Bitcoin Apparent Demand Hits 2025 Low as Large Investors Sell Off Holdings

0

0

Highlights:

- Bitcoin demand is at its lowest level in 2025 due to economic concerns.

- Large investors sold 50,000 BTC recently, worrying many about market stability.

- Bitcoin ETFs keep most funds intact which shows continued investor confidence despite price declines.

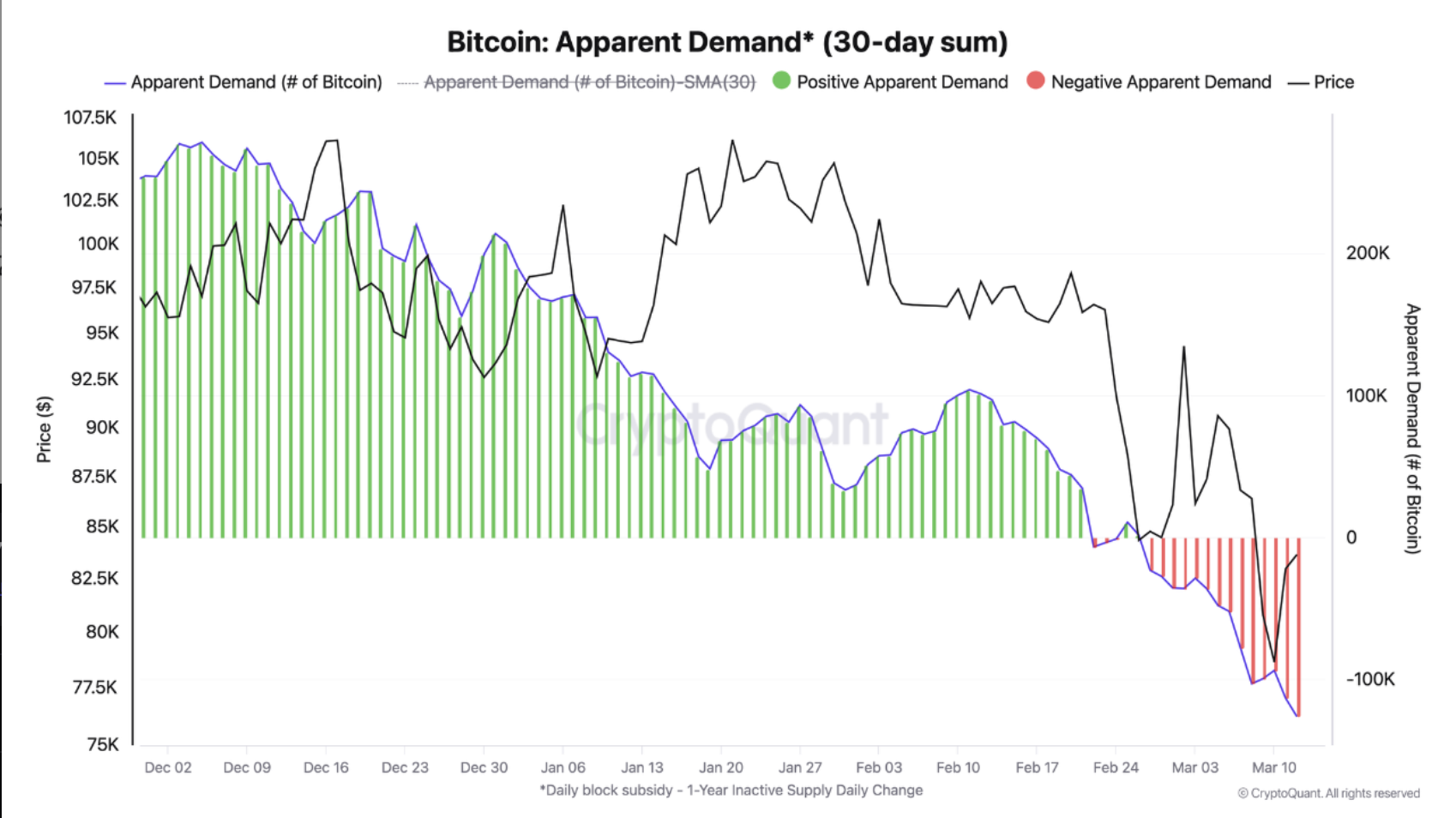

According to data from the quantitative analytics platform CryptoQuant, Apparent demand for Bitcoin (BTC) has hit the lowest level in 2025. This decline is due to macroeconomic issues that have reduced investor interest.

Bitcoin’s apparent demand turned negative on March 13, reaching a negative 142. This metric had been positive since last September, peaking around December, before gradually declining. However, demand remained positive until early March 2025 but has been declining since.

Fears of a prolonged trade war and rising geopolitical tensions are making traders cautious. Inflation remains high, though it is gradually cooling, but it is still above the Federal Reserve’s 2% target. Due to these concerns, traders are stepping away from riskier assets. Instead, they are shifting towards safer options like cash and government securities to protect their investments.

Large BTC Holders Sell Over 50,000 BTC in One Week

Another report by Santiment shows that big Bitcoin holders are selling. In the past week, wallets holding 100-1,000 BTC sold over 50,000 BTC, worth about $4.07 billion. Such movements by large investors have often influenced market trends, raising concerns about Bitcoin’s short-term outlook.

Bitcoin's key stakeholders are showing signs of dumping:

Wallets with 100-1,000 $BTC: -50,625 Bitcoin (-$4.07B) in the past week

Wallets with 10-100 $BTC: -7,062 Bitcoin (-$567.1M) in the past week

Over the long-term, markets tend to fluctuate with a mid-sized… pic.twitter.com/jSioi9mzuS

— Santiment (@santimentfeed) March 13, 2025

Bitcoin ETFs Hold Strong Despite Slower Inflows and Price Drop

Even with slower inflows, Bitcoin exchange-traded funds (ETFs) have stayed strong. They have kept over 95% of their invested money, according to senior Bloomberg ETF analyst James Seyffart. In a March 14 post on X, James Seyffart noted that Bitcoin ETF inflows have dropped to $35 billion from a peak of $40 billion.

Despite this decline, total assets under management remain at $115 billion. This shows that most funds have stayed intact even as Bitcoin’s price fell from over $109,000 in January 2025 to around $83,000 by March 15, 2025.

Seyffart said this stability is similar to U.S. stock ETFs, where long-term investors do not panic sell during market drops. Instead, they keep buying. He added that this shows investors are shifting from short-term trading to long-term wealth-building strategies.

Nice @JSeyff chart of Bitcoin ETF inflows which are down to $35b (from peak of $40b). Based on $115b of aum that means more than 95% of inv cash has held strong despite painful 25% decline = the Boomers are showing y'all how it's done.. *ducks* pic.twitter.com/8OtH6NM33g

— Eric Balchunas (@EricBalchunas) March 13, 2025

Peter Schiff Slams Bitcoin Again, Says Gold Will Outlast It

In a recent post on X, Bitcoin critic Peter Schiff tagged MicroStrategy CEO Michael Saylor. He claimed Bitcoin has been in a bear market for years when compared to gold. Schiff noted that Bitcoin’s value against gold has fallen 24% since 2021, dropping from 36.3 ounces per BTC to 27.7 ounces per BTC.

Gold is the Apex predator that will eat Bitcoin. @saylor

— Peter Schiff (@PeterSchiff) March 14, 2025

Schiff said investors do not see Bitcoin’s real decline because they compare it to U.S. dollars. He claimed Bitcoin is losing value against gold. He believes this shows a long-term downtrend despite short-term price gains.

Peter Schiff recently criticized Michael Saylor’s Bitcoin strategy. He said MicroStrategy’s aggressive BTC purchases create serious financial risks. Schiff pointed out that the company’s stock has fallen by 55%. He also warned that its growing debt could lead to bankruptcy if Bitcoin’s price keeps dropping.

Schiff argues that Bitcoin’s volatility and speculation make it an unreliable store of value. He claims gold has preserved purchasing power for thousands of years, while Bitcoin’s long-term stability is still uncertain.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Gestisci cripto, NFT e DeFi in un unico luogo

Gestisci cripto, NFT e DeFi in un unico luogoConnetti in sicurezza il portafoglio che usi per iniziare.