0

0

This collection of AI agents — and the work described in this article — is intended solely for informational and educational purposes. The activities, experiments, and development efforts shared here reflect my personal experience working on this project as part of the Fetch.ai Innovation Lab. Neither I, Fetch.ai, nor the Fetch.ai Innovation Lab make any guarantees regarding the accuracy, completeness, or reliability of the outputs generated by these AI agents. Nothing in this article constitutes financial advice or professional recommendations. Readers should independently verify all information and consult with qualified financial professionals before making any investment or financial decisions. We bear no responsibility for any financial losses, damages, or liabilities resulting from the use of or reliance upon this system.

The idea was simple: could we create a conversational interface for understanding the stock market using autonomous agents? Not just one agent answering questions, but a network of specialists that collaborate like a team of analysts.

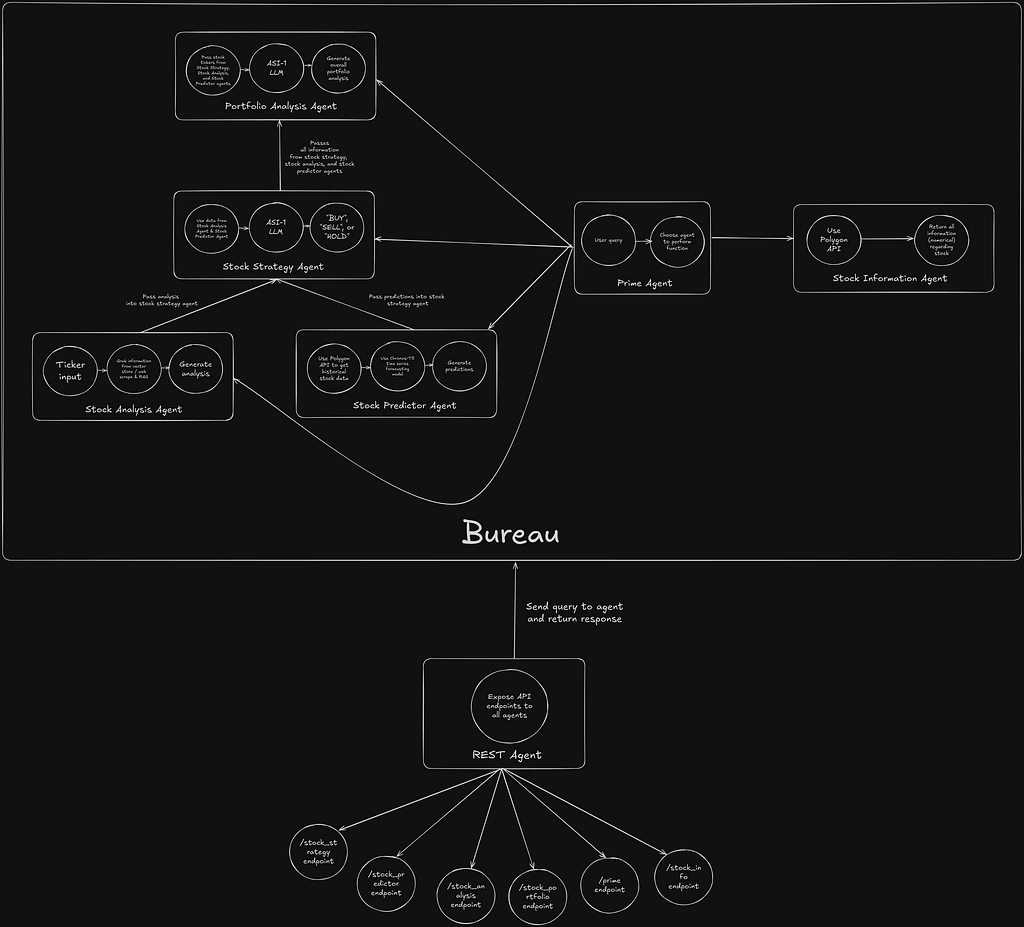

So, I got to work under the Fetch.ai Innovation Lab. That’s when we decided to create SimpleStock — a decentralized AI system consisting of seven core agents, each with a distinct role, working together to provide a complete stock market intelligence experience.

SimpleStock is built with Python, using Poetry for dependency management and environment setup. With help from the Fetch.ai Innovation Lab, we were able to leverage the power of uAgents, a framework developed by Fetch.ai that enables lightweight, secure, and interoperable agent-based systems. This support allowed us to bring our vision of a decentralized stock market intelligence system to life, where autonomous agents can communicate, collaborate, and reason independently.

For orchestration and flow control, I used LangGraph. This gave me a way to define how agents talk to one another based on the user’s query intent. Rather than hardcoding workflows, I could define dynamic graphs that adapt to query context — something that’s been a game-changer in scaling agent interactions.

To power the intelligence behind the AI agents, I integrated a variety of APIs and services that handled everything from data ingestion to semantic reasoning and web search:

Together, this tech stack created an intelligent, responsive, and scalable system of agents — each with their own specialized role but capable of working together to provide holistic stock market insights.

SimpleStock is the result of deeply integrating Fetch.ai’s cutting-edge technologies into a decentralized stock market intelligence platform. Powered by uAgents, this system brings AI-driven autonomy to financial analysis like never before.

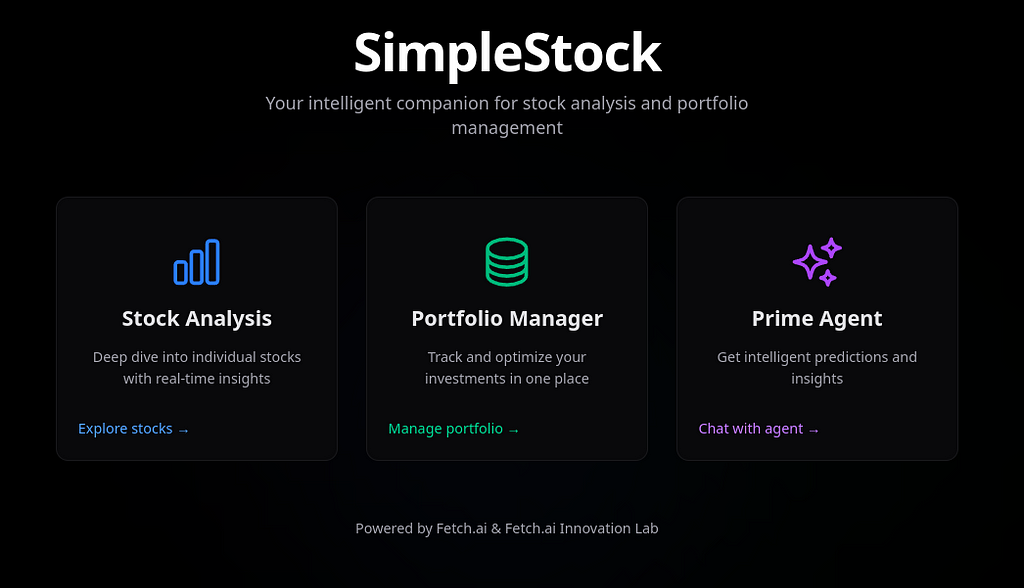

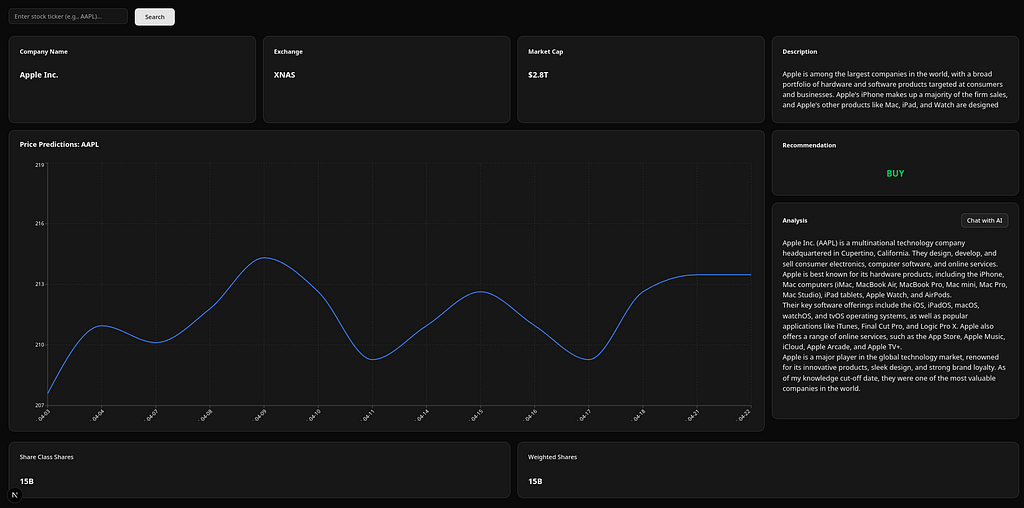

The Stock Analysis Page 📊 uses Fetch.ai’s agent-based system to deliver intelligent insights on individual stocks. These AI agents collaborate to gather, analyze, and summarize real-time market data in a context-aware manner.

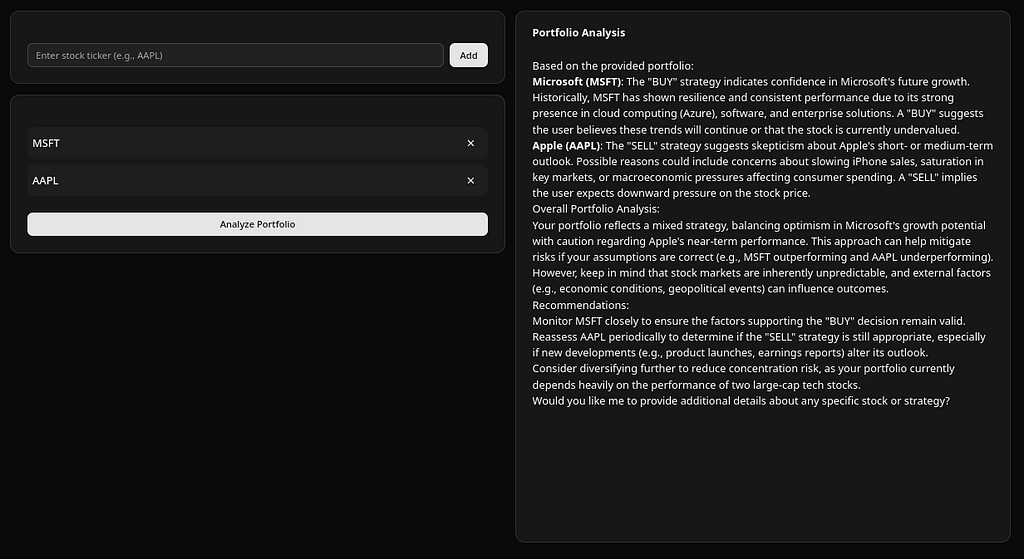

The Portfolio Analysis Page 📈 lets users input a list of stock symbols and receive a detailed, portfolio-level summary. Fetch.ai-powered agents handle everything from sector distribution to financial indicators, ensuring fast and intelligent analysis.

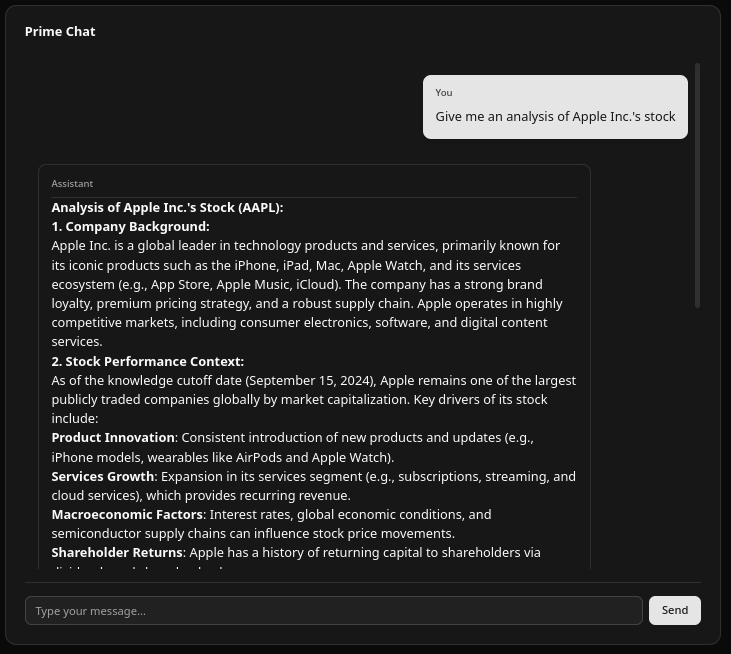

The Prime Agent Page 🤖 serves as a conversational interface to the entire Fetch.ai-powered agentic network. Through this single chat interface, users can access stock data, financial summaries, portfolio insights, and trigger advanced reasoning tasks — seamlessly routed to the appropriate AI agent.

The AI agents created using the uAgents framework collaborate as a decentralized network to analyze, interpret, and respond to stock market queries. This system essentially serves as SimpleStock’s intelligent, autonomous backend.

This project wouldn’t have been possible without the incredible tools and support provided by Fetch.ai. Through the Fetch.ai Innovation Lab, I had the opportunity to explore cutting-edge multi-agent system design with real-world applications. The uAgents framework made it remarkably intuitive to build autonomous agents that could communicate securely and reliably, while LangGraph brought orchestration to life in a way that felt both powerful and natural.

Additionally, Fetch.ai’s own ASI-1 large language model played a key role in powering advanced reasoning and natural language understanding across the system. By combining these technologies, Fetch.ai enabled me to bring SimpleStock from concept to reality — pushing the boundaries of what intelligent, decentralized agents can do. 🚀

How I Created a Team of AI Agents to Automate Stock and Portfolio Analysis was originally published in Fetch.ai on Medium, where people are continuing the conversation by highlighting and responding to this story.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.