The Crypto Bloodbath Explained: 3 Key Reasons the Market Flipped Overnight

0

0

The crypto market is currently experiencing its largest downfall ever, with nearly $19 billion in cryptocurrency positions liquidated in just 24 hours. The market has fallen to a critical low of $3.7 trillion, a drop of about 10%, with the crypto bloodbath seeing leading assets like Bitcoin, Ethereum, and BNB slipping by about 8%, 11%, and 12% respectively. This has caused confusion among investors about the cause of the turbulence. Let’s dive into the four key reasons behind the market’s dramatic flip.

The recent crypto market crash was a culmination of various factors, including macroeconomic shifts and inherent market volatility. US President Donald Trump’s escalating tariff tensions, massive crypto liquidations, government shutdown have led to the largest ever crypto bloodbath.

Trump Tariff Tensions

One of the main drivers of the prevailing crypto bloodbath is the US President’s decision to impose an addition 100% tariff on China. On October 10, 2025, Trump announced his plans, sparking speculations of more countries getting involved. This decision comes in response to China’s recent restrictions on rare earth exports, which the President views as an attempt to exert control over the global economy and has criticized as “hostile”. Trump wrote in a Truth Social post,

“One of the Policies that we are calculating at this moment is a massive increase of Tariffs on Chinese products coming into the United States of America. There are many other countermeasures that are, likewise, under serious consideration. Thank you for your attention to this matter!”

Notably, the tariffs aim to counterbalance China’s trade practices and protect US interests. Trump noted that the country’s “extraordinarily aggressive position on trade” has forced him to impose the tax. The President added,

“Some very strange things are happening in China!…They are becoming very hostile, and sending letters to Countries throughout the World, that they want to impose Export Controls on each and every element of production having to do with Rare Earths, and virtually anything else they can think of, even if it’s not manufactured in China.”

Crypto Liquidations Rise- $20B Erased in a Day

The industry is currently experiencing its largest crashes ever, with massive liquidations intensifying the chaos. most severe in history, rivaling or even surpassing major past crashes like the LUNA collapse, FTX debacle, and the Crypto Winter of 2020-22. Polygon CEO Sandeep Nailwal noted, “WOW! This was bigger than LUNA, COVID AND FTX crash.”

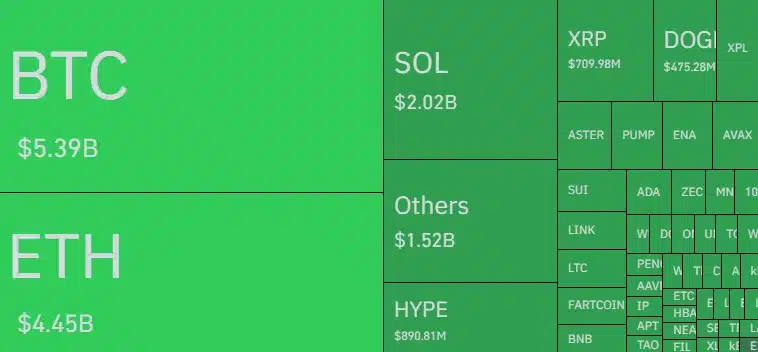

The crypto bloodbath has triggered a massive wave of liquidations, with over $19.37 billion in total market liquidation, $16.86 billion in long positions and $2.51 billion in short positions liquidated in the past 24 hours. This event, marking the largest single-day liquidation, has seen large holders removing cryptocurrencies from major crypto exchanges, including Hyperliquid, Bybit, Binance, and OKX.

The day has also seen the flow of Bitcoin, as the BTC price plummeted to a monthly low of $105k. About $5 billion of coins were wiped off across exchanges like Hyperliquid, Bybit, Binance, and more. While $4.46 9 billion coins in long position were erased in a single day, only $703 million in short positions were liquidated.

US Government Shutdown

The digital asset space has already been increased pressure amid the ongoing US government shutdown. Although the market recovered from the “Redtember lows” when “Uptober” approached, the ecosystem was struggling to exhibit the traditional rally.

Today, the crypto bloodbath worsened as the shutdown drags on, with no signs of resolution. The US federal government has started issuing layoff notices to over 4,000 employees across seven agencies. These layoffs are part of a larger effort by the Trump administration to reduce the federal workforce, with approximately 300,000 job cuts planned. The affected employees will have 60 days’ notice before their termination. This unending shutdown has also sparked concerns about the Federal Reserve’s potential decision on interest rates.

This action is a continuation of the current government shutdown, which has caused furloughs, lowered pay, and disrupted paychecks for millions of federal employees and soldiers. The government shutdown continues without much movement in Congress to address the gridlock. And on October 15, a contested court hearing will be held to determine whether to grant a request by unions to enjoin or stop government workers from being laid off.

Conclusion

In conclusion, it is clear that the fall of the economy in the crypto space is due to these factors, which demonstrate the need for better risk management and regulation of cryptocurrencies as a market commodity. The market correctly assumes, as the narrative of the crypto bloodbath espouses, that the downward trend in price will continue to move further downward and onward without acceptance of historical trends in October.

Frequently Asked Questions

- Why did the crypto market crash so suddenly?

The crash was triggered by a mix of Trump’s tariff announcement, mass liquidations, and ongoing economic instability. - Is this the largest crypto liquidation event in history?

Yes, with nearly $19 billion wiped out in 24 hours, it has surpassed previous crashes like LUNA, FTX, and COVID-era dips. - Will the market recover soon?

Recovery is uncertain as ongoing government shutdowns and macroeconomic tensions continue to apply pressure.

Glossary

- Liquidation – The compulsory sale of cryptocurrency holdings after a trader’s position has dropped below the required margin threshold.

- Tariff – A tax placed upon imported goods by a government mainly to leverage trade.

- Rare Earth Exports – Vital minerals used in electronics and technology that China controls.

- Government Shutdown – Federal operations stop when the government cannot provide Congress-authorized funds to continue operations. Layoffs and service suspensions result from government shutdowns.

- Long Position – A trade that bets on the price of an asset increasing.

- Crypto Bloodbath – A slang term for a severe market crash where multiple assets fall sharply.

Read More: The Crypto Bloodbath Explained: 3 Key Reasons the Market Flipped Overnight">The Crypto Bloodbath Explained: 3 Key Reasons the Market Flipped Overnight

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.