Bitcoin Breakout To $95,000 to Be Bolstered by $1.8 Billion ETF Inflows

0

0

Bitcoin’s recent rally has confirmed a key bullish pattern, providing further optimism for the coin’s price trajectory.

Whales are actively accumulating, and the demand from Bitcoin Exchange-Traded Funds (ETFs) has surged, both of which are fueling Bitcoin’s rise. With significant inflows from the ETF market, Bitcoin is poised to reach new highs in the near future.

Bitcoin Whales Accumulate Heavily

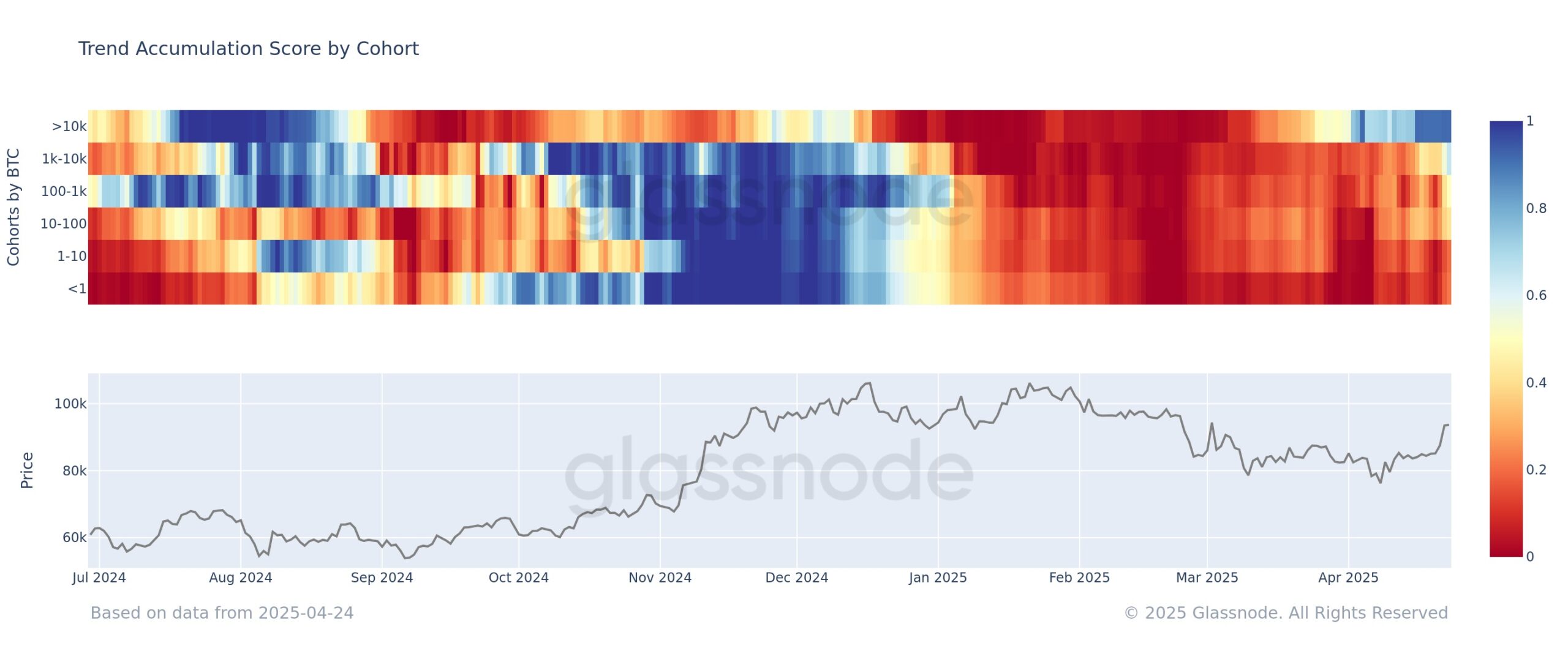

Whale activity remains a key driving force behind Bitcoin’s price rise. According to the trend accumulation score, investors holding over 10,000 BTC are showing a near-perfect accumulation score of 0.9, signaling strong optimism among large investors.

This accumulation suggests whales expect continued bullish momentum and are positioning themselves for further gains.

Moreover, investors holding between 1,000 and 10,000 BTC are also actively participating, with a slightly lower accumulation score of 0.7. This indicates that smaller but still significant players are following the whales’ lead, contributing to the overall positive sentiment surrounding Bitcoin.

The confidence exhibited by these large investors suggests that the demand for Bitcoin will continue to rise, potentially driving prices higher.

Bitcoin Trend Accumulation Score. Source: Glassnode

Bitcoin Trend Accumulation Score. Source: Glassnode

The macro momentum for Bitcoin is increasingly favorable, particularly due to recent spot ETF flows. Over the last two days, Bitcoin has seen $1.8 billion worth of inflows. On April 22, $912 million flowed into Bitcoin ETFs, followed by $917 million on April 23, marking the highest single-day inflows in over five months.

The substantial inflows are a clear indication of rising demand and reflect investor confidence in Bitcoin’s long-term potential.

These massive inflows from institutional and retail investors alike signal a broader shift in Bitcoin’s market sentiment. As the demand for Bitcoin ETFs grows, so too does the potential for Bitcoin’s price to rise. The increasing investment in Bitcoin ETFs is creating a positive feedback loop, likely driving the price higher in the near term.

Bitcoin Spot ETF Flows. Source: Farside

Bitcoin Spot ETF Flows. Source: Farside

BTC Price Aims for $95,000

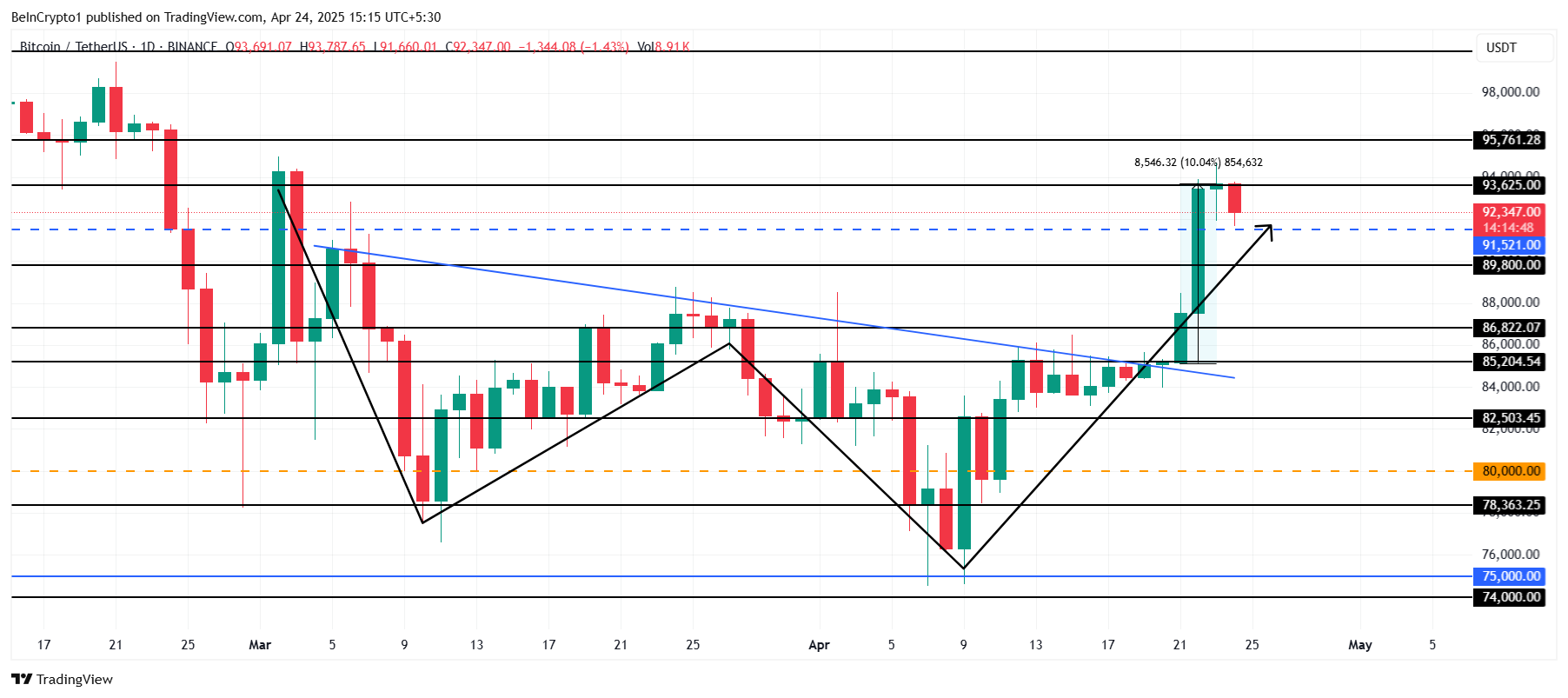

Currently, Bitcoin is trading at $92,347, just under the $93,625 resistance. Despite recent attempts, Bitcoin has not yet breached this key level. However, with the recent breakout and favorable market conditions, Bitcoin is on track to break through this resistance in the near future.

The cryptocurrency validated a double-bottom pattern earlier this week, surging by 10% in just two days. This breakout reinforces the bullish outlook, and the combination of whale accumulation and ETF inflows could help Bitcoin breach the $93,625 resistance.

A successful breakout could push Bitcoin toward the $95,000 range and potentially the $95,761 resistance.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

However, if Bitcoin fails to maintain its upward momentum and falls below the $89,800 support, it could trigger a bearish reversal.

A drop below this support level would invalidate the bullish outlook, potentially sending Bitcoin’s price down to $86,822, erasing recent gains.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.