Bitcoin Gears up to Retest $120k, but This May Happen First

0

0

Bitcoin broke above $112k a few hours ago following the CPI release. It opened Friday at $110,110 and surged afterward, attaining its current high.

However, the apex coin is trading close to its opening price, having lost momentum after retesting the highlighted level. The retracement is surprising as many expected more following the data release.

The consumer price index on a month-on-month basis came in at 0.3%, slightly below the forecast of 0.4%. On a year-on-year basis, it came in at 3%, slightly lower than the predicted 3.1%. While both data came in lower than expected, the y/y reading is higher than the previous one.

Some analysts expect the change to improve the odds of a rate cut by the end of October. As a result, the crypto market should react to the release with significant increases. However, this never happened, and the growing speculation is that the readings coming in lower than expected hampered the hikes.

Away from the macro data, the apex coin’s recent price action showed no significant shift in sentiment, either bullish or bearish. Nonetheless, some argue that the trend is about to change.

Increased Activity

In recent times, several institutions announced buying BTC, and reports from Lookonchain revealed that whales were stacking the asset. However, this news is in short supply following the massive price decline.

Nonetheless, the price drop did not affect whales’ activity in another sector: the derivatives market. A recent report confirmed the shift from the spot market to this sector, noting that it’s not the first time.

The chart above compares BTC’s price movement with open interest from large players on Bitfinex. In May 2024, these players opened long positions and maintained the trend until September, when they closed these orders. Interestingly, their “going long” occurred when the apex consolidated, and it ended when the surge began.

A similar event happened between January, when they resumed going long, and ended in April. As in the previous instance, it ended when Bitcoin began its uptrend.

The chart shows that the whales are back to opening long positions, and they are edging closer to previous levels that resulted in an uptrend. Based on this data, the apex coin may be gearing up for another bullish round.

Bitcoin Eyes $120k but Remains at Risk.

A report from Glassnode showed that Bitcoin traded close to its 0.85 cost-basis band on Oct 22. It noted the importance of holding this key level; losing could result in a drop to the 0.75 CB band at $97k.

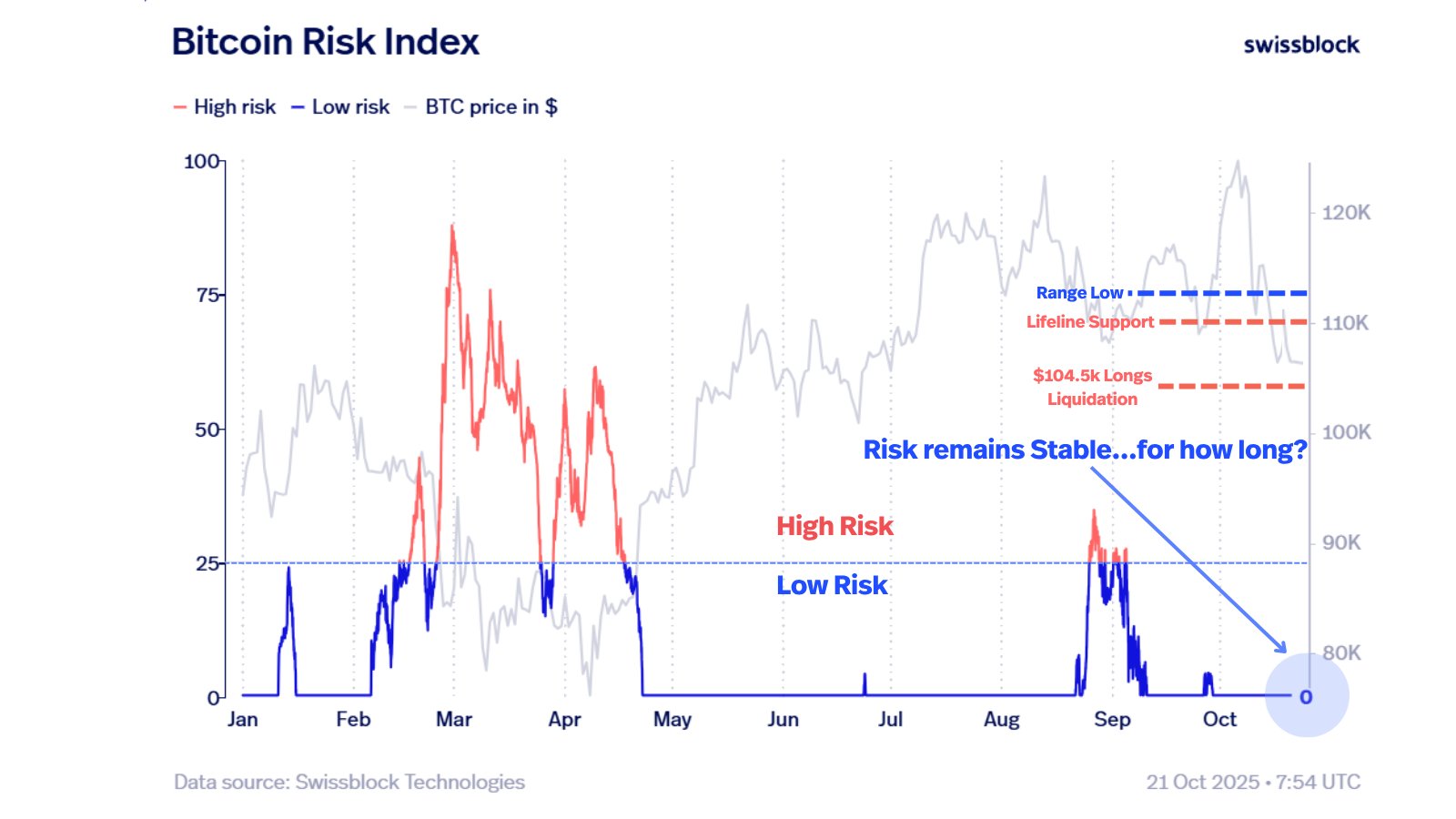

Currently trading at $110k, the apex coin is not clear from the risk of slipping below $100k. A report from Swissblock revealed that $110,000 is the first line of defense. It presented the image below, which shows the BTC risk index.

The figure above revealed that the index remains stable, but the stability may not last long. Once Bitcoin breaks $110k support, it may drop to $104.5k, triggering the index. The main factor for this trigger is the massive long liquidation at the price.

Notice that BTC maintains trading above $106k for most of the week as the bulls fear the massive liquidation at that level.

While Bitcoin is trading a bit far from the key level, a drop in demand may result in it retracing below $104k. The last time it broke below the mark, it rebounded at $103k. It may veer closer to $100k this time.

Nonetheless, maintaining the support will see the apex coin break above $120k without any of the outlined movements.

The post Bitcoin Gears up to Retest $120k, but This May Happen First appeared first on CoinTab News.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.