US Bitcoin Spot ETFs Face Concerning $187.8M Outflow Streak

0

0

BitcoinWorld

US Bitcoin Spot ETFs Face Concerning $187.8M Outflow Streak

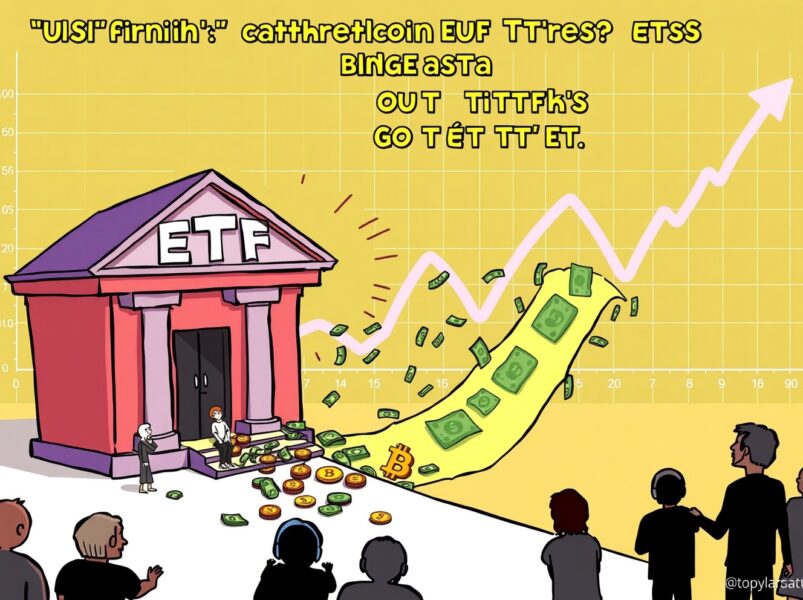

The cryptocurrency world is currently buzzing with news about a significant shift in the investment landscape. US Bitcoin spot ETFs, a key indicator of institutional interest in digital assets, have recently experienced a notable trend: four consecutive days of net outflows. This development has certainly caught the attention of investors and market analysts alike, prompting a closer look into what’s driving this movement.

What’s Behind the Latest US Bitcoin Spot ETFs Outflow?

On November 3, these prominent investment vehicles recorded a total net outflow of $187.84 million. This marks a concerning fourth straight trading day where more money left than entered these funds. The data, meticulously tracked by industry observers like Trader T, provides a clear picture of this trend.

- BlackRock’s IBIT Takes the Hit: Interestingly, the entire sum of $187.84 million was withdrawn from BlackRock’s IBIT. This particular ETF bore the brunt of the outflows, making it a focal point for discussion.

- Other ETFs Hold Steady: All other US Bitcoin spot ETFs reported zero net flows for the day. This suggests that the outflow event was highly concentrated, rather than a broad market exodus across all available spot Bitcoin products.

Such a concentrated withdrawal from a major player like BlackRock’s IBIT naturally raises questions about specific institutional decisions or broader market sentiment influencing that particular fund.

Why Are Investors Pulling Back from US Bitcoin Spot ETFs?

Understanding the reasons behind these outflows is crucial for anyone following the crypto market. Several factors could be at play when investors decide to pull back from US Bitcoin spot ETFs:

- Profit-Taking: After periods of significant price appreciation, some investors might choose to realize their gains. This is a common strategy in volatile markets like cryptocurrency.

- Market Uncertainty: Broader economic concerns, regulatory shifts, or even anticipation of future market events can lead to a more cautious investment approach.

- Reallocation of Capital: Investors might be reallocating funds to other asset classes or different crypto products they perceive as offering better opportunities or lower risk at the moment.

The sentiment around US Bitcoin spot ETFs can often reflect the larger institutional view on Bitcoin’s short-term prospects. While a four-day outflow streak is noteworthy, it’s important to view it within the context of the overall market cycle.

What Does This Mean for the Future of US Bitcoin Spot ETFs and Crypto?

These outflows, while significant, do not necessarily signal a long-term bearish trend for Bitcoin or US Bitcoin spot ETFs. The crypto market is known for its volatility and rapid shifts in sentiment. Historically, periods of outflows have often been followed by renewed inflows as market conditions evolve.

It is important for investors to consider:

- Market Resilience: Bitcoin and the broader crypto ecosystem have demonstrated remarkable resilience over time, recovering from various market corrections and challenges.

- Long-Term Adoption: The approval and existence of US Bitcoin spot ETFs represent a significant step towards mainstream institutional adoption, a trend that is likely to continue in the long run.

- Monitoring Key Metrics: Keeping an eye on trading volumes, Grayscale Bitcoin Trust (GBTC) dynamics, and overall institutional sentiment will provide a clearer picture of future trends for these ETFs.

This period of net outflows serves as a reminder that even established investment vehicles in the crypto space are subject to dynamic market forces.

Navigating the Volatility: Key Takeaways for US Bitcoin Spot ETFs Investors

For current or prospective investors in US Bitcoin spot ETFs, staying informed and adopting a strategic approach is vital. Market movements like these underscore the importance of:

- Diversification: Spreading investments across different asset classes can help mitigate risks associated with any single investment.

- Long-Term Perspective: Focusing on Bitcoin’s fundamental value proposition and its potential as a long-term store of value can help weather short-term fluctuations.

- Staying Informed: Regularly monitoring market news, analyst reports, and flow data for US Bitcoin spot ETFs can provide valuable insights for decision-making.

While the recent outflows are a point of discussion, they are a natural part of a maturing market. The journey of institutional crypto products is still relatively new, and such fluctuations are to be expected as the market finds its footing.

In conclusion, the recent four-day streak of net outflows, particularly from BlackRock’s IBIT, highlights a period of caution among some investors in US Bitcoin spot ETFs. However, this event should be viewed within the broader context of a dynamic and evolving market. As the crypto landscape continues to mature, understanding these flow patterns becomes increasingly important for making informed investment decisions. The institutional interest in Bitcoin remains strong, and these ETFs are still pivotal in bridging traditional finance with the digital asset world.

Frequently Asked Questions (FAQs)

What are US Bitcoin spot ETFs?

US Bitcoin spot ETFs are exchange-traded funds that directly hold Bitcoin as their underlying asset. They allow investors to gain exposure to Bitcoin’s price movements without directly owning or managing the cryptocurrency itself, trading like traditional stocks on exchanges.

Why are outflows from US Bitcoin spot ETFs significant?

Outflows indicate that more investors are selling their shares in these ETFs than buying, suggesting a decrease in demand or a shift in investor sentiment. Significant outflows can sometimes put downward pressure on Bitcoin’s price and reflect broader market concerns.

Does this affect Bitcoin’s price directly?

While US Bitcoin spot ETFs flows can influence Bitcoin’s price by affecting demand, they are one of many factors. The overall market sentiment, macroeconomic conditions, and other trading activities also play crucial roles in Bitcoin’s price movements.

Should I be concerned about my US Bitcoin spot ETFs investment?

It’s important to assess your individual risk tolerance and investment goals. Market fluctuations, including outflows, are common. It is advisable to conduct your own research, consider professional financial advice, and maintain a long-term perspective.

What is BlackRock’s IBIT?

IBIT is the ticker symbol for BlackRock’s iShares Bitcoin Trust, one of the largest and most prominent US Bitcoin spot ETFs. It allows investors to gain exposure to Bitcoin through a regulated financial product offered by a major asset manager.

Did you find this analysis helpful? Share your thoughts and this article with your network!

To learn more about the latest crypto market trends, explore our article on key developments shaping Bitcoin institutional adoption.

This post US Bitcoin Spot ETFs Face Concerning $187.8M Outflow Streak first appeared on BitcoinWorld.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.