CME XRP Options Go Live, Extending Regulated Crypto Beyond BTC and ETH

0

0

CME XRP options are now officially live, marking a significant step for institutional crypto access. CME Group is the world’s largest derivatives exchange. According to recent reports, the launch of XRP and Solana options under the oversight of the U.S. Commodity Futures Trading Commission was announced.

This addition brings regulated, structured exposure to XRP, a token known for fast transactions and cross-border use cases.

CME Expands Beyond Bitcoin and Ether

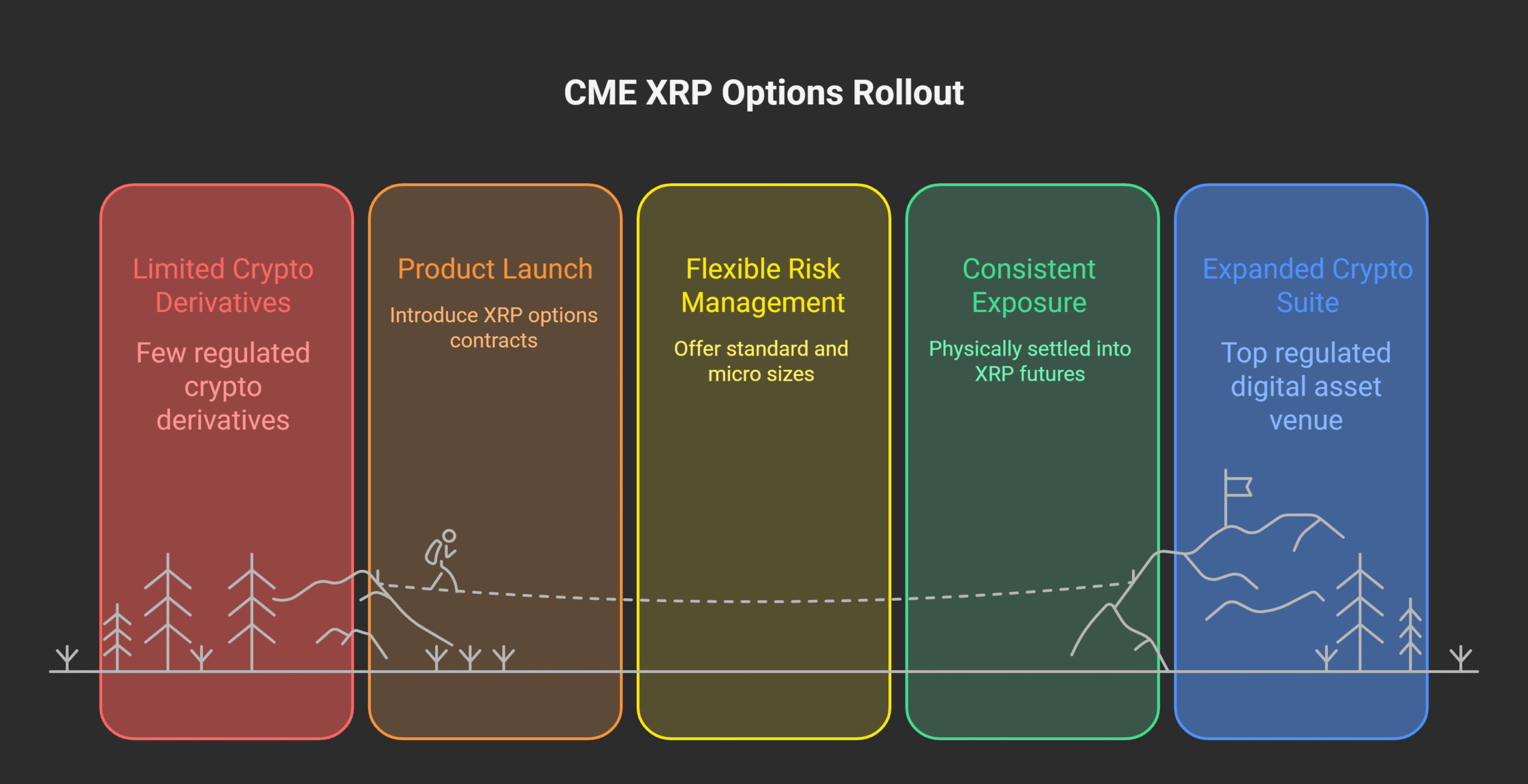

CME Group confirmed the rollout on October 13, adding CME XRP options to its growing crypto suite. These products, available in standard and micro sizes, give traders more flexibility to manage risk. They are physically settled into XRP futures, ensuring consistency between derivatives and spot exposure.

The contracts include daily, weekly, and monthly expirations, helping traders build strategies for both short-term plays and long-term hedging. With this expansion, CME strengthens its position as the top regulated venue for digital asset derivatives beyond Bitcoin and Ether.

Also Read: How CME XRP Futures Cross $18B Milestone in Just Four Months.

How CME XRP Options Function

CME offers an Exchange for Related Positions (EFRP) mechanism that allows traders to convert spot XRP into futures-based exposure. This system, regulated under Exchange Rule 538, enables participants to hedge efficiently within a compliant structure.

According to an official source, CME’s goal is to expand access to regulated crypto trading and attract long-term institutional capital. The exchange stated that the addition of XRP and Solana options reflects demand for transparent and secure derivatives markets.

Institutional Interest Grows

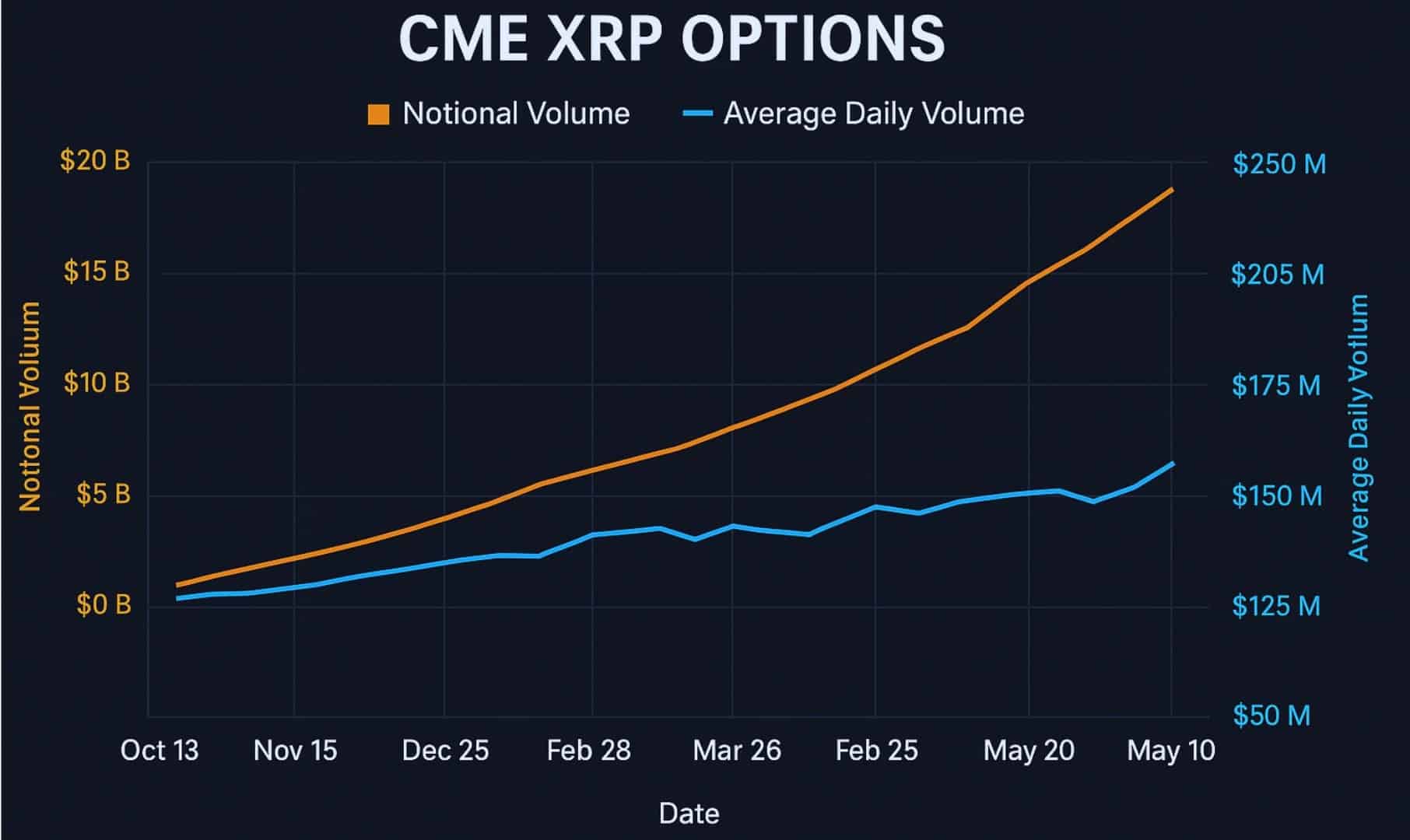

Institutional appetite for crypto derivatives has grown fast in 2025. Recent data shows that CME XRP futures have reached over 18.3 billion dollars in total notional volume across roughly 397,000 trades, averaging 213 million dollars daily. These figures highlight deep liquidity and consistent engagement from professional investors.

Earlier reports showed daily volumes peaking around 235 million dollars, reinforcing steady institutional confidence in XRP-linked instruments.

Analysts expect CME XRP options to improve liquidity and narrow market spreads further. The contracts provide an efficient way for hedge funds and asset managers to manage XRP exposure while remaining fully compliant.

Ripple Effect on the Broader Market

Experts say CME XRP options may boost confidence in Ripple’s technology and XRP’s global use cases. The addition of regulated derivatives can improve market transparency and attract more liquidity providers. If adoption continues to grow, CME’s model could serve as a blueprint for future altcoin listings under similar oversight.

This development also bridges traditional finance and digital assets more closely. By blending regulation with accessibility, CME is positioning XRP as a legitimate institutional asset, not just a speculative token.

Final Thoughts

Based on the latest research, CME XRP options mark a shift toward mainstream integration of altcoin derivatives. Their regulated structure, growing volume, and institutional appeal could make CME a key player in the global crypto derivatives landscape. If participation builds, this launch might redefine how institutions trade XRP in the long run.

For expert insights and the latest crypto news, visit our platform.

Summary

CME XRP options have officially launched under CFTC oversight, offering institutions secure exposure to XRP derivatives. The move enhances liquidity, deepens transparency, and bridges traditional finance with crypto. As institutional interest grows, CME’s XRP options could become a cornerstone for regulated altcoin trading.

Glossary

- Option: A contract that gives the right to buy or sell a futures position at a set price.

- Futures: Agreements to trade an asset at a specific date and price.

- EFRP: Exchange for Related Positions, linking spot and futures trading.

- Open Interest: The total number of active contracts not settled.

- Notional Value: The total underlying dollar value of traded contracts.

FAQs About CME XRP Options

Q1: What are CME XRP options?

They are regulated derivatives giving exposure to XRP through CME’s futures platform.

Q2: Why are they important?

They expand institutional participation and enhance transparency in XRP trading.

Q3: Who can trade them?

Institutional investors and professional traders on CME’s exchange.

Q4: How are they settled?

They settle physically into XRP futures contracts.

Read More: CME XRP Options Go Live, Extending Regulated Crypto Beyond BTC and ETH">CME XRP Options Go Live, Extending Regulated Crypto Beyond BTC and ETH

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.