Bedrock Price Surges 63% Driven by Strategic Reserve Announcement

0

0

Highlights:

- The price of Bedrock has seen a 63% price increase, driven by the announcement of the Strategic Reserve.

- Technical indicators show intense bullish sentiment; however, the RSI at 96 cautions of a short-term retracement.

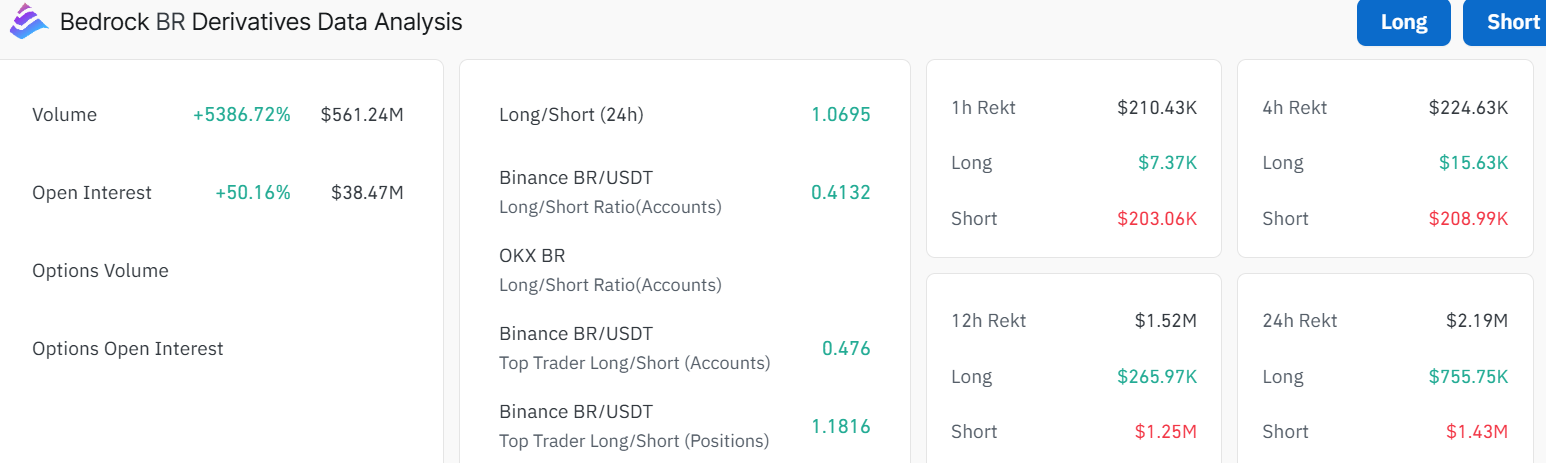

- The Bedrock derivatives market is reflecting growing market interest, as volume and OI spike 5386% and 50%, respectively.

As of 4 July, the Bedrock price is among the top trending coins on CoinMarketCap, surging 63% to the $0.12 mark. However, its daily trading volume has decreased by 2%, indicating a decline in market activity. This comes following the platform’s recent announcement of its Strategic Reserve. This reserve has played a significant role in stabilizing the price of $BR, thereby ensuring liquidity and market stability. The reserve has contributed to the number of traders working with the $BR/USDT market, which exceeds 120,000 individuals.

Bedrock Strategic Reserve | Next Phase

The Strategic Reserve has been instrumental in stabilizing BR’s price and ensuring deep, responsive liquidity — powering over $4B in daily trading volume and supporting 120K+ traders across the BR/USDT market.

As we plan the next phase,…

— Bedrock | BR is LIVE (@Bedrock_DeFi) July 3, 2025

With Bedrock at the onset of its next stage, the process is underway to transform its reserves, which are currently expressed in $BR, into ones that can incorporate Bitcoin ($BTC). This transition will facilitate the creation of long-term value and further consider the token in relation to the monetary base of Bitcoin. The recent shift means that more attention will be given to making it more sustainable and developing $BR in a way that makes it a better part of the broader ocular market.

Bedrock Price Spikes 63% as Bullish Sentiment Bolsters

As of July 4, the $BR is experiencing a strong uptrend in terms of pricing, with a recent 63% spike to $0.12. This price action indicates intense bullish activity, tilting the odds in favor of the buyers. The immediate support zone at $0.08 gives the bull’s hind legs to aim for higher levels.

The Relative Strength Index (RSI) is now resting at 96.38, and this indicates that the $BR is sitting in the overbought territory. This means that a vector-sized short-term correction is possible. Traders should be cautious and evade the bull trap, as a slight retracement is plausible.

On the other hand, the MACD momentum indicator continues to uphold a strong buy signal. This is manifested as the blue MACD has crossed above the orange signal line. Investors are at liberty to buy more BR tokens unless the MACD changes. The market statistics indicate that volumes have surged 5,386.72% to $561.24 million, and the open interest has increased by 50.16% to 38.47M. This increase in market participation means that more traders are entering, which boosts demand for $BR and thus strengthens its bullish case.

The active trading is also backed by a strong long-to-short ratio of 1.06. This also serves as an indication that there is more to come on the positive side with the given token.

Overbought Conditions Alarm of a Short-Term Retracement

The recent developments in the Strategic Reserve have sparked a rally in the Bedrock market, as trading activities have surged. However, the overbought RSI cautions for a short-term retracement before the bulls strike again. In the meantime, the bulls must sweep through liquidity, which will likely see the Bedrock price retrace toward the $0.09-$0.08 support zones.

After the correction, the bulls may initiate another rally, breaking through the $0.12 area and potentially reaching the $0.14-$0.15 range. In the meantime, traders should be cautious, as early profiteering could be imminent, potentially causing a slight drop in the Bedrock price.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.