Bitcoin Hits $126,000 Record High 📈 After the United States Government Shutdown🇺🇸

0

0

👋 Welcome to the CoinStats Scoop, your weekly newsletter with the most groundbreaking Web3 innovations and market-moving headlines in the crypto space.

Stay in the loop with all the key market moves 📈, emerging trends, and exciting developments in the crypto space from the past week.

This week in crypto, Bitcoin’s price skyrocketed to a new all-time high, as large investor capital fled to safe-haven assets amid concerns about the United States government shutdown 🇺🇸.

The stablecoin supply also rose to a record high of $300 billion 💰, signaling more blockchain payments along with global investors positioning for the next big crypto run 🏁.

October 🎃 also holds 16 crypto exchange-traded fund (ETF) applications that await a response from the United States Securities and Exchange Commission🏛️, set to bring more traditional investment into leading altcoins.

Paired with the booming $300 billion stablecoin supply, it signals a strong catalyst for a historic altcoin season breakout during the second-most bullish month of the year.

In this week’s CoinStats Scoop, you’ll find:

Crypto market analysis and the most important news in Web3📊

Bitcoin’s record $126,000 high📈, fueled by the United States government shutdown

The record $300 billion stablecoin milestone 💰

Plasma founder’s XPL insider selling allegations 🧩

Michael Saylor’s Strategy halts Bitcoin buys after $3.9 billion profit in Q3 🧠

Analysis and key events that will shape the crypto market next week 🔮

Bitcoin hits $126,000 record high 🚀 after the US government shutdown

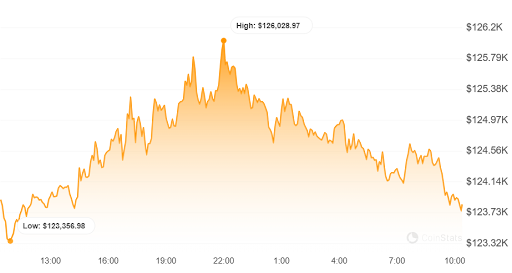

Bitcoin’s price broke out to a new all-time high of $126,000 on October 6, after seeing an over 10.2% rally 📈 during the past week, according to CoinStats data.

Bitcoin’s new record closely follows gold’s latest all-time high 🏆, signaling that more investors are fleeing into safe-haven assets amid concerns with the traditional financial system.

Days before, on October 1, the United States government suffered its first shutdown since December 2018, as Republicans led by President Donald Trump and Democrats on the other side couldn’t agree on the spending bill.

Until the two sides come to an agreement, the government will be closed due to a lack of funding plans.

Analysts are seeing the government shutdown as a catalyst for renewed appetite for assets outside the scope of United States politics 🇺🇸, such as the world’s first decentralized network’s token, Bitcoin.

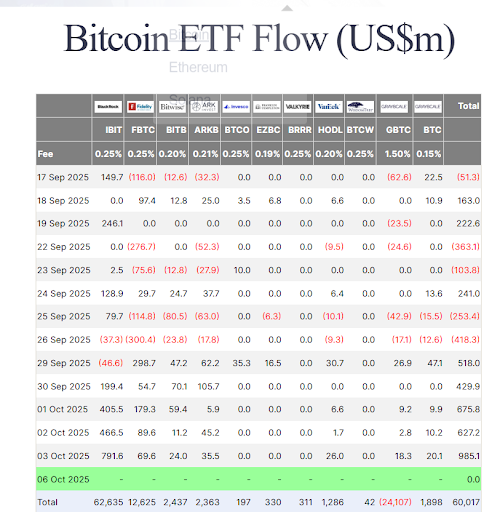

Bitcoin ETFs have also reached a record milestone 🏆 of over $60 billion 💰 in total net cumulative investments since their launch in January 2024.

The spot Bitcoin ETFs have been a significant catalyst to Bitcoin’s all-time high 🚀 this week, as these funds saw 5 days of uninterrupted inflows 📈, with $985 million on October 3 to close the past week.

Bitcoin’s latest all-time high is set to trigger the next “very quick” move that will stage a breakout to $150,000 before the end of 2025, according to hedge fund founder Charles Edwards.

Stablecoin supply breaks $300 billion 💰 record, flashing another altcoin season signal

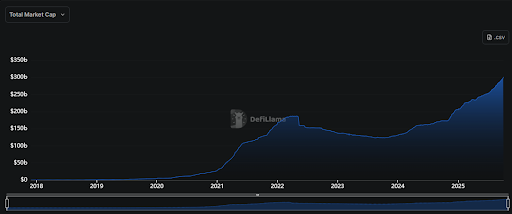

The cryptocurrency market celebrated another historic milestone 🏆 this week, as the total stablecoin supply breached the record $300 billion 💰 milestone for the first time.

The $300 billion milestone shows significant investor demand for stablecoins that grew the stablecoin market by an astonishing 46% 📈 in 2025 year-to-date.

A ballooning stablecoin supply signals that more investors are loading up on “dry powder” waiting to be deployed in the crypto market trenches.

A growing stablecoin supply is seen by analysts as a precursor for significant crypto market rallies, especially considering the historic significance of October 🎃, the best month for Bitcoin price 🚀.

During the past week alone, investors minted over $5 billion 💰 worth of new stablecoins, with Tether remaining the largest one, dominating over 58.5% 📊 of the entire stablecoin market share.

Stablecoins are the primary bridge 🌉 between fiat money and digital assets. Crypto traders see stablecoin levels as an indication of the amount of “dry powder” that may enter the markets.

In the historical context of the 4-year market cycle 🔄, the $300 billion stablecoin record could find its way into the leading altcoins, such as Solana, Avalanche, and XRP, as the tokens await their ETF approval deadline this month.

The SEC’s altcoin ETF deadlines, paired with the $300 billion liquidity, signals another strong altcoin season, when the smaller tokens start outperforming both Bitcoin and Ether’s momentum.

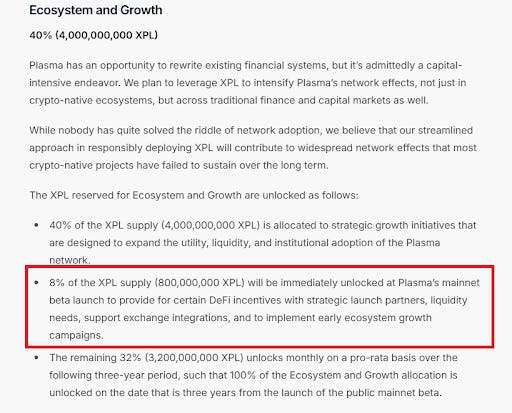

Plasma founder hit by insider trading allegations ⚖️ after XPL crash 📉

Plasma was hit by insider trading allegations this week, after investors were disappointed with the XPL token’s price crash after the project’s beta launch.

The XPL token saw a major correction, falling 30%📉 during the past week to lose the $1 psychological threshold, erasing over half of its value compared to the $1.68 📊 all-time high on September 28, according to CoinStats data.

Following the crash 📉, traders started pointing to insider selling ⚖️ as the likely reason behind the crash.

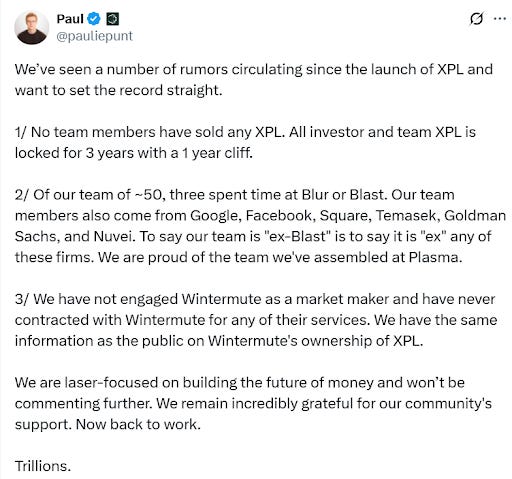

Plasma’s founder, Paul Faecks, denied the circulating rumours ❌, highlighting that all team tokens are locked 🔒 for 3 years:

“No team members have sold any XPL. All investor and team XPL is locked for 3 years with a 1-year cliff.”

The founder also denied the allegations ⚖️ that pointed to ties to market-making and algorithmic trading firm Wintermute, which Faecks said his protocol “never contracted” for any services.

However, other crypto market watchers 👀 remained unconvinced, pointing to other token allocations that were already unlocked 🔓.

Some pointed to Plasma’s 8% supply 📊 set for ecosystem growth initiatives, which was unlocked at Plasma’s mainnet launch.

Multiple X users 🐦 pointed to this freshly unlocked 8% as the reason behind the XPL token’s crash 📉, but the truth is yet to surface.

Michael Saylor’s Strategy posts $3.9 billion 💰 profit for Q3 but pauses Bitcoin investments ⏸️

Michael Saylor’s Strategy has put a pause ⏸️ on its regular Bitcoin investments, despite posting nearly $4 billion 💰 worth of gains for Q3 2025 📊.

Strategy, the world’s largest corporate Bitcoin holder, made a gain of $3.9 billion 💵 on its BTC stash during the previous quarter.

These mark unrealized gains, as the company has not sold any of its Bitcoin holdings, in line with Saylor’s investment philosophy 📈.

“No new orange dots this week — just a $9 billion 💰 reminder of why we HODL,” wrote Saylor as he announced the pause ⏸️ in BTC acquisitions.

Strategy is holding 640,000 Bitcoin worth approximately $79 billion at the time of Saylor’s post. The firm bought its Bitcoin at an average price just under $74,000 💰 per BTC.

Including Strategy’s $5.8 billion gain after the quarter’s cutoff, the company’s total gains reached over $9 billion.

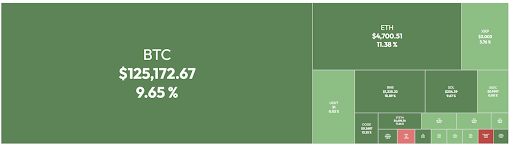

Market Overview: Uptober rally 🚀 brings new Bitcoin all-time high, institutional crypto investments 📊

Bitcoin and Ether took the lead during the first week of October, as institutional interest bought hundreds of millions of the two leading tokens via spot markets and ETFs.

While retail investors were focused on Bitcoin’s new all-time high⛰️, analysts cheered after a key daily close that confirmed the next rally 🚀 into new price discovery stages.

Bitcoin performed a crucial daily close above the key $123,400 area, confirming the breakout, a trade setup that remains valid until Bitcoin remains above this key support level 🛡️, according to crypto analyst Rekt Capital.

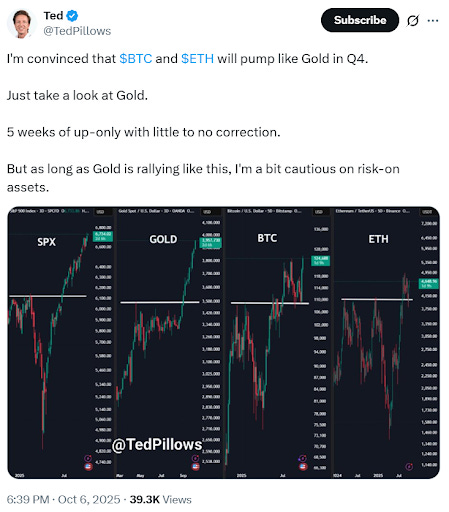

Following the United States government shutdown, more traders are now expecting both Bitcoin and Ether to follow gold’s rally 🏆.

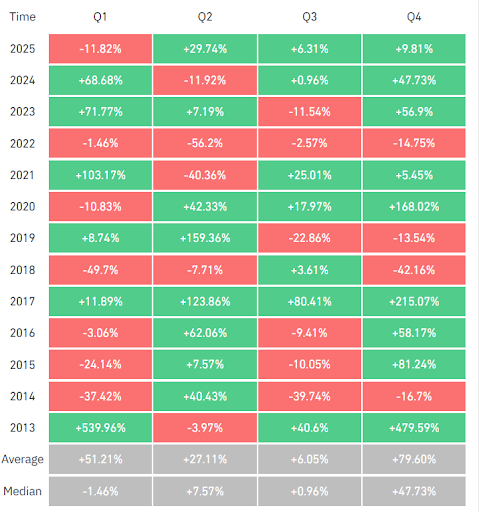

The fourth quarter of the year is historically the most bullish period 📈 of the year, with October, or “Uptober,” being the second-best year for Bitcoin, when looking at average historical returns data 📊.

On average, Bitcoin posted 20% rallies 📈 during October but skyrocketed over 46% 🚀 in November during previous years, bolstering investor predictions for new all-time highs until the end of the year.

Looking ahead, investor sentiment will continue to be shaped by the duration of the US government shutdown, which is delaying numerous other economic data releases.

On Wednesday, macro-watchers will look for the release of the Federal Open Market Committee’s Meeting minutes 🏛️, along with the 10-year note auction in the US, both key to measuring monetary policy sentiment ⚖️.

On Thursday, FED Chair Jerome Powell is set to share economic remarks 📢 along with the publication of the Initial Jobless Claims report 📊, before Friday’s critical Nonfarm payrolls data and unemployment report 📉, which will give more signs on the health of the US economy.

Whether Bitcoin and gold will continue their safe-haven rally 🚀 will depend on the outcome of these events during the following week.

Tweets & Memes

Ethereum and Bitcoin are steadily following gold’s record rally 📈.

Was this the local Bitcoin bottom before the new all-time high ⛰️?

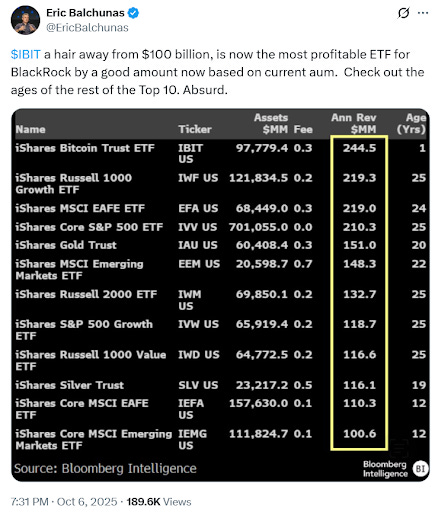

BlackRock’s Bitcoin ETF is becoming a real revenue-generating machine 💰 for the world’s largest asset manager 🌎

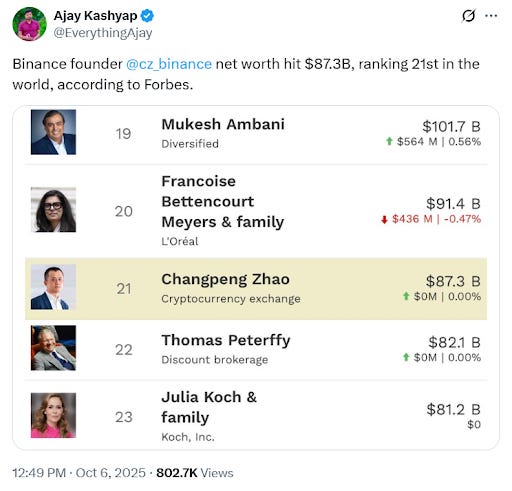

CZ’s net worth is rising to new peaks ⛰️ as both BNB and ASTER are hitting renewed all-time highs 📈.

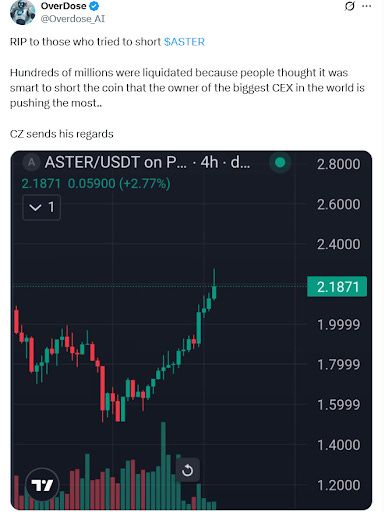

So long for all the traders shorting the Aster token 📉…

Thank you for reading the weekly CoinStats Scoop Newsletter.

CoinStats will continue to guide you through the world of crypto and DeFi. We’ll see you next week for another edition of CoinStats Scoop! 😎

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.