This Week in Crypto: German Bitcoin Sell-Offs, US CPI Data, and Celer DNS Attack

1

0

This week, the German government’s continued Bitcoin (BTC) sell-offs significantly impacted the crypto market. The release of the US Consumer Price Index (CPI) data also introduced further complexity to the economic scenario.

Meanwhile, a security breach on Compound Finance’s website has raised alarms in the decentralized finance (DeFi) community, highlighting security concerns. These developments have sent ripples through the market, marking another volatile week.

Experts Weigh In on the Future Impact of German Bitcoin Sales

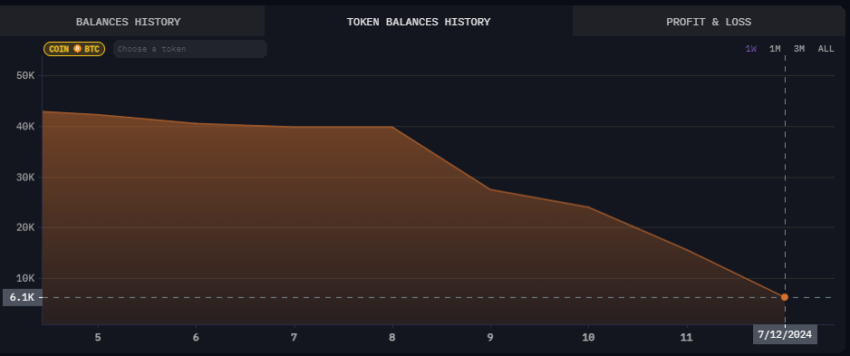

This week, the German government continued its Bitcoin sell-offs, significantly affecting the crypto market. Data from Arkham Intelligence revealed that Germany’s Bitcoin holdings dropped from 42,000 BTC on July 5 to 6,000 BTC currently.

The government wallet, now holding approximately $349.17 million worth of BTC, has transferred Bitcoins to various addresses. These transactions include crypto exchanges like Kraken, Coinbase, Bitstamp and market makers such as Cumberland and Flow Traders.

Read more: Who Owns the Most Bitcoin in 2024?

The German Government’s Bitcoin Holdings. Source: Arkham Intelligence

The German Government’s Bitcoin Holdings. Source: Arkham Intelligence

The persistent sell-offs have undeniably stirred the market, with Bitcoin’s price reflecting the ongoing sales spree. When Germany began these transfers on June 19, Bitcoin traded around $65,000. As of now, it has dropped to $57,000.

However, industry experts believe that as the wallet balance decreases, the sales will end. Consequently, the impact on Bitcoin’s price will gradually diminish.

US CPI Data Provides a Glimmer of Hope for Inflation

Bitcoin experienced a notable price jump, reaching $59,313, immediately after the Bureau of Labor Statistics (BLS) released the June US Consumer Price Index (CPI) data. Inflation in the US dropped to 3% year-over-year, slightly below market expectations of 3.1% and down from May’s 3.3%. This data suggests a 0.1% month-over-month decline.

Federal Reserve Chair Jerome Powell’s recent testimony before Congress highlighted that the Fed is not yet ready to cut interest rates. Powell emphasized that the inflation rate must show sustained progress towards the 2% target before any rate cuts can be considered. This cautious approach aligns with the latest CPI figures.

Lower-than-expected inflation is generally positive for the crypto market. Cryptocurrencies, often considered risk-on assets, tend to react bullishly to favorable economic indicators like low inflation. Jag Kooner, Head of Derivatives at Bitfinex, shared his perspective on the recent CPI data release with BeInCrypto.

“The lower-than-expected CPI reading today signals a more significant slowdown in inflation. This could reinforce the market’s expectation of a rate cut in September, boosting both equities and cryptocurrencies by increasing liquidity and risk appetite,” Kooner explained.

Cardano’s Chang Hard Fork Nears Completion

In a live Ask Me Anything (AMA) session on YouTube, Cardano founder Charles Hoskinson confirmed that the Chang hard fork is practically finished and will roll out next week. He also celebrated the completion of all elements of the Cardano Improvement Proposal (CIP) 1694, which is essential for advancing Cardano’s infrastructure.

The Chang fork will introduce Delegates (DReps) elected by Cardano token (ADA) holders. These representatives will draft the Cardano constitution, establishing the network’s supreme law.

Recently released Node 9.0 supports the initial phase of CIP-1694 in production environments but does not yet include DRep voting and all governance activities. These will be available in Node 10.0.

Named in honor of Cardano enthusiast Phil Chang, who passed away two years ago, the Chang hard fork aims to alter the ownership structure of the Cardano blockchain, initiating the Voltaire era and fully decentralizing network management.

Cardanoscan data shows that exchanges and stake pools are not yet ready for the hard fork despite this update. However, the Cardano community remains optimistic about the network’s imminent changes.

Binance Delists Four Altcoins, Prices Plummet

On Monday, Binance, the world’s largest crypto exchange by trading volume, announced it would no longer support four altcoins: BarnBridge (BOND), Dock (DOCK), Mdex (MDX), and Polkastarter (POLS). This delisting will take effect on July 22 at 03:00 UTC.

Following the announcement, the affected tokens saw significant price declines. DOCK plummeted nearly 30%, MDX dropped by 23.65%, and BOND and POLS both experienced over 17% losses. However, prices have slightly recovered since the initial drop.

DNS Attack Targets Multiple DeFi Platforms

On Thursday, Compound Labs, the team behind Compound Finance, announced that its website had been compromised. Around three hours later, Celer Network issued a similar warning, indicating a potential DNS domain attack affecting multiple projects simultaneously.

Blockchain security experts, including 0xngmi, founder of DefiLlama, and Samczsun, a researcher at Paradigm, suspect vulnerabilities in Squarespace, the website registrar, may be linked to the breaches. 0xngmi pointed out that around 65 other DeFi platform domains connected to Squarespace might be at risk, urging the community to avoid these websites for now.

Web3 security firm Blockaid shared its analysis, indicating that attackers hijack DNS records of projects hosted on Squarespace. The Pendle team also commented on this incident, ensuring that their domain and funds are secure. Despite these security breaches, the team claimed that Pendle protocol and smart contracts remain unaffected.

Lionel Messi’s Instagram Promotes Meme Coin: Hacked or Not?

This week also saw developments in the celebrity meme coins. Daddy Tate (DADDY), a Solana-based meme coin related to controversial influencer Andrew Tate, reached more than 55,000 holders. DEX Screener data shows that DADDY is currently trading at $0.1380, with a market capitalization of $82.7 million.

Read more: 11 Top Solana Meme Coins to Watch in July 2024

DADDY Price Performance. Source: DEX Screener

DADDY Price Performance. Source: DEX Screener

Additionally, the crypto market buzzed with Argentine soccer player Lionel Messi joining the list of celebrities promoting meme coins through social media. However, some believe Messi’s Instagram account was hacked to promote WATER, another Solana meme coin.

Despite speculation, the publication had not been removed, and Messi had not reported his Instagram account as compromised. This has led to disappointment among fans and further speculation within the crypto community.

1

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.