Uniswap price turns bullish as Amber Group’s $11M UNI purchase sparks momentum

0

0

Bears dominated the digital assets sector on Monday, with the global crypto market cap down 1.06% the past 24 hours to $2.23 trillion.

Altcoins display mixed performances as Bitcoin remains under pressure.

Amidst the broader indecisiveness, Uniswap’s UNI maintained an upside stance, gaining nearly 6% in the previous day to $8.05.

UNI’s impressive performance coincides with an optimistic on-chain development, signalling confidence in its future performance.

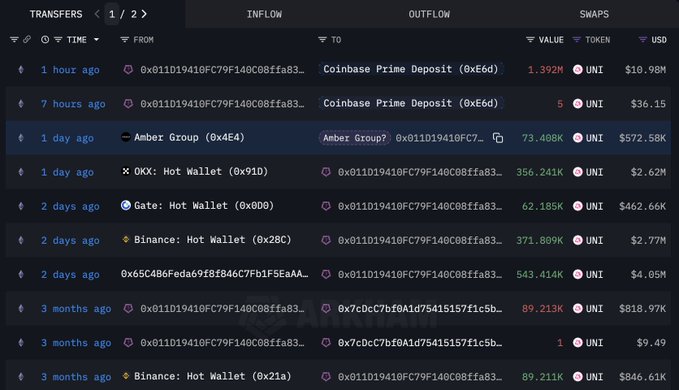

Lookonchain has revealed that a wallet tied to Amber Group, a reputable firm known for handling institutional-grade cryptocurrency flows, has been accumulating UNI lately.

Notably, the address has collected 1.41 million tokens, worth roughly $11 million, in the past three days.

And that wasn’t enough. The wallet moved almost all the assets (1.33 million UNI), worth around $10.98 million, to Coinbase Prime.

The strategic shift was enough to spark sentiments.

UNI, which had remained on investors’ radar following the UNIfication proposal, soared after the revelations.

Why is this purchase unique?

Whale buys aren’t uncommon in the virtual tokens industry. What matters is the method and timing.

Amber Group executed a quiet accumulation without attempts to move markets or create hype.

The purchase seems calculated, not speculative.

Furthermore, the subsequent transfer to Coinbase Prime signals plans to hold for the long term.

Retail players often send tokens to exchanges when planning to sell.

On the other hand, institutional investors leverage services like Prime for long-term storage of operational custody.

Thus, Amber Group could be positioning early for an upcoming UNI breakout.

UNI price outlook

The DEX’s native token exhibited an optimistic outlook amid Amber Group’s revelations.

UNI trades at $8.03 after a 5.70% jump on its 24-hour price chart.

The 60% uptick in daily trading volume signals amplified speculative activity.

Meanwhile, the digital token sways above the resistance-turned support at $7.20 – $7.30.

Therefore, buyers are targeting breakouts past the hurdle at $8.50.

That can propel UNI prices towards the sell wall at $11.5.

That would mean a roughly 43% uptick from the alt’s current market price.

On the other hand, surrendering the footing at $7.20 might see Uniswap dip to the barrier at $6.40 – $6.50.

Continued downtrends would push UNI toward $5.84.

A drop below $4.80 will invalidate UNI’s potential near-term rally.

Also, enthusiasts should watch broader performance.

The overall cryptocurrency market remains weak as Bitcoin ETFs struggle.

Uniswap’s altcoin will unlikely retain its gains for long in the current environment.

Nevertheless, Amber Group’s accumulation is part of the experts’ approach to accumulate early/at a discount, before bull runs.

The post Uniswap price turns bullish as Amber Group’s $11M UNI purchase sparks momentum appeared first on Invezz

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.