SEC Filings Reveal Quiet Bitcoin ETF Power Moves of Wells Fargo and Abu Dhabi

0

0

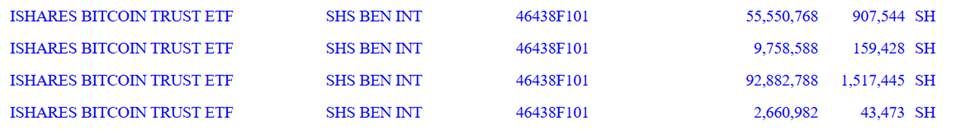

Wells Fargo has significantly expanded its exposure to BlackRock’s Bitcoin ETF, IBIT, more than quadrupling its holdings in the second quarter (Q2) of 2025.

The move comes as sovereign wealth funds in Abu Dhabi maintain some of the largest institutional Bitcoin ETF positions in the world.

Wells Fargo’s $160 Million Bet Marks Aggressive Push Into Bitcoin ETFs

According to a new SEC filing, the fourth-largest US bank by assets disclosed that it held over $160 million worth of shares in the iShares Bitcoin Trust (IBIT) as of June 30.

Wells Fargo’s Exposure to BlackRock’s BTC ETF. Source: SEC filing

Wells Fargo’s Exposure to BlackRock’s BTC ETF. Source: SEC filing

This represents a sharp increase from just over $26 million at the end of the first quarter.

Wells Fargo and Bank of America’s (BofA) Merrill unit began offering spot Bitcoin ETFs to brokerage clients in their wealth management divisions in February 2024.

Notably, this was barely a month after the financial instrument was approved in the US.

“Bank of America Corp.’s Merrill arm and Wells Fargo & Co.’s brokerage unit are offering access to ETFs that invest directly in Bitcoin, reflecting mainstream firms’ increasing acceptance of the products,” Bloomberg reported.

The banks offer the approved ETFs to some wealth management clients with brokerage accounts who request the products.

Therefore, Wells Fargo’s Q2 filings suggest the bank has gone beyond opening the door to client demand. It is now making a direct institutional allocation on its own books.

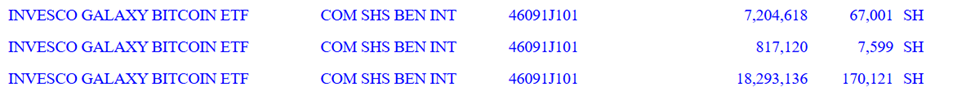

Diversifying Across Multiple Bitcoin Funds

Meanwhile, Wells Fargo’s Bitcoin exposure extends beyond BlackRock’s flagship product, IBIT. The bank also increased its stake in the Invesco Galaxy Bitcoin ETF (BTCO) from $2.5 million to approximately $26 million over the same quarter.

Wells Fargo’s Exposure to Invesco Galaxy’s BTCO. Source: SEC Filing

Wells Fargo’s Exposure to Invesco Galaxy’s BTCO. Source: SEC Filing

Its Grayscale Bitcoin Mini Trust (BTC) holdings grew modestly, from about $23,000 to $31,500. Meanwhile, its Grayscale Bitcoin Trust (GBTC) position rose from $146,000 to over $192,000.

Wells Fargo also reported smaller positions in Bitcoin ETFs managed by Cathie Wood’s ARK Invest/21Shares, Bitwise, CoinShares/Valkyrie, Fidelity, and VanEck. The bank has also diversified with allocations to spot Ethereum ETFs.

The moves indicate a broadening of the bank’s crypto-linked investment exposure. It reflects institutional interest in Bitcoin as an asset class and the growing acceptance of ETFs as the preferred access point.

Abu Dhabi’s $681 Million Bitcoin ETF Holdings

Elsewhere, Abu Dhabi’s sovereign wealth funds remain steadfast in their substantial Bitcoin ETF positions.

SEC filings show that Mubadala, one of the world’s largest state-owned investment firms, held 8.7 million IBIT shares valued at $534 million as of June 30.

Al Warda Investments, managed by the Abu Dhabi Investment Council, reported 2.4 million IBIT shares worth $147 million during the same period. Together, these holdings total $681 million, unchanged since May.

“Diamond hands at a nation-state level,” remarked Cas Abbe, an analyst and web3 growth manager.

The latest disclosures highlight the widening range of major institutional players, from US banking giants to Middle Eastern sovereign wealth funds, making calculated moves into Bitcoin ETFs.

Wells Fargo’s aggressive Q2 accumulation stands out, signaling a bet on price appreciation, a strategic hedge, or a reflection of growing client demand.

Meanwhile, Abu Dhabi’s unshaken positions suggest a long-term, conviction-driven approach in what is increasingly seen as a strategic asset on the global stage.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.