3 US Crypto Stocks to Watch Today

0

0

Crypto US stocks had a mixed session yesterday, with Strategy (MSTR) the only name closing in the green, while GameStop (GME) and Coinbase (COIN) posted further losses. MSTR rose 1.75% after Arkham uncovered over 70,000 previously unidentified Bitcoin linked to the firm, reinforcing its dominance as the largest corporate BTC holder.

GME dropped another 5.25% following investor backlash to its $500 million Bitcoin purchase, which many see as a risky pivot amid weak core fundamentals. COIN slid 2.14% despite launching 24/7 XRP and SOL futures, as concerns linger over a recent $400 million data breach.

Strategy Incorporated (MSTR)

Strategy (formerly MicroStrategy) was the only major U.S. crypto stock to close in the green yesterday, rising 1.75% while the broader market dipped.

The move comes just days after Arkham Intelligence revealed 70,816 previously unreported Bitcoin held by the firm, boosting its estimated total to 525,047 BTC—worth over $54.5 billion. This challenges Executive Chairman Michael Saylor’s public stance on wallet privacy and brings renewed focus to Strategy’s vast influence on Bitcoin markets.

The revelation follows a separate purchase of 4,020 BTC earlier in the week, bringing Strategy’s disclosed holdings to 580,250 BTC and cementing its role as the world’s largest corporate holder of Bitcoin.

MSTR Price Analysis. Source: TradingView.

MSTR Price Analysis. Source: TradingView.

Technically, MSTR has held firm above key support at $362 and is now eyeing resistance at $383. If current momentum sustains, a breakout could trigger a stronger rally in the short term.

In the pre-market today, MSTR is down a modest 0.13%, suggesting minor consolidation after recent gains.

According to TradingView, analysts remain bullish on the stock’s long-term outlook. 15 forecasts point to a 42.4% upside over the next year and a consensus price target of $527.

GameStop Corp (GME)

GameStop’s latest pivot into Bitcoin has triggered another wave of investor skepticism, sending shares into a sharp decline. The company confirmed it had purchased 4,710 BTC—worth roughly $500 million—as part of its broader plan to eventually allocate $1.3 billion to the cryptocurrency.

Despite the move being framed as a strategy to enhance liquidity and optimize returns, the market reaction has been overwhelmingly negative.

Analysts questioned the logic of mimicking MicroStrategy’s Bitcoin-heavy approach without a strong core business to support it.

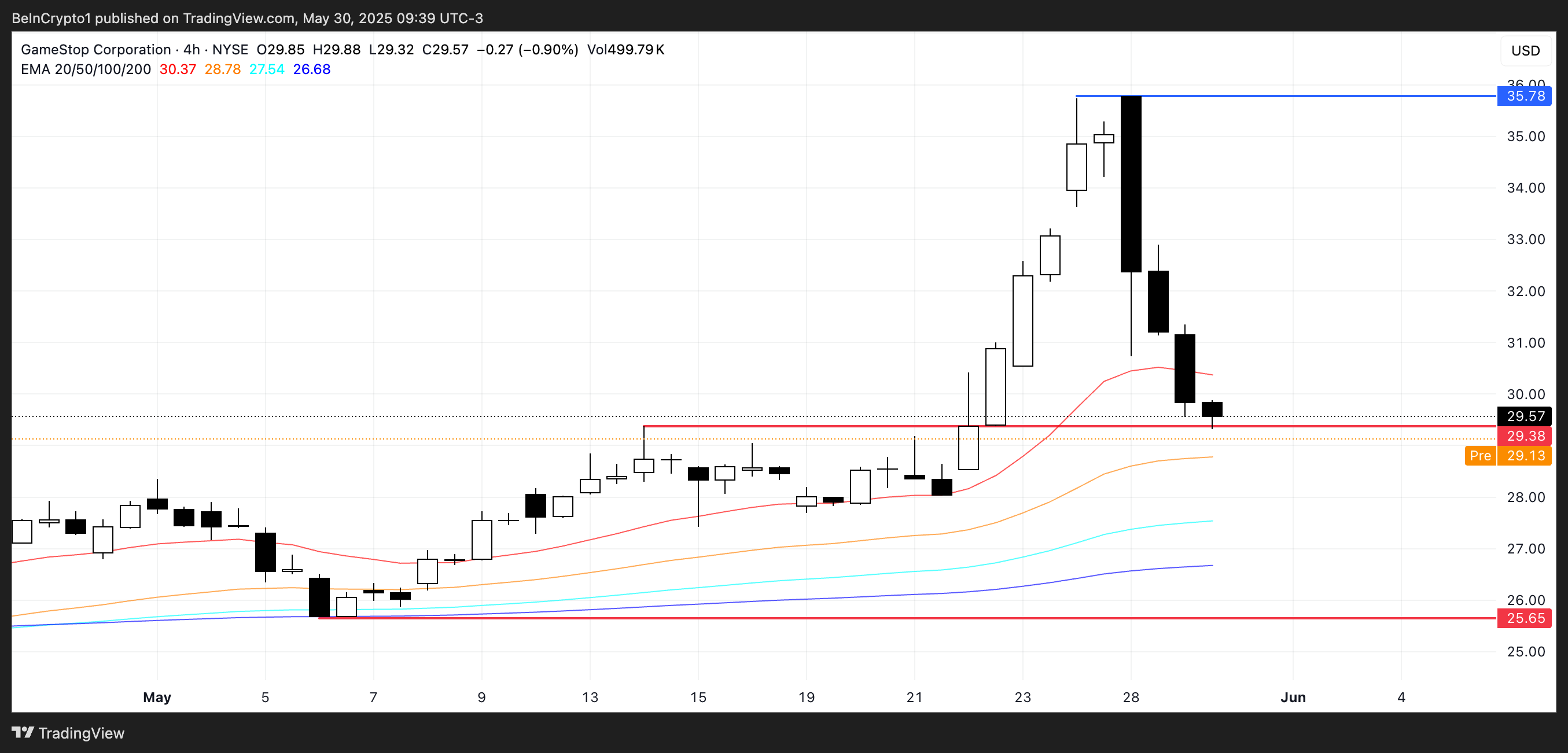

GME Price Analysis. Source: TradingView.

GME Price Analysis. Source: TradingView.

Technically, GME is under pressure and currently testing key support at $29.38. If this level fails to hold, the next downside target sits near $25.65, suggesting more pain could follow if bearish momentum continues.

The stock closed down 5.25% yesterday and is already down another 1.49% in the pre-market.

Despite retail investor loyalty, Wall Street remains unconvinced by GameStop’s strategic shift, especially given its declining sales—down 28% year-over-year—and a weakening used-game market that was once its main revenue stream.

Coinbase Global (COIN)

Coinbase has expanded its institutional offerings by enabling 24/7 futures trading for XRP, Solana (SOL), and Cardano (ADA), a move that aligns with its broader strategy to compete in both crypto and traditional finance markets.

Previously, around-the-clock trading was only available for Bitcoin and Ethereum futures. This marks a significant step as Coinbase also ventures into commodity and equity index futures, signaling its ambition to evolve into a full-spectrum derivatives platform.

However, the positive momentum from this announcement has been overshadowed by fallout from a massive $400 million data breach tied to outsourced customer support agents, raising serious concerns about operational security.

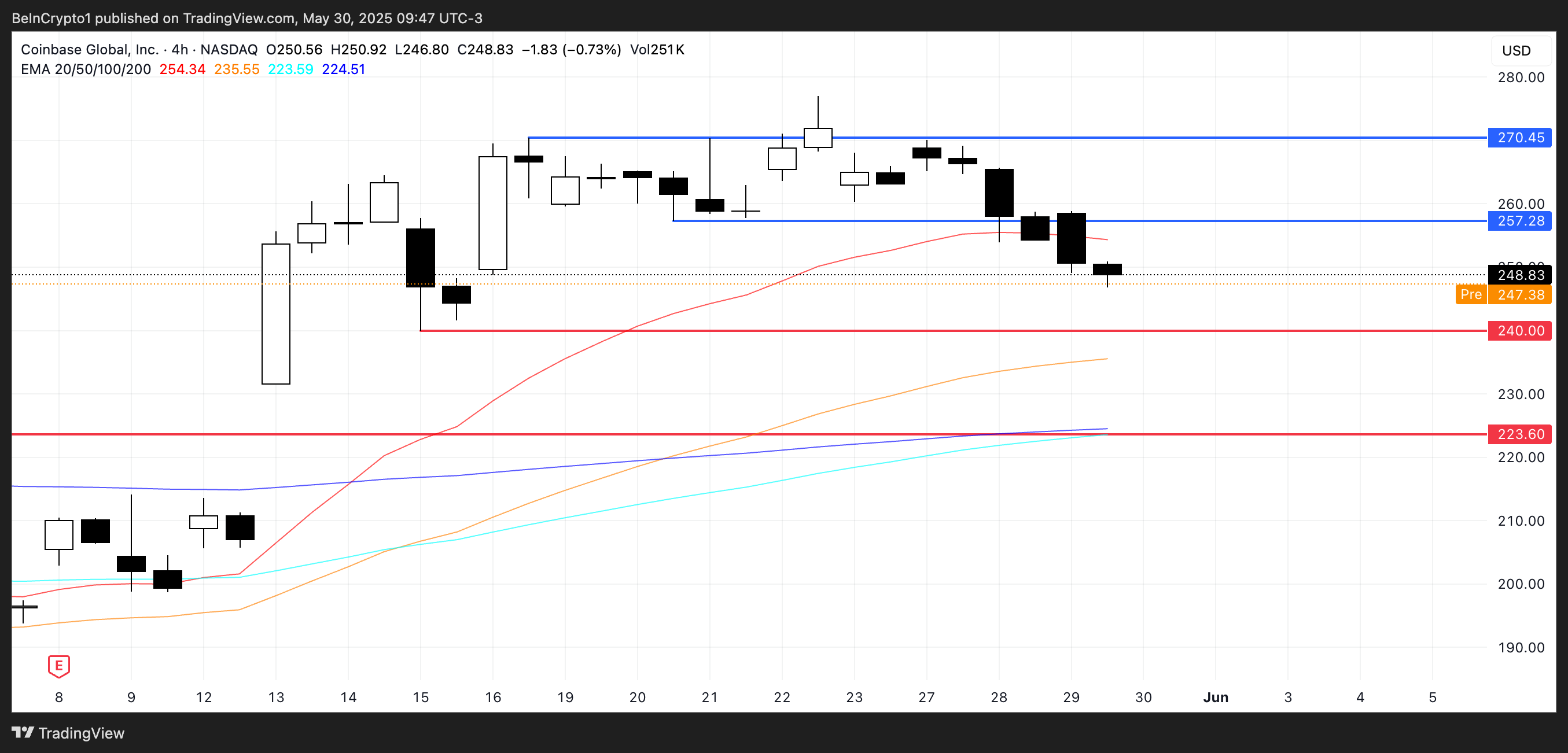

COIN Price Analysis. Source: TradingView.

COIN Price Analysis. Source: TradingView.

On the technical side, COIN closed yesterday down 2.14% and is currently down another 0.98% in pre-market trading. The stock is approaching critical support at $240; a breakdown below this level could trigger further downside toward $223.60.

Conversely, if the trend reverses, COIN may test resistance at $257, with a potential breakout pushing it to $270.45.

Despite recent headwinds, sentiment among analysts remains cautiously optimistic: 26 forecasts project an average 8.36% upside over the next year with a target of $269.65. Out of 32 analysts, 13 rate COIN a “Strong Buy,” while 16 recommend holding the stock.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.