BlackRock’s Bitcoin ETF Hits $76B: Outpaces S&P 500 Fund, Triggers ETF Arms Race

0

0

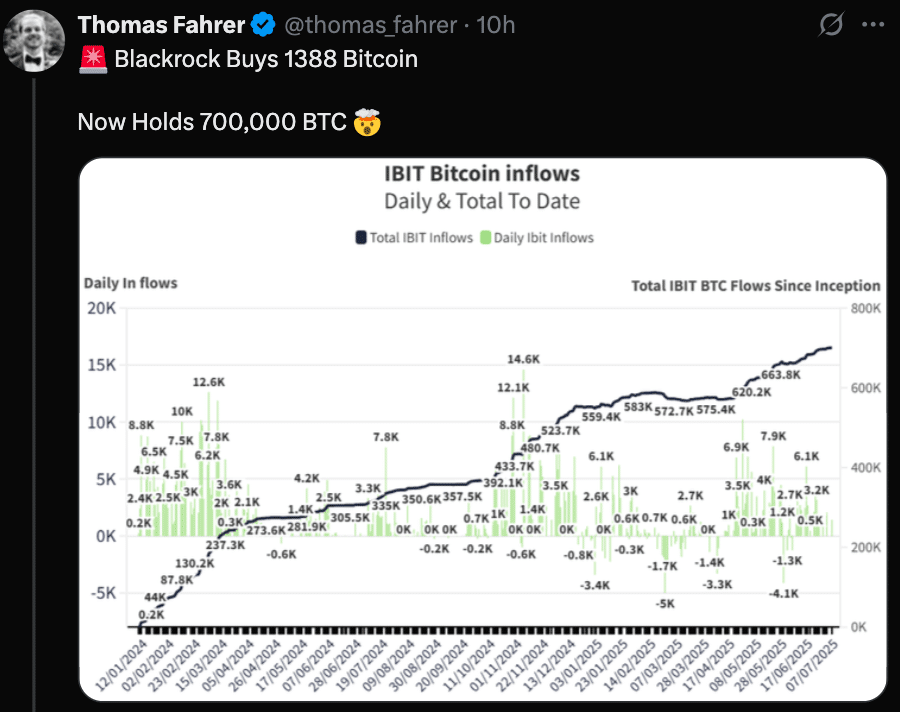

BlackRock’s Bitcoin ETF milestone is nothing short of staggering. Based on available data, the iShares Bitcoin Trust (IBIT), commonly referred to as BlackRock’s Bitcoin ETF, now holds over 700,000 BTC; more than 3% of Bitcoin’s total supply, all captured in just 18 months since its launch. This places IBIT ahead of every other U.S. spot ETF, with over 55% market share.

Its rapid accumulation and impressive 82.7% return have raised profound questions about supply dynamics, competition, and regulatory frameworks gripping this corner of finance.

Surpassing Expectations: The Acceleration Behind BlackRock’s Bitcoin ETF

Launched in January 2024, BlackRock’s Bitcoin ETF has outpaced expectations from day one. The fund reached 700,307 BTC after adding 164.6 million in inflows in a single Monday trading session, according to Apollo co-founder Thomas Fahrer. Official IBIT figures show 698,919 BTC held by Thursday, meaning the ETF added over 1,388 BTC in just two days.

Nate Geraci called the rapid accumulation “ridiculous” and highlighted how IBIT has taken the lead among over 1,197 BlackRock ETF offerings, surpassing even its flagship S&P 500 product.

Reports have it that IBIT now controls 55% of total Bitcoin in U.S. spot ETFs, making BlackRock’s Bitcoin ETF the dominant force in regulated crypto investment. Combined with MicroStrategy, Bitcoin’s corporate treasurer, and U.S. ETFs, institutional buyers have purchased $28.22 billion worth of Bitcoin this year alone, vastly outpacing the $7.85 billion newly mined supply.

This “hoarding gap” puts upward pressure on prices and intensifies competition for limited tokens.

Performance Metrics: Returns That Speak Volumes

BlackRock’s Bitcoin ETF has delivered total returns of around 82.67% since inception, far exceeding many traditional asset classes. With $76 billion in assets under management, the ETF now generates more revenue than BlackRock’s core S&P 500 offering.

Institutions are ingesting more Bitcoin than miners can produce. As demand outstrips supply, price appreciation becomes more likely, reinforcing the ETF’s allure. Market analysts note that such an imbalance solidifies IBIT’s pricing power and amplifies its influence as a price-driving institution.

Regulatory Climate: Faster Approvals and New Products

The SEC is reportedly considering reforms to streamline BlackRock’s Bitcoin ETF and future crypto ETF approvals. Proposed changes aim to reduce filings to a single S‑1 with a 75‑day review window; approval by default if no objections arise. Beyond IBIT, products like REX-Osprey’s Solana staking ETF show SEC openness to novel crypto-linked assets, expanding the investment landscape.

With BlackRock’s Bitcoin ETF controlling the majority share, rivals like Fidelity’s FBTC and Grayscale’s GBTC now trail far behind with about 203,000 and 184,000 BTC, respectively. MicroStrategy remains a major corporate holder with roughly 597,000 BTC.

Risks and Challenges Ahead

Despite impressive growth, BlackRock’s Bitcoin ETF still faces scrutiny. Continued institutional accumulation could spook regulators concerned about market concentration or systemic risk. The looming supply squeeze, combined with evolving SEC frameworks, could prompt volatility in both inflows and price.

While streamlined approvals may spur innovation, they could also fuel asset bubbles. Long-term success depends on transparent governance, fair market practices, and robust compliance.

Conclusion

At its current pacing of nearly 39,000 BTC per month, IBIT could potentially hit one million BTC in holdings by early 2026, impacting the crypto landscape dramatically. But such growth also amplifies scrutiny; regulatory bodies may impose limits on concentration or inflate systemic oversight.

Future ETF iterations, ranging from staking to altcoin baskets, will need to strike balance: innovation with stability, growth with regulatory vigilance.

Summary

BlackRock’s Bitcoin ETF, the iShares Bitcoin Trust (IBIT), has surpassed 700,000 BTC under management, representing over 55% of all Bitcoin held by U.S. spot Bitcoin ETFs. The fund’s rapid growth and $75.5 billion in assets now generate more revenue for BlackRock than its flagship S&P 500 ETF.

FAQs

What makes BlackRock’s Bitcoin ETF so dominant?

Its rapid accumulation, 700K BTC within 18 months, combined with institutional trust in BlackRock, created a virtuous cycle of inflows and market influence.

Will smaller ETFs survive IBIT’s dominance?

Yes. Fidelity, Grayscale, and others remain significant, although IBIT’s scale redefines entry thresholds and investor expectations.

How does this impact Bitcoin price?

Institutional demand exceeding miner supply likely supports upward price momentum and reduces market liquidity, favourable conditions for price increases.

Is the SEC welcoming new crypto ETFs?

The SEC seems poised to streamline approvals, as seen with IBIT, and has recently greenlit Solana and staking ETFs under new frameworks.

Glossary

Bitcoin ETF – Exchange-traded fund that provides exposure to Bitcoin price movements via regulated securities.

Spot ETF – ETF investing directly in the actual asset (Bitcoin), not derivatives.

IBIT – iShares Bitcoin Trust by BlackRock, the leading spot Bitcoin ETF.

Assets under management (AUM) – Total market value of assets managed by a fund.

Supply squeeze – When demand exceeds supply, pushing prices upward.

S‑1 Filing – SEC regulatory document required for new fund listings.

Sources

Read More: BlackRock’s Bitcoin ETF Hits $76B: Outpaces S&P 500 Fund, Triggers ETF Arms Race">BlackRock’s Bitcoin ETF Hits $76B: Outpaces S&P 500 Fund, Triggers ETF Arms Race

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.