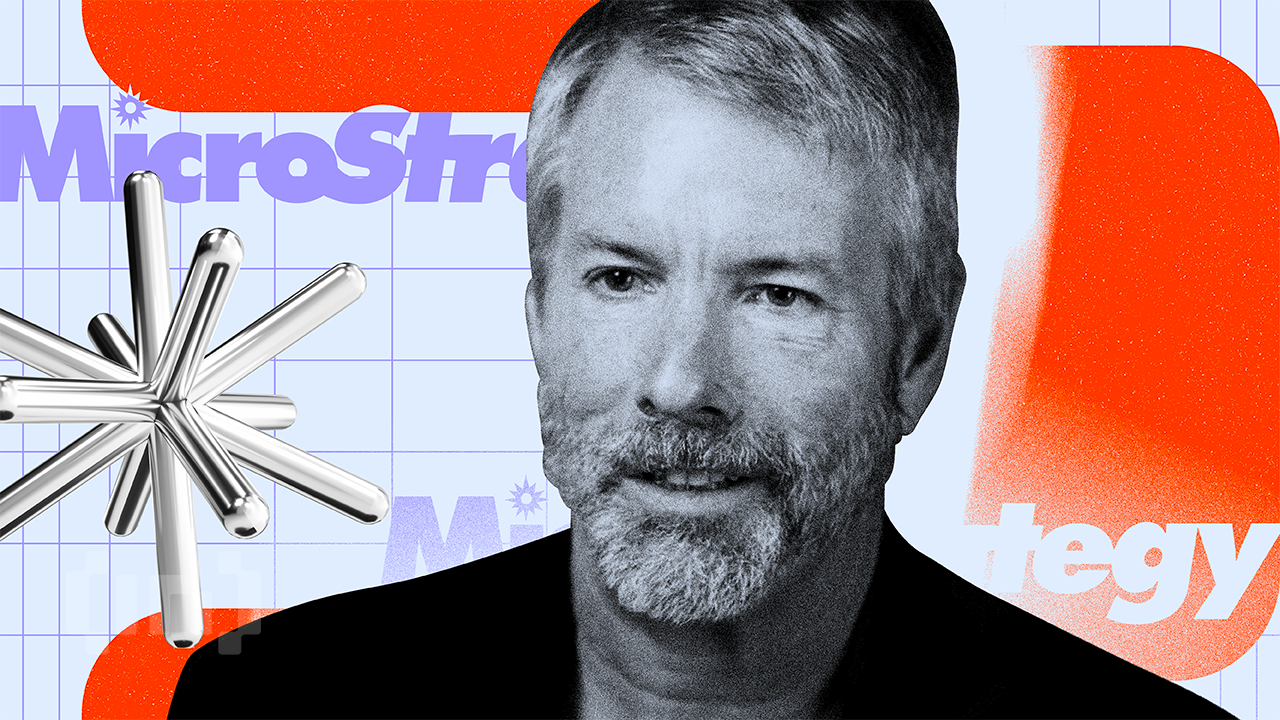

Arkham Under Fire for Exposing Saylor’s Bitcoin Wallets, Stirring Market Fears

0

0

Arkham Intelligence is under fire as it continues to reveal what it claims is 97% of Michael Saylor and MicroStrategy’s Bitcoin holdings.

Given Saylor’s heft in the crypto market, the exposé has raised fears on centralization, operational risk, and market collapse.

Arkham Under Fire for Exposing Strategy’s Bitcoin Wallets

BeInCrypto reported Arkham’s initial discovery on Thursday, May 29, linking 70,816 BTC tokens to MicroStrategy (now Strategy). This discovery violated Strategy’s executive chair, Michael Saylor’s, secrecy stance.

“The current conventional way to publish proof-of-reserves is an insecure proof-of-reserves. No institutional-grade or enterprise security analyst would think that publishing wallets is a great idea,” Saylor argued.

Despite the exposé stirring mixed sentiments, the blockchain analytics firm has proceeded with yet another revelation, extending its discovery from 87.5% to 97% of all Strategy’s Bitcoin holdings.

Specifically, Arkham Intelligence has identified an additional 53,833 BTC, valued at approximately $5.75 billion. This brings their coverage of Saylor’s Bitcoin holdings to $59.92 billion.

According to the blockchain expert, the endeavor is part of a push toward free and public proof of reserves (PoR).

However, while Arkham celebrates its transparency milestone, being the first to identify these holdings publicly, many in the crypto industry see it as a dangerous breach of privacy.

Is Michael Saylor and Strategy A Single Point of Failure?

Specifically, industry voices are raising concerns about the consequences of exposing such a large concentration of Bitcoin holdings linked to a single entity. This is especially true considering Michael Saylor’s heft in the crypto market.

“If they ever move that BTC from the wallets, expect a market collapse. We just discovered a new point of failure,” warned Markus, a crypto nomad and Bitcoin veteran, in a post.

Others echoed concerns about the risk of doxxing. Among them is meme coins trader MadPunk, who reiterated worries of a market sell-off

“You thinking you’re doing something great cool work after doxxing his secret wallets, if he ever tried to sell a bitcoin. The whole market will crash,” the trader wrote.

The revelation has triggered fierce debate over the trade-off between transparency, operational security, and the influence of market players. For some, public blockchain data should be used to ensure accountability in an age of unverified corporate claims.

“For people asking why Arkham would do this… did you forget why the 2009 crash happened? Have you heard of paper gold and paper bitcoin? Do you know that companies lie to get fame and money? If you boast about buying 60 billion worth of bitcoin… show the receipts,” The Modern Investor, a popular user on X, remarked.

Meanwhile, some see exposing a prominent individual’s holdings as undermining Bitcoin’s censorship resistance and personal sovereignty ethos.

The sentiment is that this puts the broader market at risk, given that Strategy commands a substantial share of Bitcoin’s circulating supply.

Saylor has long maintained that Bitcoin is the apex asset, famously converting MicroStrategy’s cash reserves and raising debt to acquire BTC.

“The only thing better than Bitcoin is More Bitcoin,” Saylor wrote in a post.

However, with most of his wallets now exposed, analysts say Michael Saylor may be boxed in. Meanwhile, others insist that the Bitcoin maxi may not intend to sell BTC.

“Lol, Saylor doesn’t want to sell. He’s already holding the apex asset. Sell for what? He sold Fiat for Bitcoin. Would you sell USD for Indian rupees? The answer is no, selling BTC for USD is the same thing,” chimed Josef Rakich, another popular user on X (Twitter).

Still, concerns are mounting. If any of these wallets show outbound activity, markets could interpret it as a liquidation signal, triggering panic.

With such a massive concentration of holdings now publicly linked to traceable addresses, some say bad actors could also target Saylor or Strategy directly. This is with precedence, given that the US leads in crypto kidnapping cases and rising crypto crimes in France.

While Arkham’s campaign tests the limits of crypto’s transparency culture, it has also exposed how fragile market psychology remains in the blockchain arena. Saylor’s BTC, once a symbol of conviction, is now a global risk variable.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.