Security Expert Calls Bitcoin a ‘Time Bomb’—Did Satoshi Nakamoto Make an Oopsie?

0

0

Bitcoin, the pioneering cryptocurrency, has long been praised for its decentralization, security, and immutability. However, a recent analysis by security expert Justin Drake has raised serious concerns about the sustainability of Bitcoin’s security model. He described it as a “time bomb.”

Drake warned of a critical flaw in Bitcoin’s Proof-of-Work (PoW) mechanism. If left unaddressed, it could threaten the entire cryptocurrency ecosystem.

Why is Bitcoin Security a “Time Bomb”?

Drake’s argument centers around a sharp decline in Bitcoin transaction fees, which have now hit a 13-year low, below 10 BTC per day.

Bitcoin Transaction Fees. Source: Blockchain.com

Bitcoin Transaction Fees. Source: Blockchain.com

He explained that transaction fees account for only about 1% of miner revenue. The remaining 99% comes from block rewards—the new Bitcoins generated to incentivize miners to secure the network.

However, these block rewards are cut in half every four years in an event known as the Bitcoin halving. In April 2024, the block reward dropped to 3.125 BTC. This trend will continue until Bitcoin’s total supply reaches the hard cap of 21 million coins.

Historically, the Bitcoin community believed that transaction fees would rise as block rewards decreased, ensuring miners stayed motivated to maintain network security. But data shows the opposite. Over the past decade, transaction fees have declined even faster than block rewards.

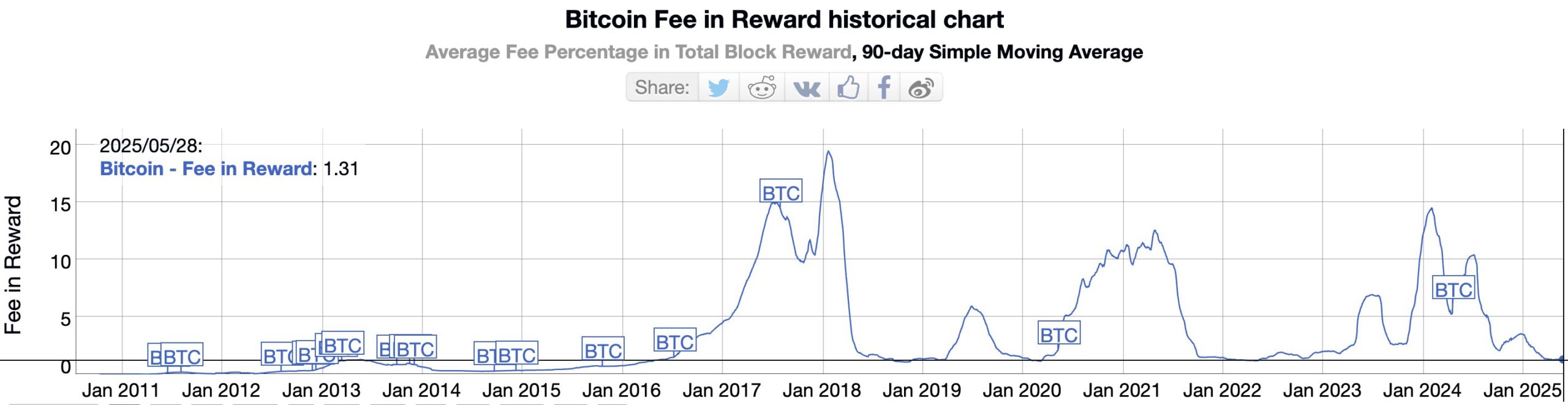

Bitcoin Fee in Reward Historical Chart. Source: Bitinfocharts

Bitcoin Fee in Reward Historical Chart. Source: Bitinfocharts

For example, in March 2016, transaction fees represented 1% of the block reward for 25 BTC. By April 2025, even with the block reward reduced to 3.125 BTC, fees still accounted for only 1%. This persistent decline in fee revenue is shrinking Bitcoin’s security budget, which is the funding that incentivizes miners. As a result, the network is becoming increasingly vulnerable to attacks.

“Imagine fees were the only source of miner revenue today:→ revenue drops 100x→ hashing infra decreases 100x→ 1% of today’s infra (1 large farm) can 51% attack BitcoinThat’s the trajectory we’re on. The 21 million cap breaks security, it’s self-destructive. It should be clear now Satoshi made an ooopsie.” – Justin Drake said.

Efforts to boost transaction utility and increase fees have failed. Initiatives like Lightning Network, Liquid, Stacks, and Ordinals caused only temporary fee spikes, followed by declines.

As a result, Bitcoin’s security still heavily depends on block rewards—a finite resource that will eventually disappear under the current model.

Not everyone agrees with Drake’s assessment. Kushal Babel, a researcher at Category Labs, argued that transaction fees should be measured in US dollars, not BTC, to understand their true trend.

“It’s incorrect to say fees are at an all-time low by denominating them in BTC. What matters for security is the fees in dollar terms—we need to consider the BTC/USD price. That may tell a different story.” – Kushal Babel said.

Did Satoshi Make a Mistake?

Drake proposed two potential solutions to prevent a security crisis. However, both are highly controversial within the Bitcoin community.

The first is to introduce perpetual block rewards by removing the 21 million BTC cap. This would break a core principle of Bitcoin: its scarcity as a digital asset. The second option is to abandon PoW and switch to a Proof-of-Stake (PoS) consensus mechanism, as Ethereum did in 2022. PoS relies on validators staking coins instead of computing power. It’s more energy-efficient and may offer a more sustainable security model.

However, both ideas are culturally unacceptable to many Bitcoiners. They challenge foundational principles of scarcity and decentralization.

Lukasinho, Strategy Analyst at Auditless, argued that Satoshi made no mistake. Instead, he believes Bitcoin drifted away from Satoshi’s original vision and became a store of value that doesn’t generate enough transaction activity to raise fees.

“Satoshi didn’t make an error nor are the 21 million wrong. The small blockers made the oopsie. Satoshi’s vision was for BTC to become digital cash, used frequently—and generating tx fees. Not for it to become a pet rock sleeping in wallets.” – Lukasinho said.

There is also a factor Satoshi likely didn’t anticipate: quantum attacks.

Due to the cost and coordination required, a 51% attack like Drake’s may seem unlikely. Still, experts have recently increased their warnings about the threat of quantum computing. It could break Bitcoin’s cryptography, further increasing the urgency of developing a robust and future-proof security model.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.