Ether.Fi Price Analysis – Why ETHFI Could Soon Hit $3

1

0

Highlights:

- Ether.Fi is one of the top gainers in the last 24 hours

- Momentum driven by the Ethereum ecosystem growth in the past week

- Fundamental developments within Ether.Fi could see it hit $3 soon

Ether.Fi (ETHFI) is one of the biggest gainers in the last 24 hours, as market sentiment, product announcements, and rising DeFi interest strengthened Ether.fi’s ecosystem. When writing, Ether.Fi was trading at $1.32 today, with a 27% gain. The protocol takes advantage of reinvigorated excitement in the Ethereum ecosystem and continues attracting investor interest in its integration and adoption strategies.

Ethereum Rally Boosts Ether.Fi Along Other ERC-20 Tokens

Ethereum’s ongoing rally is critical for Ether.Fi’s growing valuation. With Ethereum on the upswing, projects built on its blockchain are experiencing inflow growth, with Ether.fi being one of the largest beneficiaries. This trend is poised to spur interest in decentralized finance (DeFi), which had lost traction over the last year. Ether.fi continues to be appealing because of its restaking implementation. As Ethereum rallies, this aspect to EtherFi could see it outperform most DeFi tokens.

$ETH ETF inflows are just $13,500,000.

Imagine the surge when the real money starts flowing in.

The Ethereum rally could be epic. pic.twitter.com/JWbSimg9Er

— Ted (@TedPillows) May 14, 2025

Rebrand to NeoBank Could Drive Ether.Fi Adoption to New Highs

Ether.fi stands to benefit as the protocol seeks to expand into a fully decentralized neobank with services encompassing the entire financial ecosystem on the blockchain. It includes spending and saving accounts, automated bill payment services, and payroll system integrations. These are standard features offered by finance apps used by the general population.

stake gives you the assets.

liquid vaults find the rewards.

cash brings it into the real world.https://t.co/gbHcksy7eA isn’t a product. it’s a platform to manage your finances.

join the club: https://t.co/qHXzdOCkeG pic.twitter.com/ixSHV7S5Ue

— ether.fi (@ether_fi) May 7, 2025

This paradigm aims to simplify user onboarding for DeFi. Merging traditional financial offerings alongside blockchain’s verifiability and trustless nature significantly reduces the hurdles for those seeking financial independence through decentralized options.

Cash Card Launch Brings Real-World Utility to Ether.Fi

Ether.fi recently unveiled a Visa-powered cash card enabling users to spend fiat and withdraw cash against their crypto assets collateral. This development allows for digital finance participants to harness real-world cash utility. The card has been launched in select states in the US as part of a broader rollout while staying compliant with the regulations. This move opens EthFi to a broader audience and could help push its price higher in the long term.

Introducing a new, refreshed https://t.co/gbHcksy7eA.

Take charge of your crypto.

Save, grow, and spend.Get your credit card today at https://t.co/Q3fKrgfoN4 pic.twitter.com/dT3VSODX3u

— ether.fi (@ether_fi) April 24, 2025

Focus on User-Centric Innovation to Push Ether.Fi to New Heights

With Mike Silagadze as CEO, Ether.Fi is now focused on building a seamless, accessible DeFi ecosystem that caters to basic financial needs. Structural innovation at the platform level seeks to ease access to an array of crypto services, especially to more sophisticated aspects of decentralized finance, for users without deep technological expertise in blockchain.

All the stuff we promised would melt faces in Q1 2025 is going to happen in Q2.

Starting with the @ether_fi Cash launch for retail and corporate.

Cash is going parabolic. By end of year we’ll be the largest crypto payments platform.

Bookmark this tweet. pic.twitter.com/eWaTaMGuot

— Mike Silagadze

(@MikeSilagadze) May 10, 2025

Ether.Fi Dominates Restaking and Has Record-Level Total Value Locked

Even though the excitement surrounding restaking has generally diminished over the last year, Ether.fi has retained user capital. Ether.Fi currently holds 2.7 million ETH in total value locked (TVL), approximately $4.4 billion. This positions Ether.fi close to its all-time highs in ETH-denominated TVL, indicating that users still trust the platform’s stability and yield offerings.

Ethereum’s total value locked (TVL) currently stands at a commanding $64 billion, securing its position as the leading smart contract platform.

In contrast, its top competitors, Solana, BNB Chain, and Tron, collectively hold just $22.3 billion in TVL. pic.twitter.com/Szs18KPoHk

— CryptoWeekly (@WeeklyCrypto) May 10, 2025

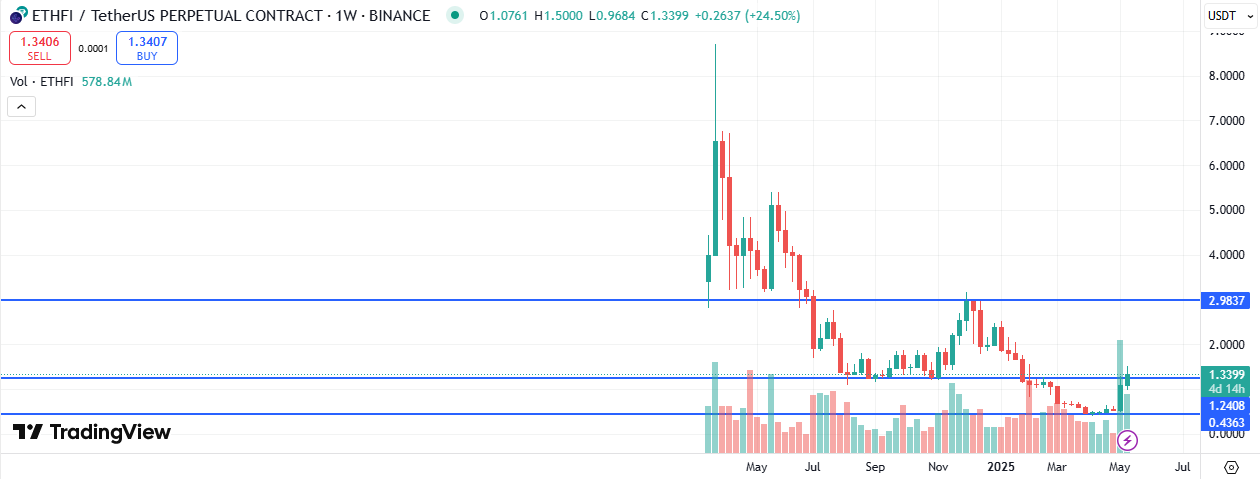

Technical Analysis – Ether.Fi Price Breaches Weekly Resistance

From the charts, Ether.fi’s token is sending bullish signals. Recently, Ether.Fi breached the $1.24 resistance days after a strong bullish reversal at the $0.43 weekly support.

Provided it sustains this bullish momentum and ends the week above $1.24, Ether.Fi could spike to $3 in the short term.

Recap

With a rebrand, new product lines, and an expansion to the U.S., Ether.fi sits at the front of the evolution of DeFi. The platform now integrates high-yield crypto with practical financial services tools, paving a new direction for decentralized finance that emphasizes usability, compliance, and real-world application. This puts it in pole position to be one of the best performers as the ongoing bull rally gains traction.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

1

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.