Bitcoin Closes October in Red 📉, Faces “Greatest Shakeout” of 2025 to Start November.

0

0

👋 Welcome to the CoinStats Scoop, your weekly newsletter bringing you the most groundbreaking Web3 innovations and market-moving headlines in the crypto space.

Stay in the loop with all the key market moves 📈, emerging trends, and exciting developments from the past week.

Last week’s crypto market recovery proved short-lived for investors, as market sentiment took another hit after Bitcoin closed October in the red for the first time in 8 years.

Exacerbating investor concerns, Bitcoin fell to a 4-month low this week 📉, briefly dipping below the all-important psychological $100,000 level for the first time since June.

Crypto analysts called the temporary crash the “biggest shakeout of 2025”, pointing to whales and other large participants forcibly pressuring crypto prices to force the weakest and most over-leveraged investors to sell.

However, in a silver lining to the market structure, Bitcoin has just entered its most bullish month by average returns, with November boasting a 41% historical profit.

For retail investors, this means staying put 💪 and not taking any leveraged bets until corporate crypto treasuries and Bitcoin exchange-traded funds (ETFs) resume accumulation.

In this week’s CoinStats Scoop, you’ll find:

🌍 Crypto market analysis and the most important news in Web3

🏦 Bitcoin faces a crucial IPO moment: Wall Street veteran

🤝 IREN Bitcoin miner’s $9.7 billion deal with Microsoft

💰 Coinbase’s $300 million Bitcoin investment and growing revenue

🔐 Elon Musk’s new X-chat with “Bitcoin-like” encryption

📅 Analysis and key events that will shape the crypto market next week

Bitcoin Faces IPO Moment of Reckoning: Wall Street Veteran 💼

Bitcoin is facing its initial product offering (IPO) stage as it turned 17 🎂, heading towards a crucial moment of maturation that may decide its future mainstream adoption.

Bitcoin has extended its weekly downtrend 📉, as more long-term holders and whales rushed to sell their Bitcoin to lock in profit.

However, new buyers are slowly stepping in, as the fresh blood is steadily scooping up the tokens sold by long-term holders.

This large-scale redistribution is the confirmation of Bitcoin entering its IPO phase, according to Wall Street veteran and macroeconomic analyst Jordi Visser 💼.

At this stage, early believers cash out as new investors step in to bring fresh excitement and capital, Visser said during Anthony Pompliano’s podcast on Saturday.

“The excitement of concentration is being replaced by the durability of distribution. The early believers are passing the torch to long-term holders who bought at higher prices and have different motivations. This is what success looks like. This is Bitcoin having its IPO.” 🔥

The question now is how long will whales and OG holders’ selling pressure continue to limit Bitcoin’s recovery, before fresh capital steps in, or institutions restart accumulating through corporate treasures or ETFs?

Visser also stated that Bitcoin is not in a bear market 🐻, but simply in a consolidation period, as evidenced by the continued buying at these price levels.

IREN Bitcoin Miner Closes $9.7 Billion Deal with Microsoft 🤝

Bitcoin mining companies are seeing a growing synergy with artificial intelligence (AI) companies and applications 🤖, as evidenced by the latest such partnership.

On Monday, Bitcoin mining firm IREN signed a GPU cloud service contract with Microsoft, signaling growing demand from Big Tech firms for computing power to run AI applications.

In exchange for the $9.7 billion contract 💰, the Bitcoin miner will provide Microsoft access to Nvidia GB300 GPUs hosted within IREN’s data centers for the next five years.

Iren is among the top Bitcoin mining firms by total hash rate ⚡, powering the network. The Bitcoin miner started exploring the AI sector as an additional source of revenue at the beginning of 2024.

Many other Bitcoin mining firms have started offering AI services since the 2024 Bitcoin halving cut the block reward in half, forcing miners to seek additional sources of revenue.

MARA Holdings, HIVE Digital, and TeraWulf have all announced AI expansion beyond their BTC mining activities 🚀.

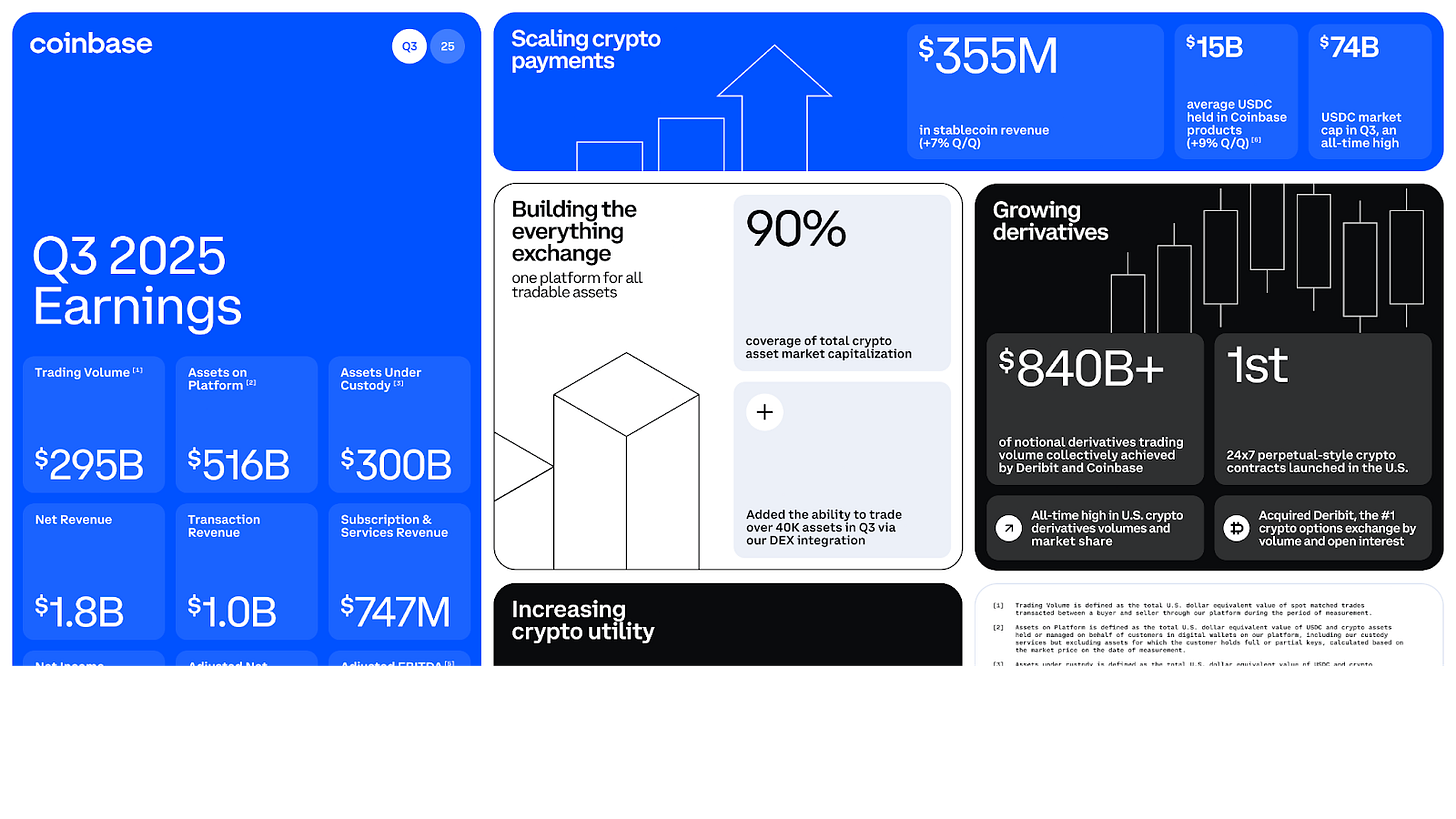

Coinbase Buys $300 Million Bitcoin to Reach $1.5 Billion Holdings, Posts $1.8 Billion Net Revenue for Q3 💸

Coinbase cryptocurrency exchange has added another $300 million to its significant Bitcoin holdings, signaling more institutional appetite for the world’s largest cryptocurrency.

Coinbase reached 14,547 Bitcoin worth approximately $1.57 billion 📊, according to its Q3 results report.

The crypto exchange had a lucrative financial quarter 💹, as its net income saw a 5 times increase year over year to $432 million, bringing total revenue to $1.9 billion.

“Coinbase is long bitcoin. Our holdings increased by 2,772 BTC in Q3. And we keep buying more,” wrote Coinbase CEO Brian Armstrong.

For investors concerned about the end of the current bull cycle 🐂, Coinbase’s $300 million Bitcoin investment is a sign of institutional confidence in the extension of Bitcoin’s rally.

Elon Musk Reveals X Chat with “Bitcoin-like” Encryption 🔐

Billionaire Tesla and SpaceX CEO Elon Musk is launching a new messenger stack for the X social media platform, which will be built resembling Bitcoin’s architecture.

Elon Musk is preparing to launch “X Chat” as a new privacy-preserving messenger application with Bitcoin-like peer-to-peer encryption 🔐.

The billionaire entrepreneur first announced the plan on his latest appearance on the Joe Rogan Experience podcast 🎙️.

“It’s using a peer-to-peer-based encryption system, kind of similar to Bitcoin. It’s very good encryption; we’re testing it thoroughly.”

The new messenger app will be launched in the next few months ⏳, with no advertising loops, such as its other competitors, like WhatsApp, explained Musk, who called the practice of sharing personal information with advertisers a “massive security vulnerability.”

Musk had a complicated history with crypto 💰 but has generally been optimistic about Bitcoin. His electric vehicle company, Tesla, still holds millions worth of Bitcoin, but stopped supporting Bitcoin-based car payments a few years ago.

Market Overview: Bitcoin Faces the “Greatest Shakeout” of 2025 Ahead of November’s Historic Gains ⚡

Bitcoin investor sentiment took another hit this week 📉, after Bitcoin closed the month of October in the red, for the first time in 8 years.

Crypto investor sentiment sank to “extreme fear” earlier this week, despite the release of a White House document announcing a Chinese import tariff deal made by President Donald Trump, a long-awaited development for markets.

However, Bitcoin’s price fell 10% during the past week, briefly dipping to a 4-month low just below $100,000 for the first time since June 2025.

Despite the abrupt correction, most industry watchers expect more upside for Bitcoin 🚀, as it entered its most bullish month by average historic returns.

Some analysts are pointing to an orchestrated “shakeout” as the reason behind the correction, which means that large players are trying to eliminate the weakest or most over-leveraged holders to buy their tokens at a discount before the recovery.

“This will go down in history as the Great Shakeout of 2025,” wrote crypto trading resource Brave New World 📝.

“All we are doing here is allowing the exchanges, the market makers, the institutions, and the whales to enter the market with far greater financial power to counter positions and liquidate them, which is what is repeatedly happening. I’ve no idea how people do not recognise this.”

Other popular crypto analysts, such as OnChain Mind, see this as one of the year’s best buying opportunities 💰, based on the aggregated value of Bitcoin’s key indicators and risk score.

“This is shaping up to be the 4th-best buying opportunity of this entire cycle. When all of these roll over together, it’s usually the market resetting risk - not breaking down.” 🔄

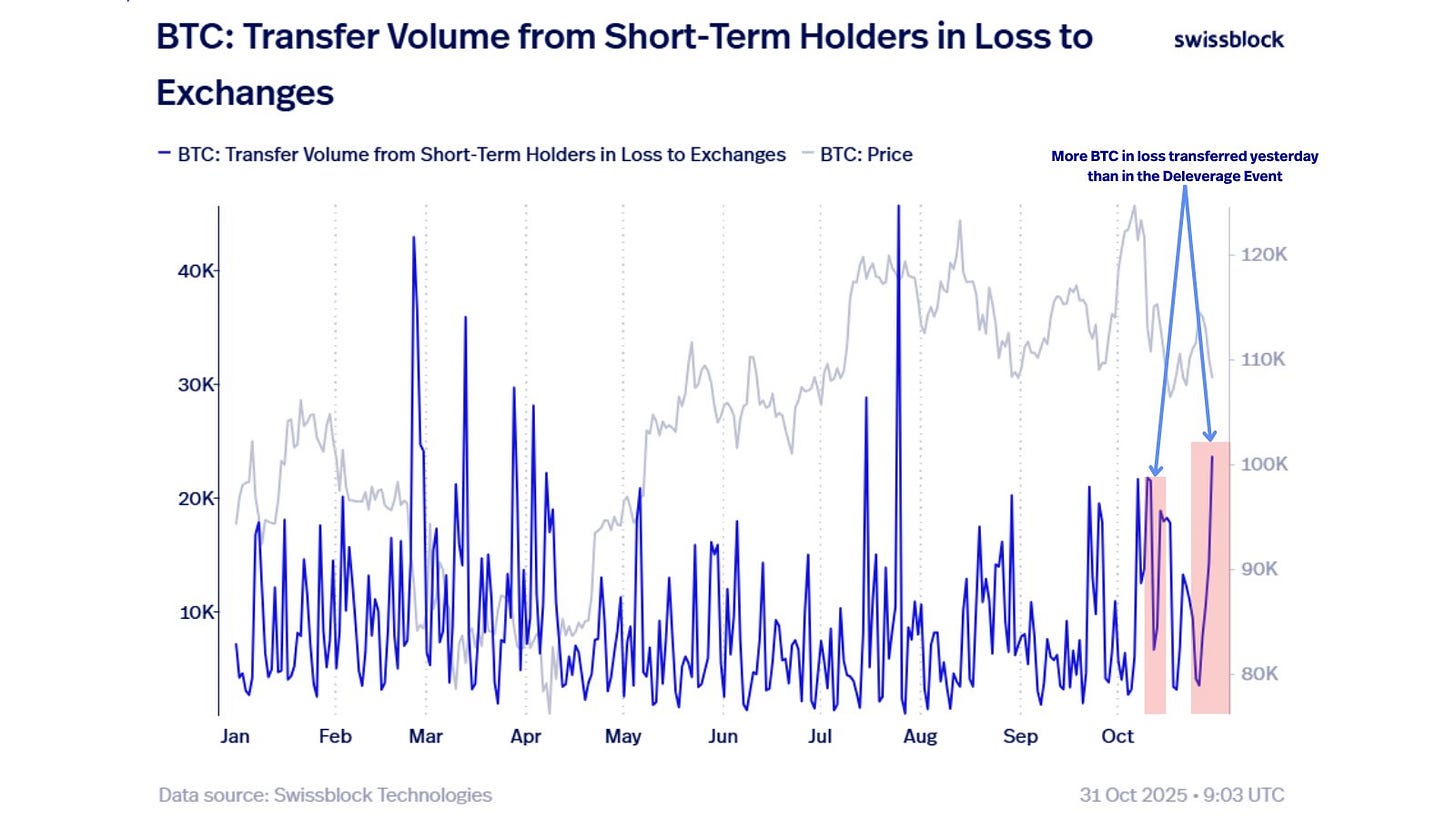

In another promising precursor for a crypto market recovery, the massive selling from short-term holders is signaling a local bottom that will form the foundation of the November recovery rally.

However, short-term holders have yet to show full capitulation ⚠️, meaning that in the absence of an imminent recovery, this sensitive cohort could stage another massive sell-off at a loss, wrote Swissblock.

“Yesterday saw more $BTC in loss sent to exchanges than during the Deleverage Event: a clear stress flare 🔥, but not yet full capitulation. From here, either BTC reclaims $113.4K or short-term holders break completely like in March or late July. There’s no middle ground”.

Tweets & Memes

The Bitcoin fear & greed index signals an imminent market recovery… Strap in! 🎢

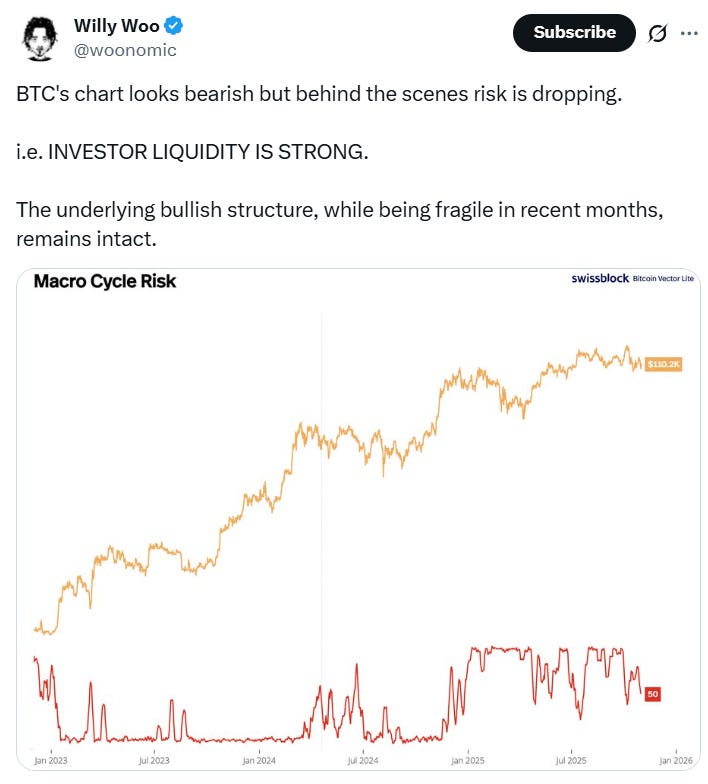

Risk is dropping across the Bitcoin market structure 📉, according to Willy Woo.

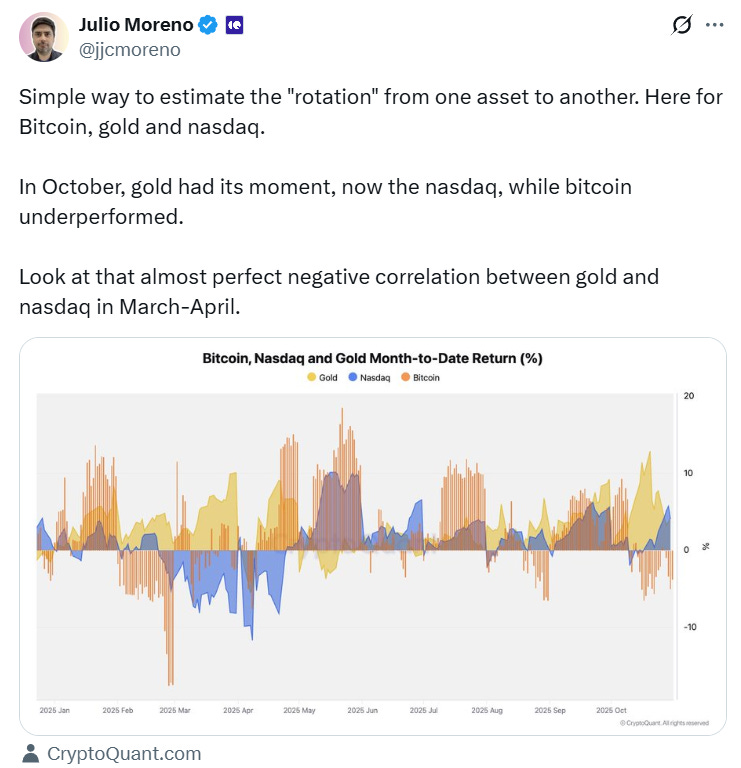

The Nasdaq and Gold ratio also point to an incoming Bitcoin rotation 📊, according to analysts.

Coinbase is buying the dip, stacking hundreds of millions in Ethereum and Bitcoin 💰

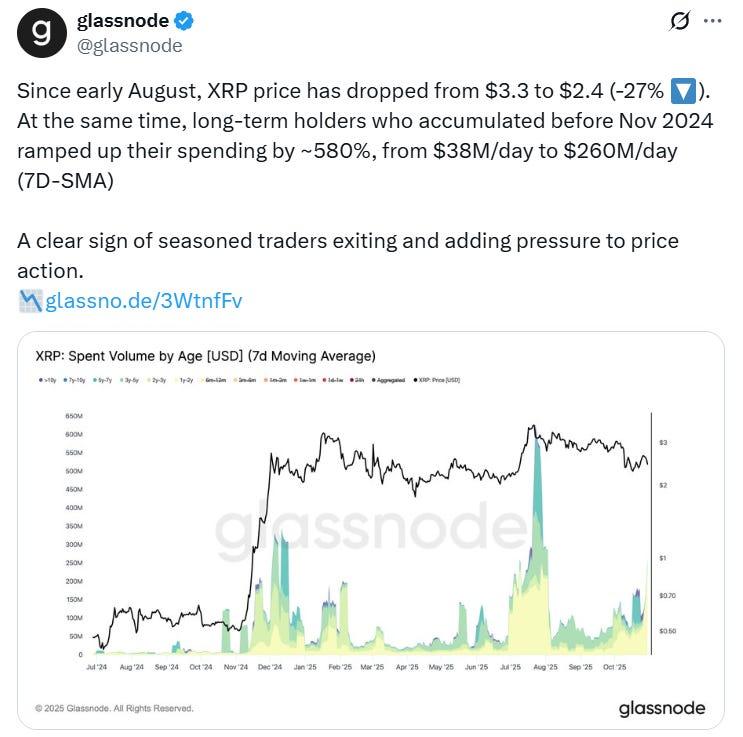

Seasoned crypto traders are selling their XRP positions despite the wave of new ETF applications 📉

Thank you for reading the weekly CoinStats Scoop Newsletter.

CoinStats will continue to guide you through the world of crypto and DeFi. We’ll see you next week for another edition of CoinStats Scoop! 😎

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.