3 US Crypto Stocks to Watch Today

0

0

Crypto US stocks are back in focus today as Coinbase (COIN), Core Scientific (CORZ), and MARA Holdings (MARA) trade near key technical levels ahead of earnings.

COIN rebounds slightly in pre-market after a recent pullback but still faces resistance at $206.9. CORZ is riding strong momentum, up 25% in the last month, with today’s earnings call likely to decide whether the rally continues. Meanwhile, MARA has lost steam recently but could reclaim higher ground if tomorrow’s earnings report sparks a breakout above $14.68.

Coinbase (COIN)

Coinbase (COIN) stock dipped 1.26% in yesterday’s session but is showing signs of early strength with a 2.02% gain in pre-market trading.

Despite this, the stock has struggled to break above the $206.9 resistance level in recent days, reflecting market indecision ahead of a key earnings report.

COIN Price Analysis. Source: TradingView.

COIN Price Analysis. Source: TradingView.

The current Relative Strength Index (RSI) reading of 50.79 places COIN in neutral territory—neither overbought nor oversold—indicating a lack of strong momentum in either direction. This aligns with the recent sideways price movement as investors await further clarity.

Should the consolidation phase resolve to the downside, Coinbase could retest its $194 support, with further downside risks toward $183 or even $176 if that level fails.

On the flip side, tomorrow’s earnings call is seen as a potential catalyst—positive surprises in revenue or guidance could prompt a breakout above $206.9, setting the stage for a run toward $221.71.

Core Scientific (CORZ)

Core Scientific (CORZ) is gaining attention ahead of its earnings call today. The Bitcoin mining company closed 2.74% higher yesterday and added another 3.11% in pre-market trading.

Over the past 30 days, CORZ has surged 25%, positioning itself as one of the top-performing U.S. crypto-related stocks.

The stock’s Relative Strength Index (RSI) has climbed to 64.45 from 54.22 just a week ago, reflecting growing bullish momentum but also approaching overbought territory, where reversals can sometimes occur.

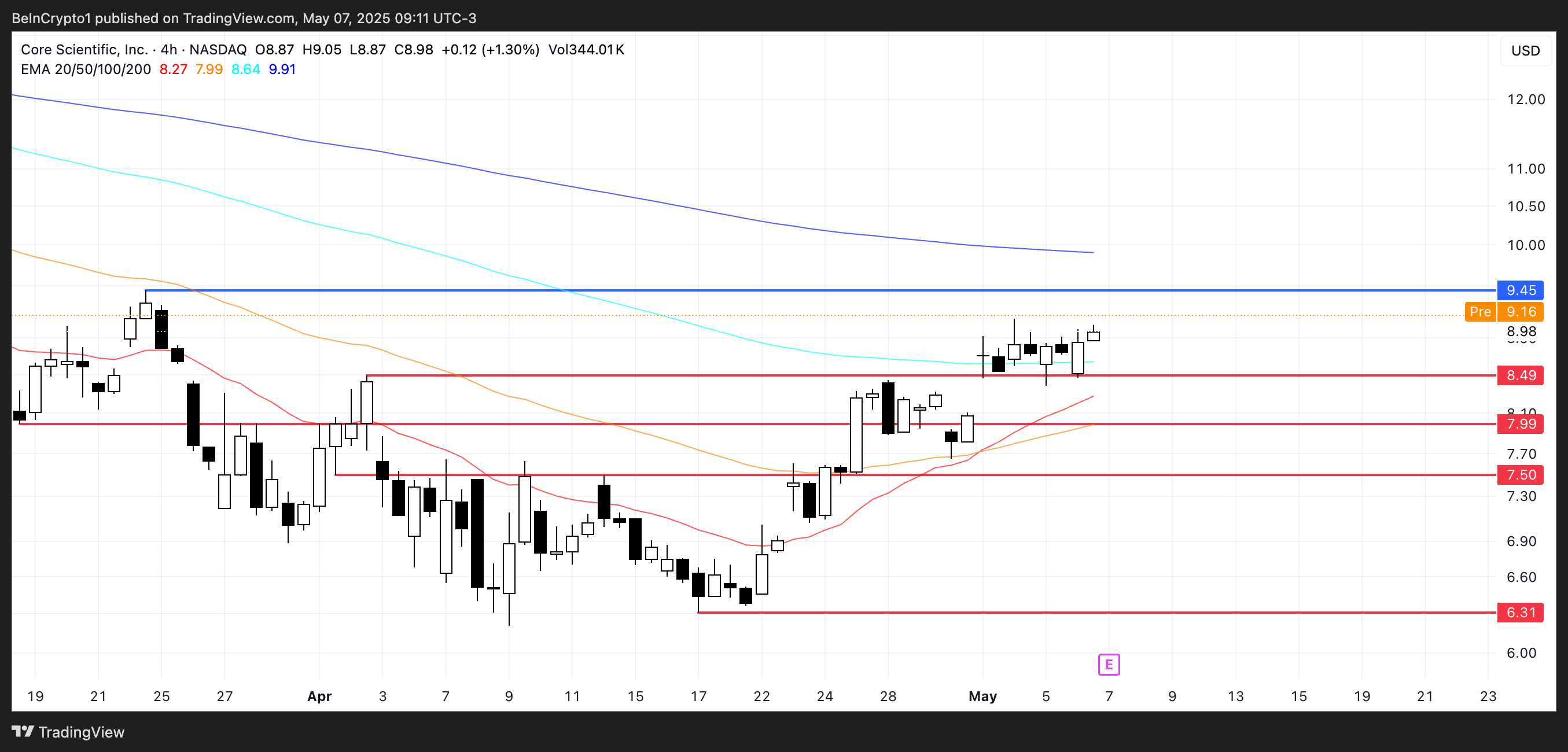

CORZ Price Analysis. Source: TradingView.

CORZ Price Analysis. Source: TradingView.

Traders are now focused on today’s earnings report, which could fuel the next move.

A strong print could push CORZ toward $9.45, representing an additional 5% upside from current levels.

However, the $8.49 support level is seen as critical—if broken, downside targets emerge at $7.99 and $7.50.

MARA Holdings (MARA)

MARA Holdings is showing early signs of strength ahead of its earnings call tomorrow, closing up 0.46% yesterday and gaining 2.81% in pre-market trading.

The stock is up 16.37% over the past month, but recent momentum has cooled, with a 7.5% decline in the last five days.

Its RSI has dropped from 58 to 46.5 in that same period, signaling fading bullish momentum and a shift toward neutral-to-bearish sentiment.

MARA Price Analysis. Source: TradingView.

MARA Price Analysis. Source: TradingView.

If this trend continues, MARA could fall to test its key support level at $12.06. On the other hand, a strong earnings report could reignite buying interest and push the stock toward resistance at $14.68.

A breakout above that level would set the stage for a move to $16.24, marking MARA’s first time above $15 since early March. All eyes are now on tomorrow’s results for the next major catalyst.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.