MEXC Vs OKX 2025: Which Crypto Exchange Is Best for Trading?

0

1

MEXC and OKX are global crypto exchanges that offer spot, futures, and other basic and advanced trading tools to beginners and experienced traders alike. Since these exchanges have similar product offerings, it can be challenging to determine which one is better.

So, in this MEXC vs OKX review, we will highlight each platform’s key features, fees, pros and cons, security features, referral program, and more. Then compare both crypto exchanges side-by-side to help you decide on the better exchange for your trading needs.

MEXC vs OKX: Overview Comparison

| Criteria | MEXC | OKX |

| Best For | Wide range of altcoins, high leverage, and advanced trading features. | Deep liquidity and high-volume derivatives trading. |

| Launch Year | 2018 | 2017 |

| Key Features | Zero-fee pairs, Kickstarter, MEXC launchpad, demo trading, and copy trading. | Algorithmic bots, OKX Wallet, copy trading, demo trading, and institutional services. |

| Trading Options | Spot trading and futures/perpetual contracts. | Spot, margin, futures/perpetuals, options trading. |

| Supported Cryptocurrencies | 3,000+ | 400+ |

| Trading Fees (maker and taker) | Spot: 0.00% and 0.05%

Futures: 0.08% and 0.10% |

Spot: 0.00% and 0.02%

Futures: 0.02% and 0.05% |

| Security Measures | Cold storage, 2FA, insurance fund, and multi-signature wallet. | Cold storage, 2FA, insurance fund, and multi-sig wallet. |

| Native Token | MX Token (MX) | OKB |

| Mobile App | iOS and Android | iOS and Android |

What is MEXC?

MEXC is a global cryptocurrency exchange founded in 2018. The exchange has a low profile in terms of founder identity, but it was launched and is currently led by a team of professionals with backgrounds in blockchain technology, finance, and cybersecurity.

The platform offers a wide array of services, including spot trading, futures, margin trading, launchpad, demo trading, and staking, giving users access to over 3,000 digital assets and trading pairs. MEXC Exchange is popular for its high-performance trading engine capable of processing 1.4 million transactions per second.

Traders also choose MEXC for its extremely low trading fees, deep liquidity, and commitment to listing emerging tokens early. This commitment is one reason MEXC has gained popularity worldwide, serving over 40 million users across more than 170 countries and amassing $6+ billion in daily trading volume according to CoinMarketCap.

Pros & Cons of MEXC

| Pros | Cons |

| Wide selection of cryptocurrencies, including new and trending tokens | Limited fiat on-ramp options compared to larger exchanges |

| Low trading fees for both spot and futures markets | The interface can feel complex for beginners, especially with the extensive products the exchange offers |

| The verification process is quick, allowing users to register with only an email and a password. | MEXC is restricted in some regions, including the United States. |

| High leverage options of up to 500x for futures trading | |

| Fast trade execution and deep liquidity | |

| Frequent token listings and promotional campaigns |

MEXC is best for:

- Traders who want access to a wide variety of cryptocurrencies and new token listings

- Futures and derivatives traders who need high leverage of up to 500x leverage and advanced trading tools

- Beginners and high-volume traders who want to benefit from low trading fees.

- Beginners and advanced traders alike, thanks to its user-friendly interface and professional-grade features

What is OKX?

OKX, formerly known as OKEx, is a leading cryptocurrency exchange launched in 2017 by Mingxing “Star” Xu. Headquartered in Seychelles, the exchange was created to offer a comprehensive digital asset ecosystem that includes spot trading, futures, perpetual swaps, options, and DeFi products.

OKX is one of the most widely used crypto exchanges globally, serving millions of users in over 100 countries and recording over $5 billion in daily trading volume according to CoinMarketCap.

While OKX offers exchange services, including trading bots, spot trading, and derivatives products, what sets it apart is its robust trading infrastructure, multi-chain wallet, and commitment to Web3 development through products like OKX Wallet and OKX Chain.

Pros & Cons of OKX

| Pros | Cons |

| Advanced trading tools and a professional-grade interface | Does not offer exchange services in the United States. |

| Strong security infrastructure and transparent operations | Occasional high network fees during peak times |

| Broad product range including spot, futures, options, and DeFi | Limited fiat trading options |

| Integrated Web3 wallet and multi-chain ecosystem | Complex and advanced features may overwhelm new traders |

| Competitive trading fees and high liquidity | |

| The company has its own native blockchain (X Layer), which ensures faster and cheaper transactions. |

OKX is best for:

- Professional and institutional traders looking for advanced trading tools, derivatives products, and deep liquidity

- DeFi and Web3 enthusiasts who want to explore decentralized apps, staking, and NFTs via the OKX Wallet

- Investors looking for diverse earning opportunities like savings, staking, and dual investment products

- Beginners seeking an all-in-one platform for spot, futures, and passive income products, as well as access to the web3 ecosystem and strong educational support.

MEXC vs OKX: Trading Features

| Feature | MEXC | OKX |

| Trading Options | Spot and futures/perpetuals | Spot, margin, futures/perpetuals, and options |

| Leverage (futures/perpetuals) | Up to 500x on major coins/pairs. | Up to 125x on select pairs. |

| Margin Modes | Cross and isolated margin; supports Hedge mode (holding long and short in the same contract). | Has single-currency cross margin, multi-currency cross margin, etc. |

| Trading Bots | Yes | Yes |

| Token Launch Platform | Yes, MEXC launchpad. Users can participate through the MEXC launchpool and Kickstarter. | Yes, Jumpstart. |

| Staking | Yes | Yes |

| Copy Trading | Yes | Yes |

| Demo Trading | Yes | Yes |

MEXC vs OKX: Platform Products and Services

MEXC and OKX have some key features that make them suitable for different traders. Let’s explore these features in detail.

What MEXC Offers:

- High Leverage: MEXC offers high leverage options, up to 500x on certain futures contracts, allowing traders to amplify their positions and potential profits.

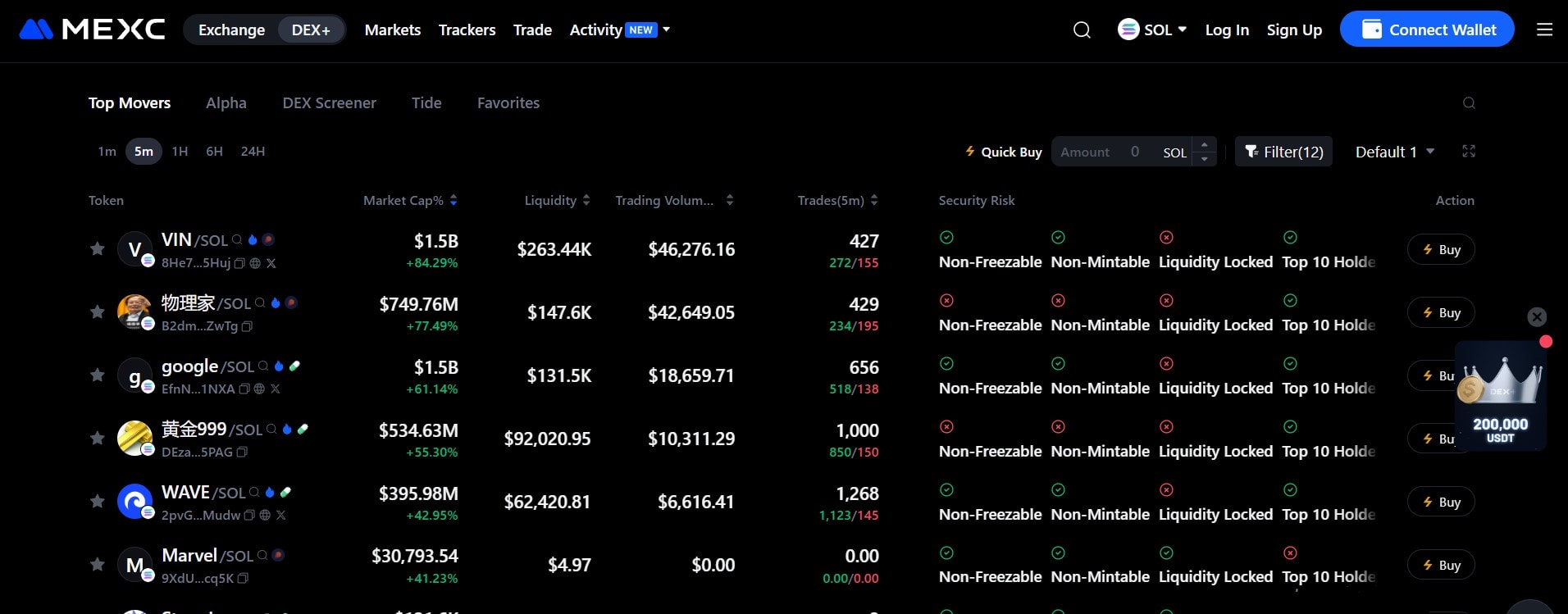

- DEX+ is MEXC’s decentralized exchange integration that allows users to trade directly from their wallets while maintaining control of their assets. DEX+ combines the security benefits of DeFi with the liquidity and speed of a centralized platform.

- MEXC Launchpad and Launchpool: The Launchpad helps new blockchain projects introduce their tokens to the market. Through MEXC launchpool, traders can participate in early-stage token sales and gain access to promising new projects before they are listed.

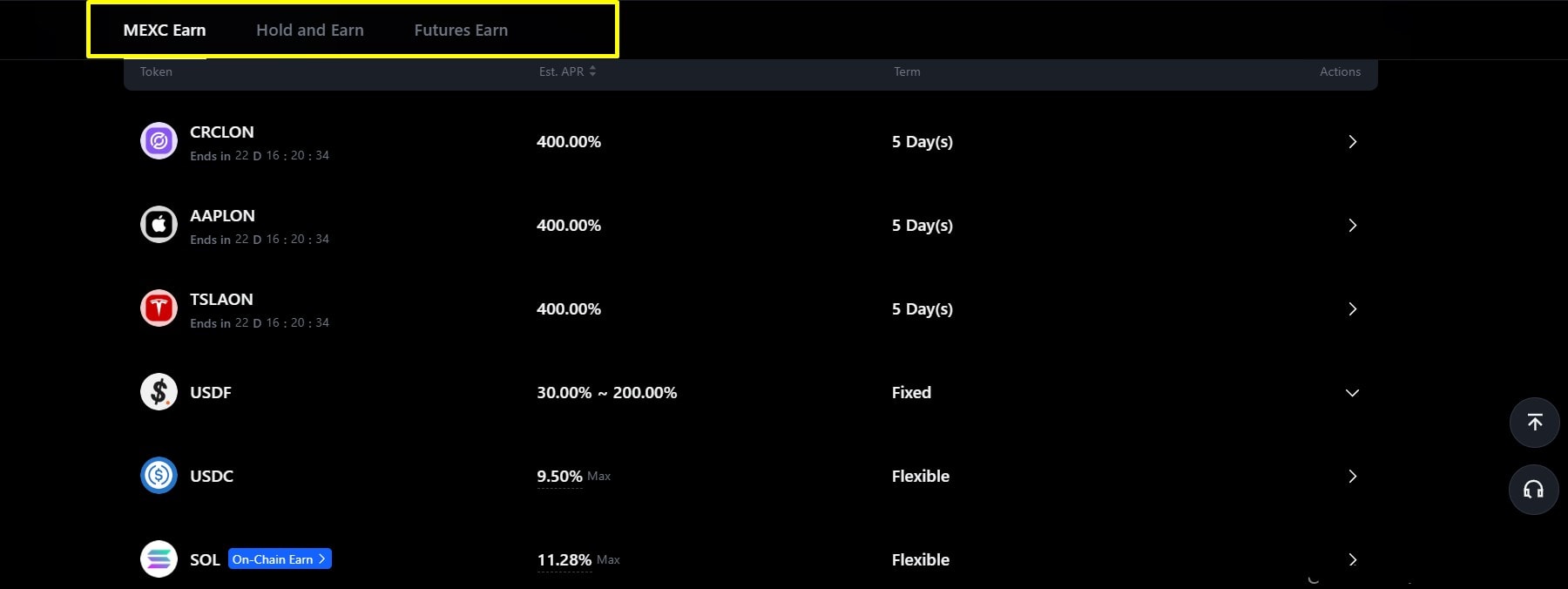

- MEXC Earn: offers both locked and flexible savings products that let users earn passive income on their idle crypto. Flexible savings allow withdrawals anytime, while locked savings provide higher returns for users who commit their funds for a fixed period.

What OKX Offers:

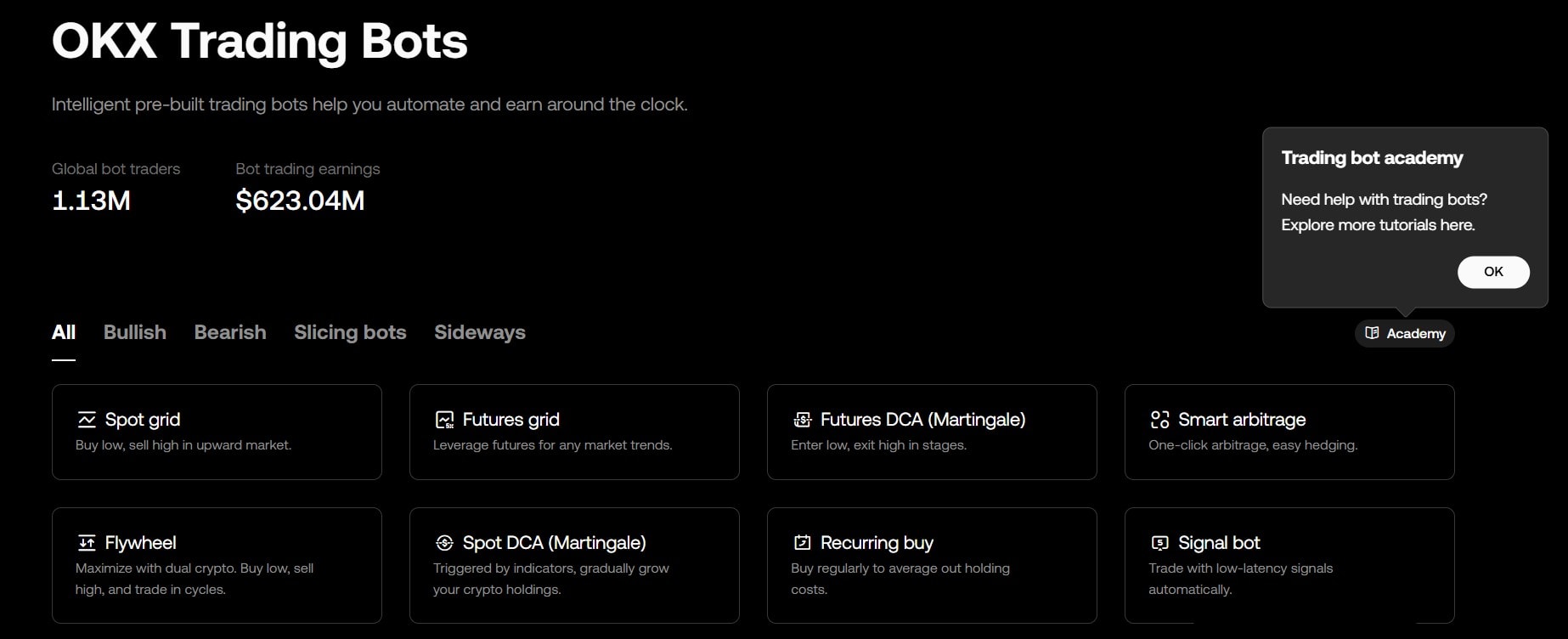

- Trading Bots: OKX offers automated trading bots that help users execute trades based on pre-set strategies without constant manual monitoring. These include spot grid bots, futures grid bots, DCA (Dollar-Cost Averaging) bots, and arbitrage bots.

- OKX Earn: OKX Earn offers a range of products, including savings and staking, crypto loans, and access to an on-chain lending marketplace. You can choose between flexible or fixed terms to earn interest on your holdings, stake tokens for network rewards, or lend assets to borrowers for additional yield opportunities.

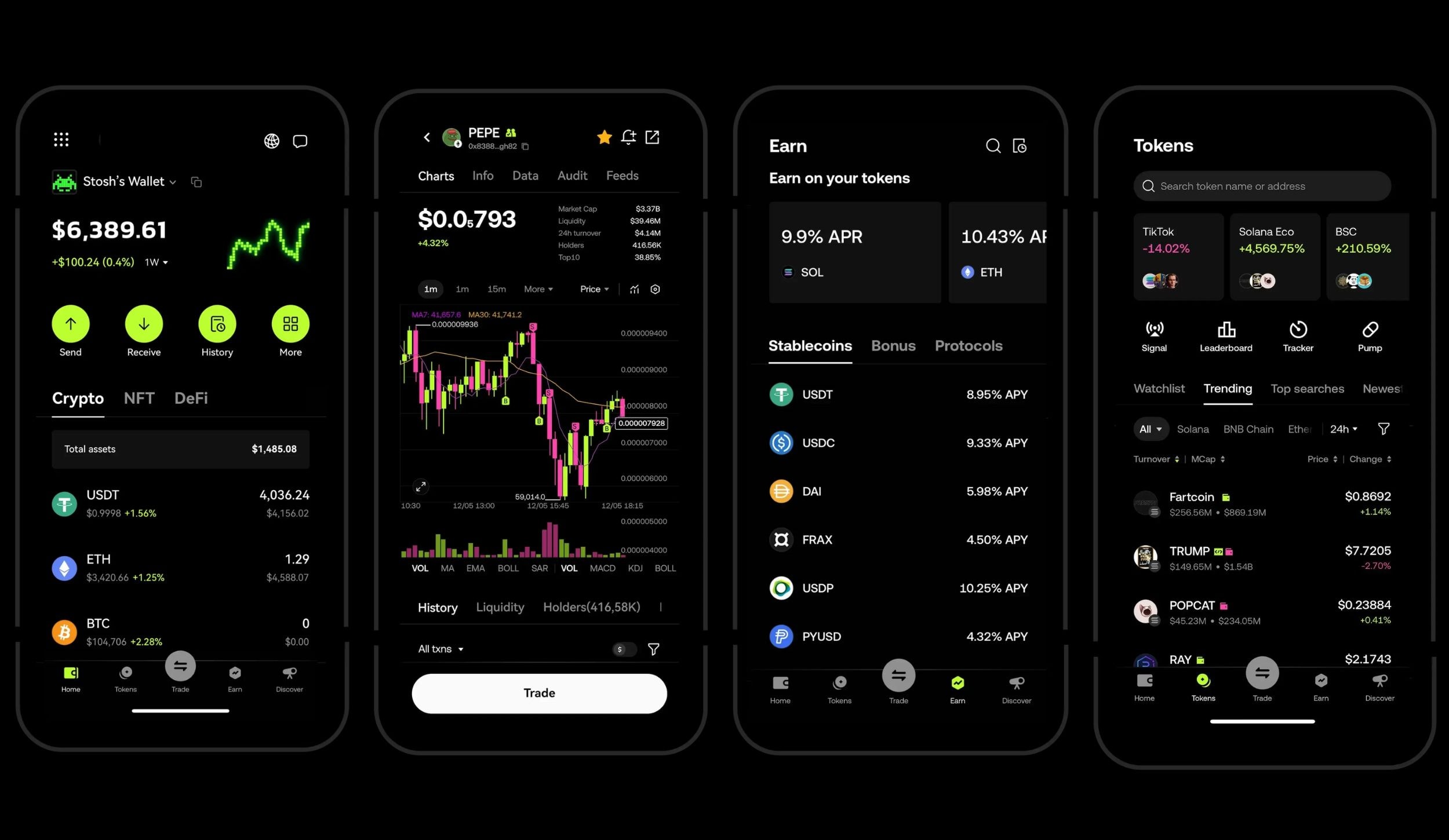

- OKX Wallet: The OKX Wallet is a self-custodial, multi-chain wallet that allows users to store, trade, and manage their crypto and NFTs securely. It supports thousands of tokens across 30+ blockchains, enabling users to access DeFi platforms, dApps, and Web3 games directly.

- Jumpstart: OKX Jumpstart is the platform’s token launch platform that allows users to participate in early-stage blockchain projects. It gives users access to new token sales or airdrops by staking OKB (OKX’s native token).

Among the similar services OKX and MEXC offer are institutional-grade tools and solutions for hedge funds, asset managers, and professional traders. These services include advanced APIs, customized API access, deep liquidity pools, dedicated account managers, and over-the-counter (OTC) trading.

MEXC vs OKX: Fee Structures

| Fee | MEXC | OKX |

| Spot (maker/taker) | 0.0000% and 0.0500%

Up to 50% discount available for MX token holders. |

0.080% and 0.100%

Discounts are available via tiered VIP levels. |

| Futures (maker/taker) | 0.000% and 0.020%

|

0.020% and 0.050% |

| Deposit Fees | Free

|

Free |

| Withdrawal Fees | Varies by token and network

|

Varies by token and network |

| Zero Fee Pairs | Yes

|

Yes

|

| Discounts | Hold 500+ MX tokens and get up to a 50% fee discount. The MX token “deduction” also gives 20 % off. | Tiered discounts based on 30-day volume plus OKB holdings. |

MEXC vs OKX: Coins Supported, Liquidity & Volume

| Criteria | MEXC | OKX |

| Supported Coins | 3,000+

|

400+ |

| Trading Pairs | 2,000+ pairs (spot and derivatives combined)

|

500 spot pairs and 400+ derivatives pairs |

| Market Liquidity | Deep liquidity is available for major pairs, although some smaller tokens may have comparable liquidity. | Deep liquidity, especially on major pairs. Also offers a Liquid Marketplace for institution/block trades to reduce slippage |

| 24-hour Trading Volume (CMC) | $6,441,204,299

|

$4,911,631,568 |

Note: All data above reflect data available at the time of writing. Cryptocurrency market volumes and liquidity fluctuate frequently due to market volatility and trading activity. Please verify current data directly on the respective exchange websites or crypto tracking software before making any trading decisions.

MEXC vs OKX: Security Comparison

Both MEXC and OKX prioritize security by implementing robust security measures to safeguard users’ assets.

MEXC Security Measures

- Cold Storage: The Majority of user funds are stored in offline cold wallets, minimizing exposure to online threats.

- Two-Factor Authentication (2FA): Adds a second layer of protection for login and withdrawals through Google Authenticator or SMS verification.

- Security Insurance Fund: MEXC has introduced a $100 million “Guardian Fund” intended to provide user protection against major security breaches, technical failures, and other severe incidents. The fund is publicly disclosed on-chain so that its balance and transactions are transparent.

- Futures Insurance Fund: The exchange’s Futures Insurance Fund (for derivatives/liquidation risk) exceeds USD 540 million, which is used to cover losses when a user’s liquidation exceeds their margin, “negative balance” events.

OKX Security Measures

- Cold Storage: OKX stores 95% of user funds offline in highly secure, air-gapped cold wallets with encrypted private keys and multi-signature approval processes for any movements.

- Account Security: User accounts benefit from mandatory two-factor authentication (2FA) and withdrawal address whitelisting, which requires pre-approval before you can send funds to new addresses.

- AI-powered threat detection scans for fraudulent activity, deepfakes, and fake profiles under the OKX Eagle Eye program.

- Semi-Offline Multi-Device Authorization: OKX stores its private keys across multiple secure devices that are not connected to the internet (semi-offline). These devices use encrypted communication channels to sign transactions offline, meaning the private keys themselves never leave their protected environment or get exposed online.

MEXC vs OKX: Affiliate & Referral Programs

| Criteria | MEXC | OKX |

| Referral Bonus (Sign up) | Up to 10,000 USDT | Up to 10,000 USDT |

| Trading Fee Discount (Referrals) | 50% | 30% |

| Affiliate Commissions | 70% on your referrals’ trading fees | 30% on your referrals’ trading fees |

| Additional Perks for Affiliates | 10% commission for sub-affiliates and custom rates for top affiliates. | Additional rewards for high-volume affiliates, including a 20% increase in commission. |

| Payout Frequency for Affiliates | Daily | Weekly |

| Current Referral Code | mexc-NFTP | 98973395 |

| Mandatory KYC | Yes | Yes |

Pro Tip: Learn how to use the MEXC referral code and OKX referral code to unlock up to 10,000 USDT in welcome rewards.

MEXC vs OKX: User Experience

From our MEXC Review, we found that onboarding on the crypto exchange is quick and straightforward. You can sign up with just an email or phone number and a password. While completing KYC isn’t mandatory to explore MEXC’s products, verified users get higher withdrawal limits.

The mobile app mirrors the features on the web platform, supporting both spot and derivatives trading, although the interface can feel slightly cluttered compared to OKX. MEXC’s trading interface includes standard order types, TradingView charts, and advanced charting tools. Users also get access to demo trading, fiat on-ramps, and earning products.

On the other hand, our OKX review revealed that the platform has a more structured onboarding process that includes KYC and additional security setup, making it slightly slower than MEXC but more compliant. The interface is modern and recently upgraded, offering multiple modes: Simple, Advanced, and Web3. The mobile app for iOS and Android is stable, responsive, and well-designed compared to the MEXC mobile app.

OKX’s trading interface offers advanced order types, in-depth analytics, and comprehensive tools for derivatives, including margin, futures, and options. It also offers automated trading bots, earning products, Web3 wallet integration, fiat on-ramps, and cross-chain features.

MEXC vs OKX: Customer Support

MEXC provides 24/7 customer support through live chat, email, and a ticketing system, responding within minutes via chat and within 24-48 hours for email inquiries. Its Help Center features detailed trading guides, security resources, and API documentation, complemented by active regional Telegram communities for informal assistance. It’s also one of the most language-friendly exchanges out there, supporting over 40 languages across major regions.

Similarly, OKX offers 24/7 support through chat and tickets, and a comprehensive Help Center. Users can begin with automated responses and escalate to live agents, with average wait times of seconds for chat and about 10–15 minutes for tickets.

The exchange provides clear documentation on trading, security, and platform navigation, along with product tutorials. OKX currently supports around 15 major languages, giving global traders easy access to help whenever they need it.

Conclusion

MEXC and OKX offer powerful trading and decentralized ecosystems that serve traders differently. If you want to explore new tokens and high-leverage trading, MEXC provides basic and advanced trading tools, as well as a robust token launch platform to help you catch new/trending projects before they hit the public.

However, if your focus is on high-volume derivatives trading and smooth navigation, OKX is a more balanced choice. At the end of the day, the best platform is the one that aligns with your goals and trading style, so take time to explore their tools.

FAQs

What Exchange is Better Than MEXC?

To determine which exchange is better than MEXC, it’s important to consider factors like trading fees, trading pairs, liquidity, security, user experience, and regulatory compliance. Top alternatives to MEXC are OKX, Binance, Bybit, Bitget, and Coinbase.

Which Cryptocurrency Exchange has Lower Fees: MEXC vs OKX?

MEXC has lower fees compared to OKX. Although both exchanges charge low fees and offer zero fee pairs, MEXC charges less, placing it among the exchanges with the lowest transaction costs in the crypto market.

Which Exchange is More Beginner-friendly: MEXC or OKX?

MEXC is more beginner-friendly. While both exchanges offer various basic features for beginners, we consider MEXC more beginner-friendly due to its easy-to-use interface, educational content, low fees, and large coin selection.

Which Crypto Exchange is Safer: MEXC vs OKX?

Both exchanges implement robust security measures to keep users’ assets safe. MEXC and OKX both store the majority of user assets in cold/offline wallets with multi-sig approval, encouraging various account security measures. Additionally, they both have an insurance fund to reimburse traders in case of breaches.

Which is Best for Advanced Traders: MEXC vs OKX?

OKX is best for advanced traders. OKX and MEXC both offer products and a platform that are suitable for seasoned traders, but OKX is a stronger pick for professional derivatives traders.

The post MEXC Vs OKX 2025: Which Crypto Exchange Is Best for Trading? appeared first on NFT Plazas.

0

1

한 곳에서 모든 암호화폐, NFT 및 DeFi 를 관리하세요

한 곳에서 모든 암호화폐, NFT 및 DeFi 를 관리하세요시작하는 데 사용하는 포트폴리오를 안전하게 연결하세요.