Grayscale’s Dogecoin and XRP ETFs Set for NYSE Debut on November 24

0

0

Grayscale will introduce new exchange-traded fund products tied to Dogecoin and XRP on Nov. 24 after securing approval to list both vehicles on the New York Stock Exchange.

The Grayscale Dogecoin Trust ETF (GDOG) and the Grayscale XRP Trust ETF (GXRP) will debut as spot ETPs holding their respective underlying tokens.

Grayscale Expands ETF Lineup With Dogecoin and XRP

The firm is converting its existing private trusts into fully listed ETFs, a move that represents a major liquidity event for current investors.

GXRP will enter a market that already includes spot products from Canary Capital and Bitwise.

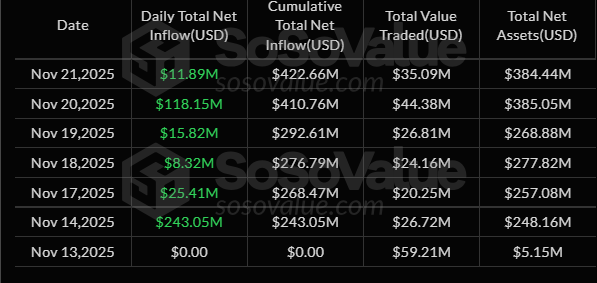

Those funds have drawn about $422 million in combined inflows during their first two weeks of trading, signaling early institutional interest in XRP-linked products.

XRP ETFs Daily Inflow Since Launch. Source: SoSoValue

XRP ETFs Daily Inflow Since Launch. Source: SoSoValue

On the other hand, GDOG will be one of the first Dogecoin ETF available to US investors.

Dogecoin, once a meme token, has grown into the ninth-largest cryptocurrency by market capitalization. Its deep retail following has made it one of the most frequently traded and discussed digital assets, a trend Grayscale expects will support ETF demand.

Considering this, Bloomberg Intelligence analyst Eric Balchunas said the product could attract as much as $11 million in volume on its first trading day.

GDOG and GXRP’s launch broadens the mix of crypto ETFs available in the US market, extending the industry’s expansion beyond Bitcoin and Ethereum products that dominated the initial wave of approvals.

Their arrival also reflects shifting regulatory conditions in Washington.

Both approvals are part of a broader acceleration in digital asset oversight under Securities and Exchange Commission (SEC) Chairman Paul Atkins.

Since taking office, Atkins has moved the agency away from a “regulation by enforcement” approach and toward a disclosure-focused framework.

Through his “Project Crypto” initiative, he has signaled that the SEC is open to reviewing compliant digital asset products, clearing the path for issuers seeking to list new ETFs.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.