdings. This move shows positive ETH-related sentiment.

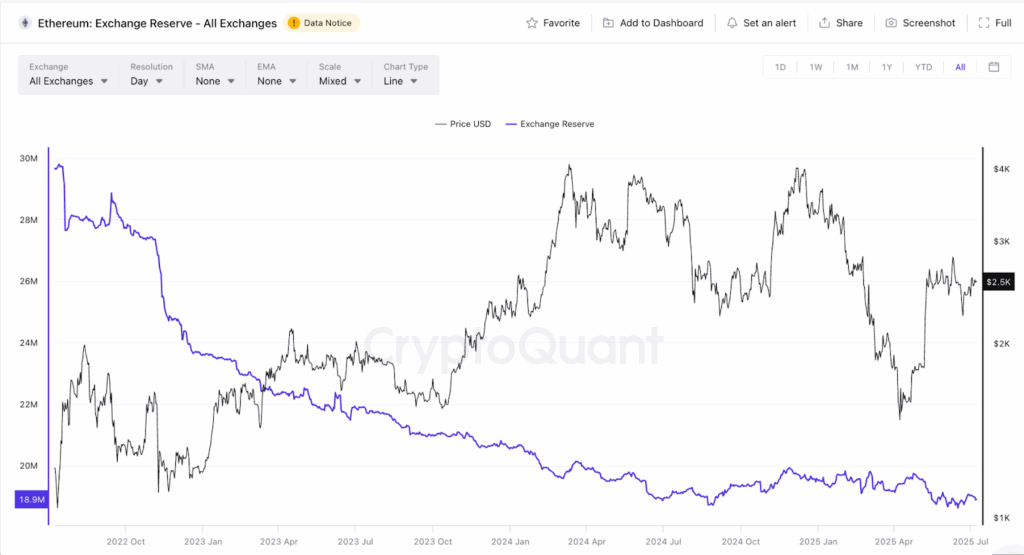

Ethereum Exchange Reserves Collapse to 18.9M

Despite this aggressive rotation, ETH’s price remains flat. According to CryptoQuant, the amount of Ethereum held on centralized exchanges has dropped to just 18.9 million, the lowest level in recorded history. That’s a clear sign of declining sell-side liquidity, typically seen as bullish.

When reserves fall, it usually suggests that holders are moving ETH to self-custody or staking contracts, effectively removing it from active trading circulation. That’s exactly what appears to be happening.

But in a market that thrives on momentum, low supply alone isn’t enough. The lack of corresponding upside in price raises a red flag; either buyers are already saturated, or some entities are quietly unloading into every rally.

Staking Hits All-Time Highs, But ETH Price Lags

ETH staking has also surged. Per CryptoQuant, total value staked has now crossed 35.8 million ETH, the highest it’s ever been. This growth reflects deepening conviction in Ethereum’s Proof-of-Stake model, where stakers earn yield by locking up tokens to help secure the network.

The issue? All this ETH being pulled off exchanges and staked should act like a supply shock, yet ETH remains trapped in a narrow band. The market seems to be waiting for a narrative trigger or liquidity spark to reignite interest.

Ethereum Price Trades in Tight Range Despite Macro Tailwinds

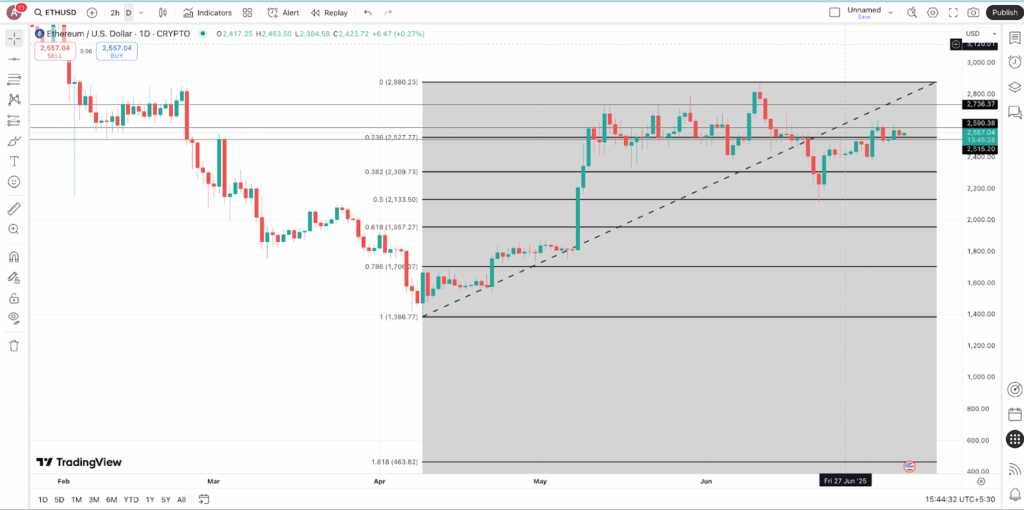

As of now, ETH price is trading in a horizontal chop zone between $2,515 and $2,590, a frustratingly tight range that has held since early July. It has failed to break convincingly above this band, despite the bullish structural changes in reserves and staking.

If we extrapolate the Fibonacci retracement from the swing low of $1,386 to the local high of $2,880 reached in June, multiple resistance zones emerge. The 0.236 Fib level at $2,527 aligns with ETH’s current stall point. A breakout above $2,736, the next key Fibonacci resistance, would signal renewed bullish strength.

For context, Fibonacci retracement levels are horizontal lines that indicate where support and resistance are likely to occur based on historical price moves. They’re widely used by traders to anticipate bounce or breakout zones.

Right now, ETH is stuck just under that first resistance, lacking the conviction to push higher, even as supply dynamics flash green.

Ethereum’s fundamentals look better than ever: exchange reserves are at all-time lows, staking has never been higher, and institutional buyers are stepping up in size. But the price isn’t listening yet.

If ETH breaks past the $2,736 barrier, that could validate the underlying bullish structure. Until then, Ethereum remains a coiled spring, with the only question being whether it’ll snap higher or fizzle sideways again. Do note that a dip under $2,309 could invalidate the optimistic trend.

The post Ethereum (ETH) Reserves Hit All-Time Lows Yet the Price Stays Flat appeared first on The Coin Republic.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.