Figure IPO Nasdaq Targets $4B Valuation as Blockchain Lender Turns Profitable

0

0

According to recent reports, Figure IPO Nasdaq has become one of the most talked-about moves in the blockchain and fintech industry. The company seeks a valuation above $4 billion with its public listing, a bold step that signals fresh confidence in crypto-linked finance.

More than a headline, this event shows how blockchain lenders are beginning to stand alongside traditional institutions.

The Road to a $4 Billion Valuation

The firm has filed to sell more than 26 million shares priced between $18 and $20 each. At this level, Figure IPO Nasdaq aims to raise over $500 million. The stock will trade under the ticker FIGR, with top banks managing the deal.

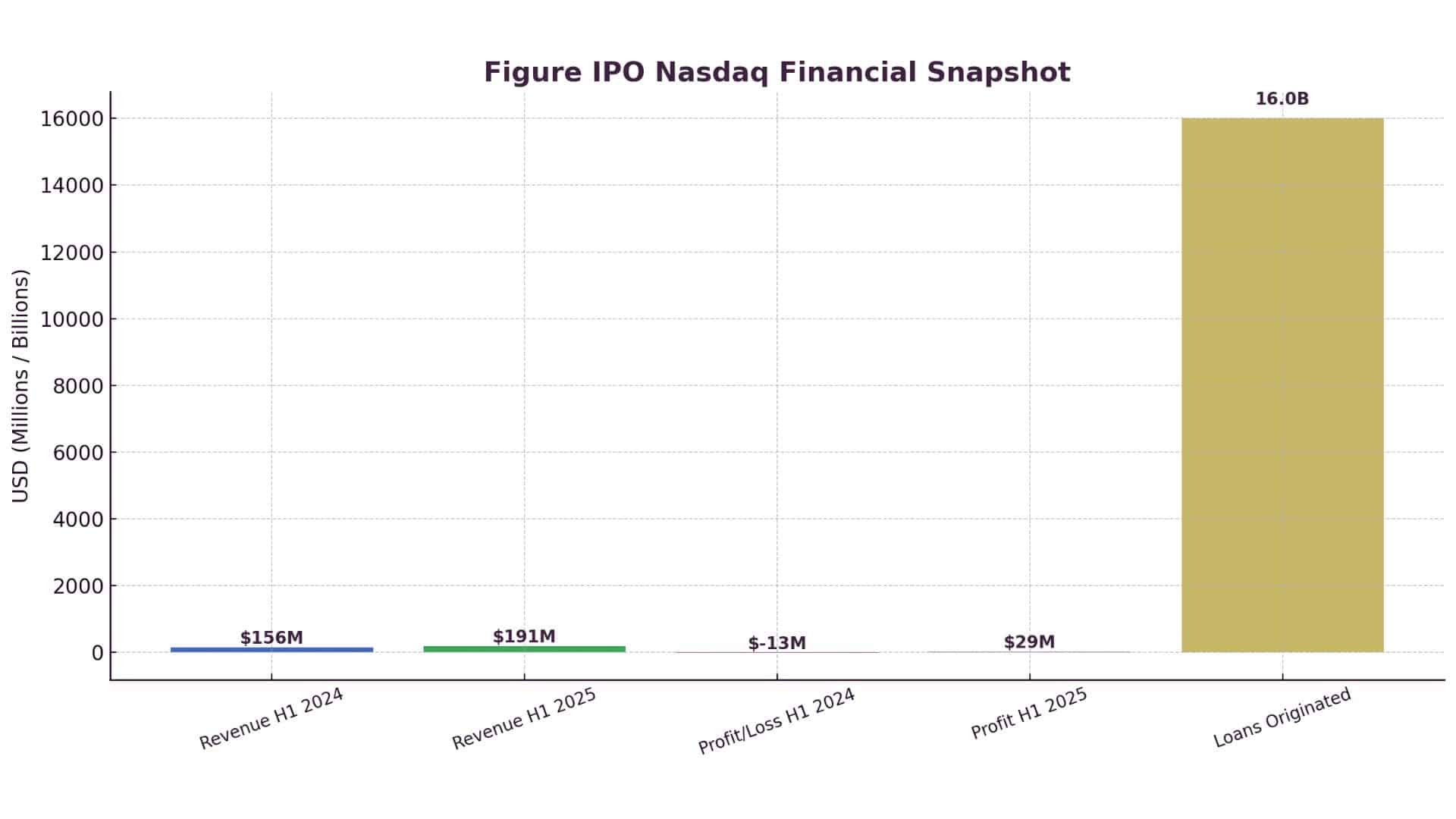

In the first half of 2025, revenue hit $191 million, up 22% year over year, with profits of $29 million. The year before, the company posted losses. This reversal gives the market a reason to take notice. Analysts say the Figure IPO valuation reflects both improved performance and renewed investor appetite for blockchain-driven finance.

Also read: Kraken Aims for $15B Valuation With $500M Raise Ahead of 2026 IPO

Blockchain at the Core

Figure is known for its Provenance blockchain, which processes home equity loans and other financial products. More than $16 billion in loans have already been originated on the platform.

As company co-founder Mike Cagney explained, “By taking historically illiquid assets, such as loansand putting these assets and their performance history on-chain, blockchain can bring liquidity to markets that have never had such”.

This foundation fits wider trends. Regulators are more open to blockchain finance, while investors want faster and more transparent systems. The Figure IPO Nasdaq arrives as these forces converge, pushing blockchain further into mainstream finance.

Investor Sentiment and Market Impact

The Figure IPO valuation is attracting attention from Wall Street and retail traders. Institutions see it as a test of demand for blockchain lenders, while crypto readers watch for ripple effects in tokenized assets. Activity on X shows traders waiting to see if FIGR rises or falls, and comparisons with past fintech IPOs suggest the valuation is competitive.

Broader Industry Outlook

The Figure IPO Nasdaq reflects a broader shift, with more blockchain firms from exchanges to stablecoin issuers, considering public listings. Analysts note that markets now favor companies that deliver both growth and solid fundamentals. As profitability spreads among blockchain lenders, the Figure IPO valuation highlights a move from hype to real performance for crypto-focused readers.

Conclusion

Based on the latest research, Figure IPO Nasdaq is more than a financial milestone. It shows blockchain finance stepping into the mainstream with support from regulators, institutions, and traders.

For crypto readers, it points to a future where decentralized tools and traditional markets work side by side. A strong debut could spark more blockchain IPOs and deepen links between crypto and Wall Street.

Also read: Sonic Labs Eyes Nasdaq Listing and ETF with 200 Million Funding Plan

Summary

Figure IPO Nasdaq targets a $4 billion valuation, signaling confidence in blockchain lending. With revenue up 22% and profits turning positive, the company seeks to raise over $500 million on Nasdaq under ticker FIGR. Its Provenance blockchain has processed more than $16 billion in loans, showing real-world adoption. For crypto readers, the IPO highlights how traditional and blockchain finance are moving closer together.

Glossary of Key Terms

IPO (Initial Public Offering): When a private company sells shares to the public for the first time.

Valuation: The market value assigned to a company before or during its IPO.

Ticker Symbol: A unique code under which a company’s stock is traded.

Provenance Blockchain: A blockchain platform built to support lending and capital markets.

FAQs for Figure IPO Nasdaq

Q1: What is the expected valuation for Figure IPO Nasdaq?

Between $4.1 and $4.3 billion.

Q2: What ticker will Figure trade under?

Shares will trade on Nasdaq under FIGR.

Q3: How has the company performed financially?

In H1 2025, revenue rose 22% to $191 million, with profits of $29 million.

Q4: Why is this IPO important for crypto readers?

It shows blockchain lenders are gaining mainstream acceptance, linking crypto with traditional markets.

Read More: Figure IPO Nasdaq Targets $4B Valuation as Blockchain Lender Turns Profitable">Figure IPO Nasdaq Targets $4B Valuation as Blockchain Lender Turns Profitable

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.