Jupiter Price Breaks Out of Inverse H&S Pattern, Surges 5% as Analyst Eyes $0.85

0

0

Highlights:

- The price of Jupiter has surged 5% to $0.64, as the bulls break out of the Inverse H&S pattern.

- The rising derivatives activity suggests increased trader confidence in the market.

- A crypto analyst foresees a rally to $0.85 in Jupiter’s price.

The Jupiter price is boasting a splendid bullish outlook, surging 5% to $0.64 in the past 24 hours. Accompanying the price movement is its daily trading volume, which has soared 32%, indicating intense trading activities. Meanwhile, the JUP token is up 28% in a week and 37% in a month, indicating growing bullish sentiment. Let’s uncover what’s behind JUP’s positive outlook.

Jupiter Revamps Onboarding to Enhance User Accessibility

Along with improving the market, Jupiter has simplified onboarding to allow more people to use cryptocurrency. For the first time, users worldwide can enter the digital asset market by buying cryptocurrencies using nearly any fiat currency on the platform.

We've revamped Jupiter Onboard. Now you can:

✓ Buy crypto with most fiat currencies

✓ Transfer from a crypto exchange

✓ Bridge from other chains with @deBridgeFinance

✓ Bridge USDC with @circle pic.twitter.com/lmVJyxJiBu— Jupiter (

,

) (@JupiterExchange) May 26, 2025

It’s also worth noting that Jupiter helps make the process of moving crypto from exchanges to your wallets very convenient. Jupiter has added support for DeBridge Finance and Circle, so people can easily bridge currencies from various blockchain systems and quickly exchange USDC.

Jupiter Price Technical Outlook

JUP just broke above the neckline in an inverse head and shoulders pattern, which signals it may be beginning a bullish trend. Since this formation generally means the prevailing trend is reversing, JUP’s trend movement confirms the bullish change.

A quick look at the technical outlook, including the RSI at 69.05, suggests buying pressure is building up, but the market isn’t yet overbought. The MACD has turned positive, showing more buying action ahead. The present level of the 50-day moving average at around $0.47 is providing support for the bulls, and the 200-day moving average near $0.76 continues to stand as the key resistance.

After breaking through key resistance, traders believe Jupiter will rally toward targets at $0.67, $0.7,6 and possibly $0.855, according to Jonathan Carter. If the price goes above $0.76, which is in line with the 200-day moving average, it could lead to further increases for the Jupiter price.

Jupiter has broken above the neckline of an inverse head and shoulders pattern on the 12H chart

The price is showing strong bullish momentum after completing this classic reversal formation

After the retest, the price could drive targets toward $0.670, $0.760, and… pic.twitter.com/vF1TAZ2O11

— Jonathan Carter (@JohncyCrypto) May 26, 2025

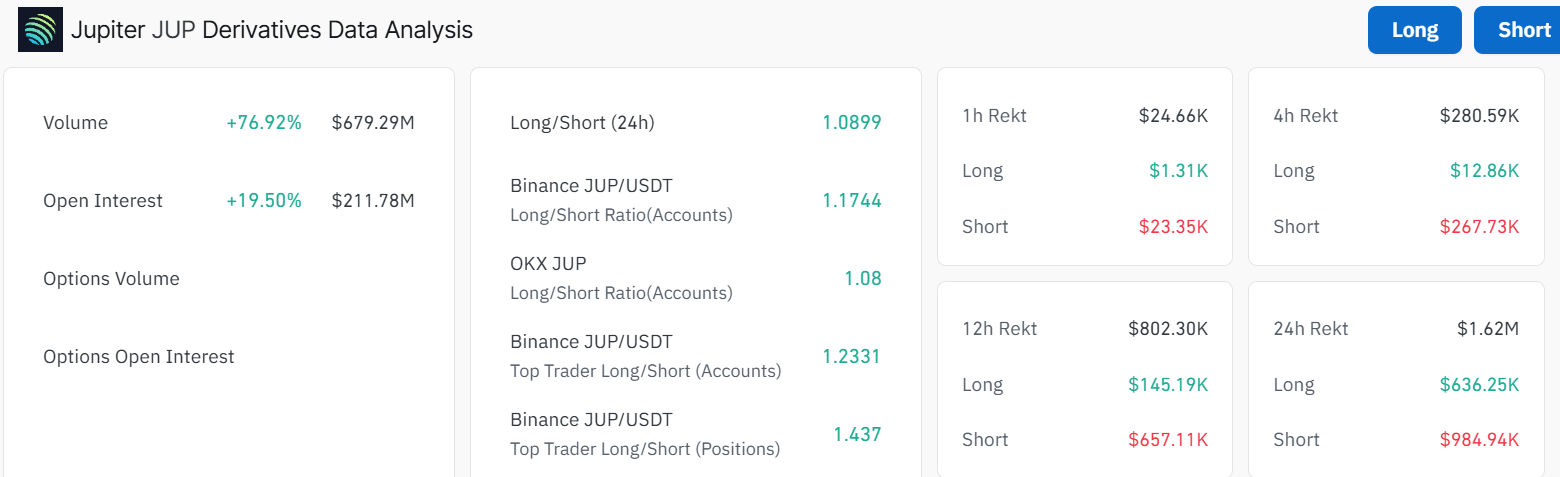

Rising Derivatives Activity Reflects Growing Trader Confidence

Sentiment in the derivative sector around Jupiter appears to be rising. There is a sharp increase of 76.92% in trading volume today, making it $679.3 million. About a 20% rise in open interest proves that people are now participating more in JUP futures and options contracts.

Successful Binance traders have conviction since the long-to-short ratio they hold is above 1.4. Having said that, the large number of short positions suggests risk management measures are in place to prevent the market from becoming too volatile. The rise of these trends in derivatives points to stronger interest from both institutions and investors in Jupiter’s token as a rising asset.

What’s Next for Jupiter Price?

JUP’s major technical milestone, rise in derivatives activity, and effortless onboarding process suggest continued growth is likely. If the Jupiter price continues to surge and break above the $0.75 critical barrier, further upside could be plausible. In such a case, the $bulls could rally to $0.84 or reclaim $1 in the coming days.

On the flip side, if the key barrier at $0.5 proves too strong, it may cushion the bulls against further upside, causing a drop. In such a case, the $0.59, $0.53, and $0.46 support zones will act as a safety net against further downside. Watching main price levels is recommended for investors and traders. Moreover, the derivatives trends should be kept in mind, while new users can use Jupiter’s straightforward system. As a result, Jupiter is on solid ground to keep rising.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.