OpenAI Partnership With Solana Could See Unilabs’s DeFi Asset Manager Become the Next $5 Billion Altcoin

0

0

BitcoinWorld

OpenAI Partnership With Solana Could See Unilabs’s DeFi Asset Manager Become the Next $5 Billion Altcoin

The Solana price momentum is growing as AI and blockchain converge, and Unilabs is positioned at the heart of this trend. As OpenAI’s partnership with SOL reshapes the future of decentralized computation, Unilabs, with its AI-powered DeFi asset manager and a live presale, could become the next $5 billion altcoin. With ChainGPT also going live on SOL, the entire crypto AI landscape is entering a high-growth phase, and Unilabs is in pole position.

Unilabs: Where AI Meets Decentralized Fund Management

Unilabs isn’t just another DeFi token; it’s the first AI-managed multi-fund asset platform built for the decentralized economy. With over $30 million in assets under management (AUM), Unilabs combines AI intelligence, on-chain transparency, and diversified funds into one unified system. These funds include the AI Fund, BTC Fund, RWA Fund, and Mining Fund, all optimized in real-time by AI logic to reduce risk and enhance performance.

The platform simplifies complex investment decisions by using algorithmic allocation and dynamic switching between fund baskets, tailoring strategies for everything from blue-chip tokens like SOL to volatile memecoins. The result? A DeFi-native, AI-supervised hedge fund accessible to anyone holding UNIL.

Live Presale Opportunity: How to Join Unilabs Early

While SOL welcomes ChainGPT, Unilabs is simultaneously gaining traction through its own AI-DeFi revolution. At the current price of just $0.0051, those who buy now are poised to lock in a 21.5% ROI once the price climbs to $0.0062 in the next stage, before the token even hits the open market.

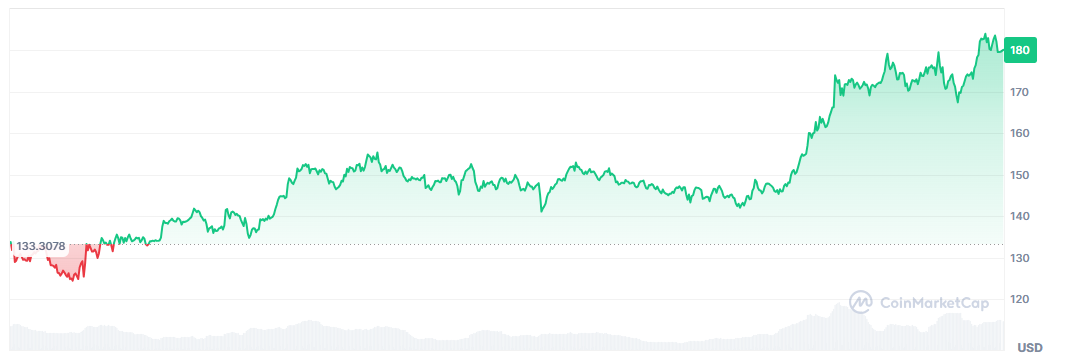

The Solana price shows an uptrend due to broader market conditions and also due to AI partnerships. As of now, SOL is trading near the range of $180.

The UNIL token is central to the Unilabs ecosystem. It’s not just for governance; it’s a yield-generating, access-granting, and benefit-unlocking asset designed to reward long-term holders and active participants.

Holders receive dividends from platform-generated profits, directly deposited into their wallets. UNIL stakers can earn passive income, while those holding larger amounts unlock premium features like advanced analytics, institutional-grade investment tools, and early access to private pools and exclusive reports.

Unilabs offers a tiered benefit system where higher UNIL holdings provide better perks. Investors with 500K to 5M tokens can earn between 0.1% and 0.5% of the total fee pool allocations. These benefits make UNIL the next token to reach a $50 billion market cap.

Solana Price Momentum Prompting AI Partnerships

With the Solana price gaining on bullish AI partnerships, the ecosystem is heating up. The OpenAI and SOL collaboration shows the network’s readiness to power large-scale AI solutions. And now, ChainGPT is going live on SOL, deploying its entire AI suite, chatbots, developer tools, swap features, and token launchpads on SOL’s high-throughput chain.

Because the convergence of AI and SOL infrastructure boosts credibility for AI-driven asset managers. Unilabs benefits from the same SOL native features, low gas fees, real-time execution, and network scalability that are essential for executing fast, AI-driven portfolio changes. As ChainGPT adds over 3 million followers to the SOL ecosystem, platforms like Unilabs stand to gain user spillover and infrastructure tailwinds.

Moreover, with projects like ChainGPT planning an AI-dedicated Layer-1 (AIVM), the future of AI-backed blockchain products is unfolding fast. For Unilabs, which already operates with multi-strategy AI models and real-time fund reallocation, this trend validates its thesis and accelerates adoption.

With the Solana price trending upwards and AI becoming a dominant narrative, the stage is set for Unilabs to emerge as the premier AI-DeFi asset manager—one that could easly surpass a $5 billion market cap if adoption mirrors competitors like Lido or Ondo.

Conclusion

The Unilabs presale is open, and history shows that early participants in projects with strong fundamentals and real use cases often see the highest returns. With $30M AUM, an anticipated $50 billion market cap, and a full suite of AI-managed funds, Unilabs could become the SOL-linked, AI-native asset manager that leads the next generation of DeFi platforms.

If the Solana price keeps surging alongside OpenAI and ChainGPT integrations, Unilabs stands out as the most rational speculative play. Join the presale, stake early, refer your network, and grow alongside AI in DeFi.

To learn more about it, visit:

Website: https://www.unilabs.finance/

Presale: https://buy.unilabs.finance/

X: https://x.com/unilabsofficial

This post OpenAI Partnership With Solana Could See Unilabs’s DeFi Asset Manager Become the Next $5 Billion Altcoin first appeared on BitcoinWorld and is written by Keshav Aggarwal

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.