Why Bitcoin Miners Might Hold the Key to BTC’s Next Breakout

0

0

Bitcoin (BTC) has struggled to maintain bullish momentum after reaching an all-time high of $111,917 on May 23. Since then, the king coin has faced a period of correction and consolidation, with its price hovering around the $105,000 mark over the past few days.

Despite this cooling off, on-chain metrics reveal that miners show no signs of panic. Their behavior suggests growing confidence in a potential upward move, and this analysis explains why.

BTC Miner Reserve Climbs to 1.8 Million as Selling Pressure Eases

According to CryptoQuant, miners on the Bitcoin network continue to hold tightly to their coins amid BTC’s sideways price movement. This is evident in the rising BTC miner reserve, which indicates that fewer coins are being sent to exchanges for liquidation.

BTC Miner Reserve. Source: CryptoQuant

BTC Miner Reserve. Source: CryptoQuant

As of this writing, the BTC miner reserve holds 1.8 million coins, adding 1,556 BTC over the past week. When the miner reserve rockets like this, miners on the network are holding onto more of their mined coins instead of selling them. This behavior signals bullish sentiment, as miners expect higher prices in the near term.

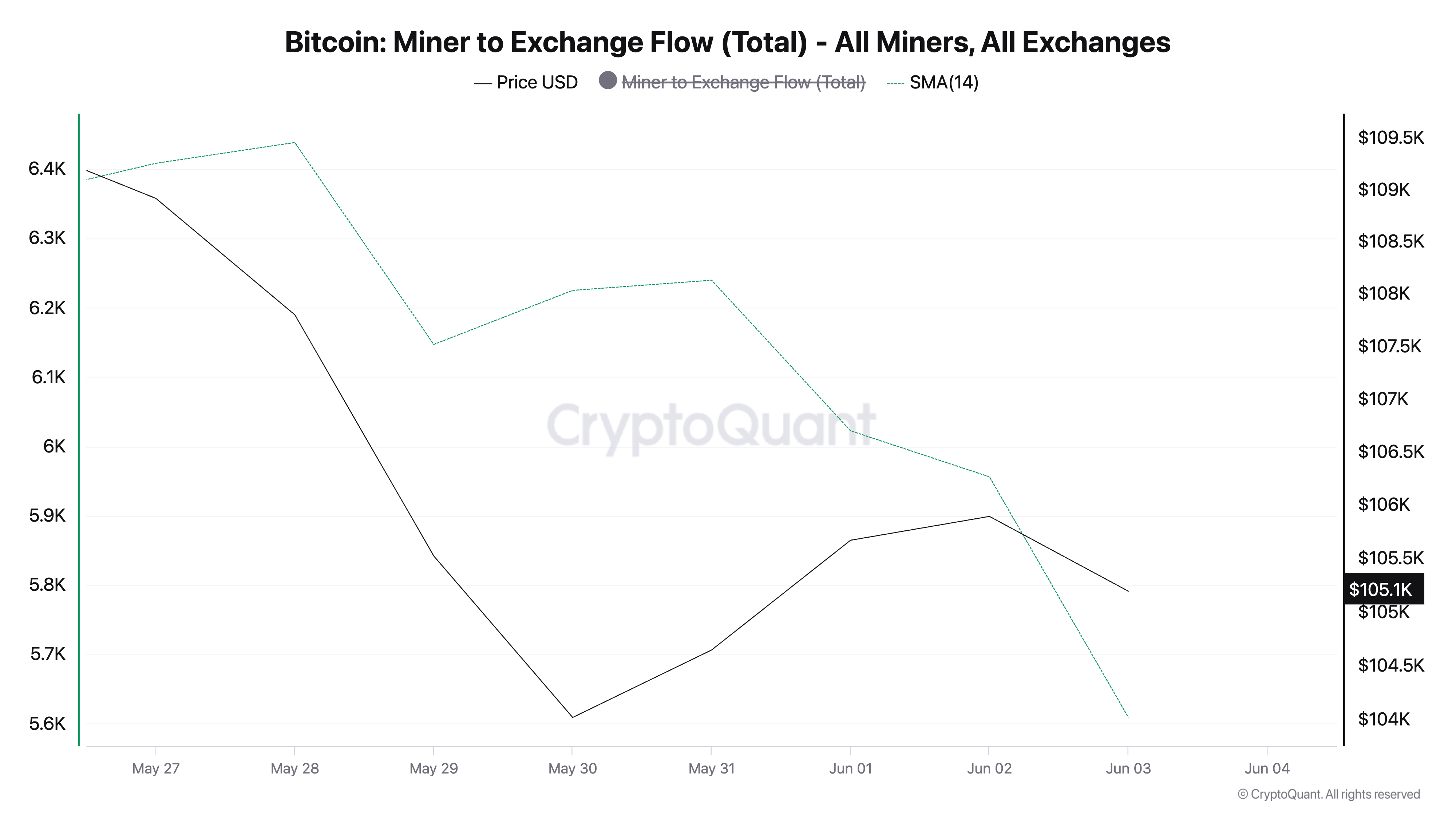

Moreover, BTC’s Miner-to-Exchange Flow—which measures the total amount of coins sent from miner wallets to exchanges— has dipped. Observed on a 14-day small moving average, it has dropped 14% over the past seven days.

BTC’s Miner-to-Exchange Flow. Source: CryptoQuant

BTC’s Miner-to-Exchange Flow. Source: CryptoQuant

When BTC’s Miner-to-Exchange Flow drops like this, it suggests that miners are not selling their coins. This reduced selling pressure can help stabilize BTC’s price and trigger a sustained rally.

BTC Teeters Between $109,000 Target and $100,000 Breakdown

BTC trades at $105,103 at press time, just below the resistance formed at $106,548. If Bitcoin miners refrain from selling, this could trigger a market-wide accumulation that pushes BTC past this resistance level.

In this scenario, the coin could trade at $109,310.

BTC Price Analysis. Source: TradingView

BTC Price Analysis. Source: TradingView

However, if profit-taking strengthens, BTC could fall further to $103,061. Should this support floor weaken, the coin risks breaking below $100,000.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.