Fed Rate Cuts: Neel Kashkari’s Crucial Warning on Tariff Impact and Inflation

0

0

BitcoinWorld

Fed Rate Cuts: Neel Kashkari’s Crucial Warning on Tariff Impact and Inflation

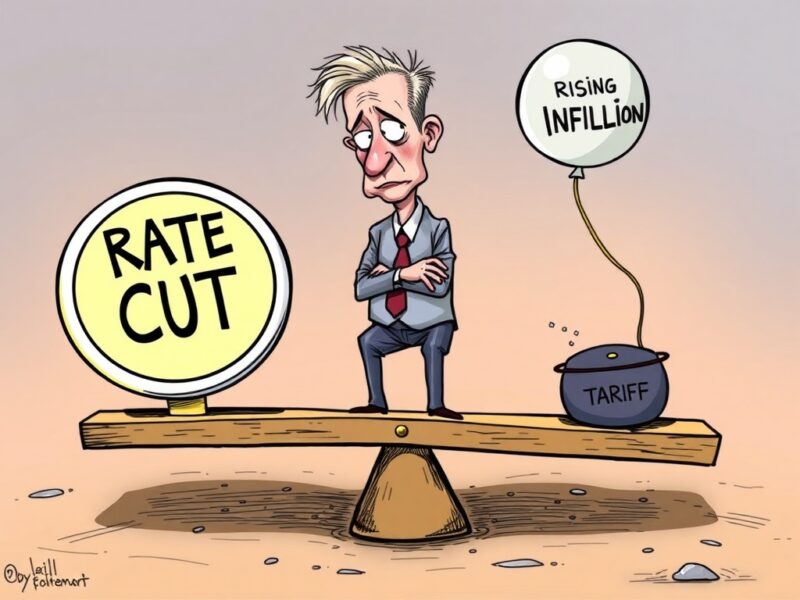

The prospect of Fed rate cuts has been a hot topic for global markets, influencing everything from investment strategies to daily consumer spending. Recently, Minneapolis Fed President Neel Kashkari offered a nuanced perspective on the central bank’s path forward, hinting at potential shifts in monetary policy. His insights are crucial for understanding the evolving economic landscape and what it could mean for your financial future, especially regarding the inflation outlook.

Neel Kashkari’s Stance on Potential Fed Rate Cuts

Neel Kashkari, a prominent voice within the Federal Reserve, recently reiterated his view that two Fed rate cuts remain appropriate for the current year. This outlook aligns with a broader sentiment among some policymakers who believe that easing monetary policy could support economic growth and stability. However, Kashkari’s statement came with a significant caveat, highlighting potential headwinds that could alter this trajectory for future Fed rate cuts.

- Initial Expectation: Kashkari believes two rate reductions are still suitable for 2024.

- Economic Support: Easing monetary policy can potentially stimulate economic activity.

- Crucial Caveat: External factors, particularly trade policies, could shift this outlook.

The Rising Threat: Tariff Impact on the Inflation Outlook

While the Federal Reserve aims for price stability and sustainable economic growth, new challenges are emerging on the horizon. Kashkari specifically pointed to the potential tariff impact on the nation’s inflation outlook. Tariffs, essentially taxes imposed on imported goods, can directly increase the cost of products for consumers and businesses. If these costs rise significantly across various sectors, they could reignite inflationary pressures, making the Fed’s job of managing prices much harder and directly influencing the monetary policy path.

- Direct Cost Increase: Tariffs raise the price of imported goods.

- Inflationary Pressure: Higher import costs can translate into broader inflation.

- Policy Complication: Renewed inflation complicates the Fed’s easing plans.

Navigating Complex Monetary Policy Decisions

The Federal Reserve’s approach to monetary policy is a delicate balancing act, requiring careful consideration of numerous economic indicators. Policymakers must weigh factors like employment data, consumer spending patterns, and, most critically, the rate of inflation. Neel Kashkari‘s remarks underscore the inherent complexity of this task, especially when external forces, such as evolving trade policies and their potential tariff impact, introduce new and unpredictable variables. A sudden surge in inflation dueled by tariffs could indeed compel the Fed to reconsider its current easing path, potentially leading to a pause in cuts or, in a more extreme scenario, even a rate hike, significantly altering the economic outlook.

- Balancing Act: The Fed considers employment, spending, and inflation.

- External Forces: Trade policies add unpredictable elements to the economic equation.

- Potential Outcomes: A pause in cuts or even a rate hike if inflation accelerates.

- Agile Strategy: The Fed must remain flexible to adapt to changing conditions.

What This Means for the Broader Economic Outlook

Understanding these intricate dynamics is vital for anyone monitoring the broader economic outlook. If tariffs do indeed lead to higher inflation, the eagerly anticipated Fed rate cuts might be delayed or scaled back. This scenario could have ripple effects, influencing borrowing costs for mortgages and loans, impacting investment decisions across various sectors, and generally dampening overall market sentiment. Both businesses and individual consumers should remain agile, preparing to adapt to potential shifts in the economic environment as the Federal Reserve navigates these significant challenges, especially concerning the inflation outlook.

- Delay in Cuts: Higher inflation from tariffs could postpone rate reductions.

- Financial Impact: Affects borrowing costs and investment strategies.

- Market Sentiment: Potential for a dampened overall market mood.

- Adaptability is Key: Businesses and consumers should be prepared for shifts.

In summary, Neel Kashkari‘s recent comments provide a clear picture of the tightrope walk the Federal Reserve faces. While two Fed rate cuts are still on the table, the significant threat of tariff impact on the inflation outlook could easily derail these plans. The future of monetary policy hinges on how these external pressures evolve, shaping the overall economic outlook. Staying informed about these crucial developments is key to navigating the uncertain waters ahead.

Frequently Asked Questions (FAQs)

1. What is Neel Kashkari’s current stance on Fed rate cuts?

Neel Kashkari believes that two Fed rate cuts remain appropriate for this year, provided economic conditions align.

2. How could tariffs affect the inflation outlook?

Tariffs can increase the cost of imported goods, potentially leading to higher consumer prices and reigniting inflationary pressures, which could impact the inflation outlook.

3. What is the Federal Reserve’s primary goal in monetary policy?

The Federal Reserve’s primary goal in monetary policy is to maintain price stability (controlling inflation) and promote maximum sustainable employment.

4. Why is it important to monitor the economic outlook now?

Monitoring the economic outlook is crucial because potential shifts in Fed policy due to factors like tariffs could impact borrowing costs, investments, and overall market sentiment.

5. Could the Fed actually hike rates if inflation rises due to tariffs?

While less likely than a pause, Neel Kashkari noted that the Fed could consider a rate hike if tariffs push inflation significantly higher and become a persistent threat.

If you found this analysis helpful, please share it with your network! Stay informed on the latest economic developments by sharing this article on social media.

To learn more about the latest monetary policy trends, explore our article on key developments shaping global economies and their future price action.

This post Fed Rate Cuts: Neel Kashkari’s Crucial Warning on Tariff Impact and Inflation first appeared on BitcoinWorld and is written by Editorial Team

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.