Bitcoin Bleeds Into April as Tariff Fears Kill Q1 Momentum

0

0

NAIROBI (CoinChapter.com) — Bitcoin (BTC) closed the first quarter of 2025 with a 13% loss, marking its weakest Q1 since 2018. The drawdown capped a volatile period driven by trade tensions, hawkish economic data, and gold’s rising appeal as a safe haven.

The macro climate darkened in late March as markets digested a fresh wave of tariffs from U.S. President Donald Trump’s administration. April 2—dubbed “Liberation Day” by Trump—will mark the rollout of broad new duties, weighing heavily on investor sentiment.

Bitcoin Slides as Gold Hits Highs, Traders Eye April 2

BTC/USD traded near $81,200 at March’s close, retreating from January’s highs near $95,000. CoinGlass data showed a 12.7% Q1 drop—the worst since the ICO fallout in 2018.

In contrast, gold reached repeated all-time highs, flipping the BTC/gold narrative. The GOLD/BTC ratio broke a 12-year downtrend, according to Glassnode, highlighting renewed preference for traditional hedges over crypto exposure.

“Markets are in for a wild week,” macro research firm The Kobeissi Letter posted on X, warning that the April 2 tariff event could affect up to $1.5 trillion in U.S. imports. They called it “the biggest escalation of the trade war to date.”

Trump’s aggressive trade stance has already triggered global retaliation. China, the European Union, Canada, and Mexico all announced or prepared countermeasures in March, deepening investor concerns over geopolitical instability.

PCE Inflation, Weak Sentiment Fuel Risk-off Mood

The final blow to Q1 came on Mar. 28, when core Personal Consumption Expenditures (PCE) data came in at 2.8%—above the expected 2.7%. The release sparked a broad risk-off move that dragged down equities and crypto alike.

S&P 500 and Nasdaq 100 each shed over 2% in response, erasing over $1 trillion in equity market cap in a single session. Bitcoin followed suit, retreating as macro headwinds overwhelmed buying pressure.

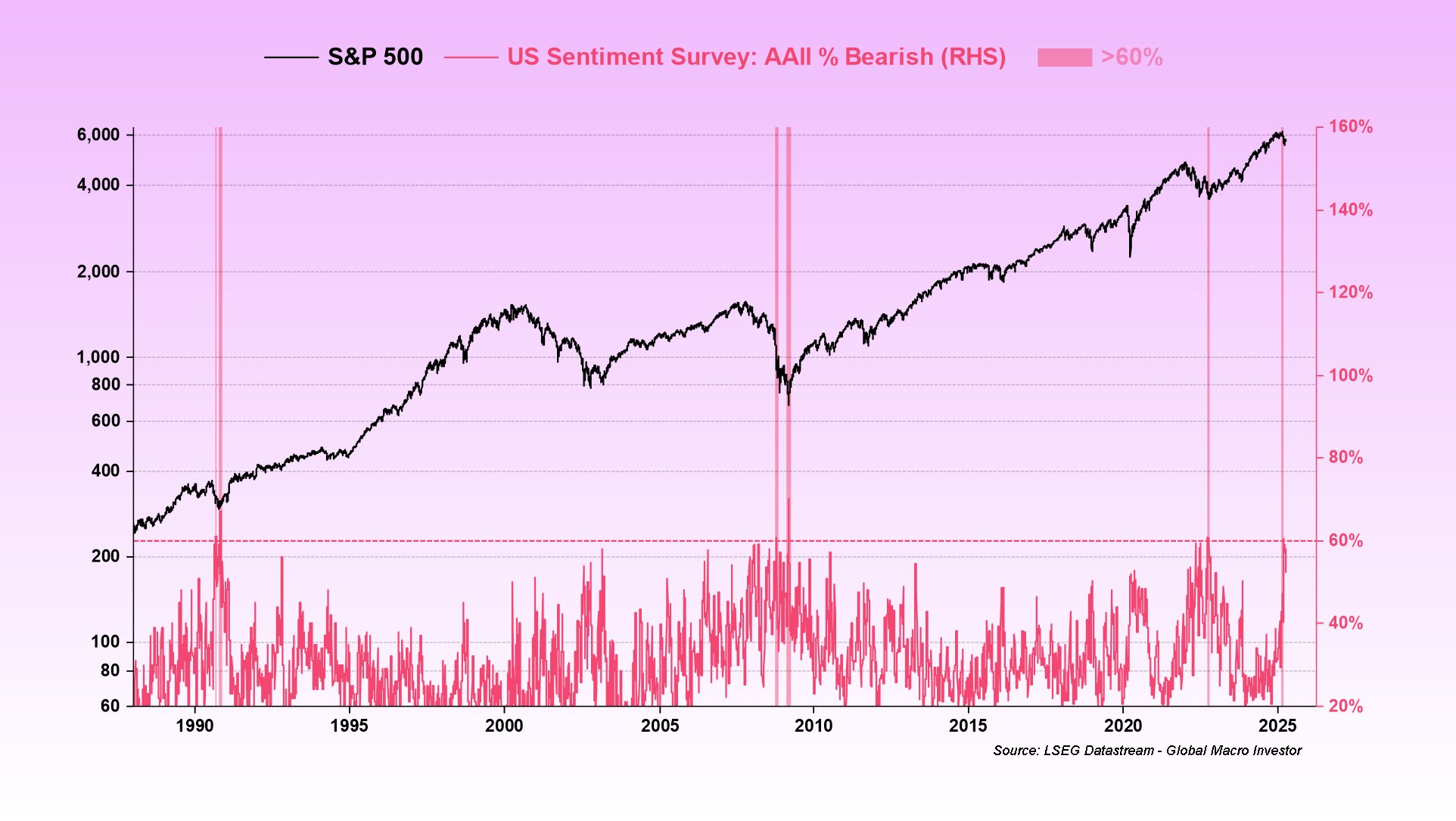

According to the Conference Board, U.S. consumer sentiment fell for a fourth straight month in March. The Expectations Index dropped to 65.2, its lowest since 2013. The number of Americans expecting stock prices to rise also fell sharply, from 47.5% in Feb. to 37.4%.

This macro caution filtered into crypto markets. Ethereum (ETH) led losses with a 46.4% plunge, nearly matching its Q1 2018 performance. Bitcoin’s drawdown, while less severe, broke a two-year streak of Q1 gains—72% in 2023 and 69% in 2024.

BTC Chart Signals Remain Bearish Despite Long-term Confidence

Market structure offers little relief. Barchart noted that both Bitcoin and U.S. stocks face potential “death crosses,” as short-term moving averages approach bearish confirmations.

“The odds are on the side of it getting filled quite soon,” trader CrypNuevo posted on X, referencing the downside wick on the four-hour BTC chart.

On higher timeframes, fellow trader HTL-NL flagged a “bearish engulfing” weekly candle. “Let’s see if it plays out,” he added. Compression between the 1-day and 1-week 50-EMA also points to a pending aggressive move, CrypNuevo noted.

Meanwhile, onchain analytics from CryptoQuant show the Market Value to Realized Value (MVRV) ratio nearing its historical average. In early March, MVRV flashed a bearish “death cross,” followed by the current drawdown. Contributor Yonsei Dent wrote that while the overheated zone has cooled, “no definitive bottom signal has emerged yet.”

Coinbase Premium Holds Neutral as Long-term Sentiment Lingers

The Coinbase Premium Index—measuring the spot price gap between Coinbase and Binance—held steady near neutral.

“Panic selling is decreasing,” CryptoQuant analyst Crypto Sunmoon posted, hinting that the worst may be behind.

According to Glassnode, much of the recent selling pressure originated from investors holding BTC for over 155 days.

What Comes Next? All Eyes on April Data and Powell

The market now braces for a packed first week of April. Alongside Trump’s tariff rollout on Apr. 2, traders await job openings data, jobless claims, and the critical nonfarm payrolls report.

Federal Reserve Chair Jerome Powell is set to speak on Apr. 4 in Arlington, Virginia. CME Group’s FedWatch Tool continues to price a rate cut in June, but Powell’s tone may shift expectations if inflation risks persist.

As Global Macro Investor’s Julien Bittel noted, policy tightening from Q4 2024 is only now starting to impact markets. “There may still be a near-term chop or a final dip into the April 2 tariff announcement,” he said. “But the path of least resistance after that feels higher.”

Until then, Bitcoin remains vulnerable to the crosswinds of policy, sentiment, and risk.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.