TRX Flips DOGE While TRON Races #8 Fueled by USDT Volume, IPO Momentum

0

0

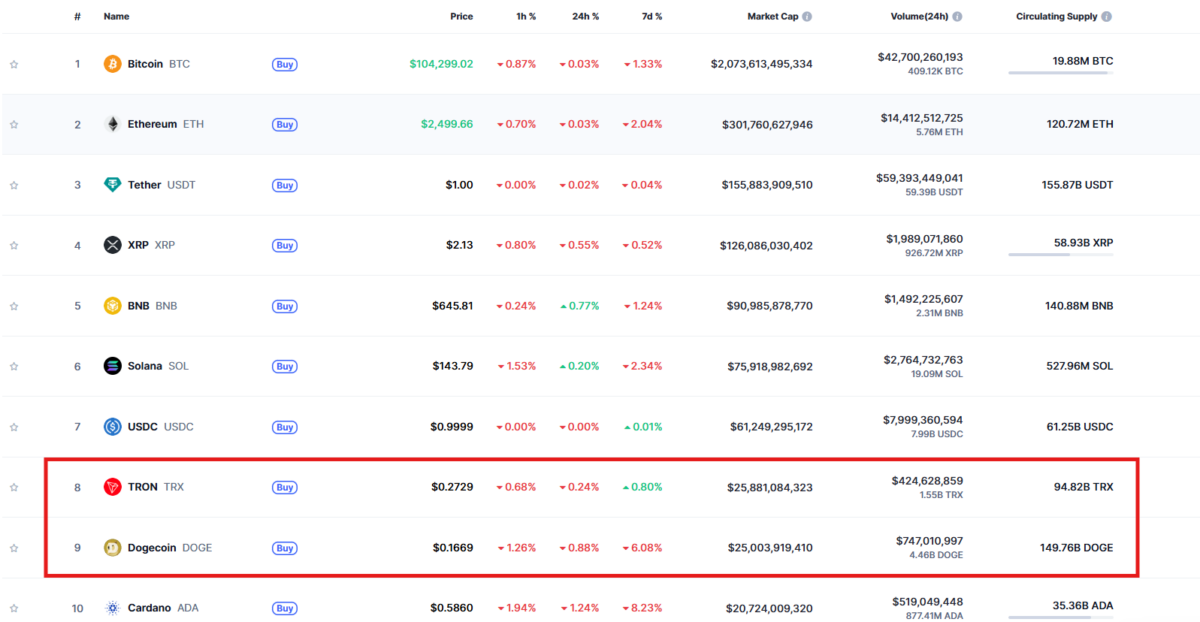

TRON’s TRX has overtaken Dogecoin to become the eighth-largest digital asset by market cap, according to CoinGecko. TRX $0.27 24h volatility: 0.2% Market cap: $25.90 B Vol. 24h: $520.69 M is trading around $0.2731 with a market cap of $25.9 billion, now sitting over $500 million above Dogecoin’s $25.03 billion.

TRX overtakes DOGE to rank #8 by market cap | Source: CoinMarketCap

The rally comes amid increasing USDT $1.00 24h volatility: 0.0% Market cap: $155.93 B Vol. 24h: $42.31 B activity on the network and growing excitement over TRON’s upcoming public listing via a $210 million reverse merger with SRM Entertainment.

USDT Volume And IPO Buzz Drive TRON’s Market Cap Gains

TRX has gained more than 130% in the past year, while DOGE $0.16 24h volatility: 3.8% Market cap: $24.40 B Vol. 24h: $1.00 B has dropped over 25% in the past month as meme coin interest continues to fade. TRON’s growing real-world use cases, especially in emerging and developing markets through USDT transfers, are reinforcing its momentum. According to CryptoQuant, TRON processes over 65% of total on-chain USDT activity, with Binance alone handling $2 billion to $3 billion daily.

The TRON DAO emphasized that USDT activity is now global, not just emerging-market-driven. Analysts suggest TRON’s infrastructure could rival traditional payments networks in regions like Latin America. Meanwhile, DOGE is facing more than 80% decline in weekly trading volume, signaling investor shift toward utility-based projects like TRON.

USDT on #TRON is scaling both ends of the global financial spectrum. 🌐

Over 662K daily transactions under $100 and 25K over $100K.

A network built for both everyday users and institutions.

Read more from @coinmetrics ⤵️ https://t.co/b4VwW4LytX

— TRON DAO (@trondao) June 17, 2025

Will TRON Maintain #8 Rank as DOGE Outflows Continue?

As noted in our previous coverage, Dogecoin has seen a sharp increase in exchange outflows this week, suggesting that investors are taking profits or rotating into other assets.

That shift in sentiment may be fueling TRX’s lead, but the question remains whether TRON can hold its position at #8 amid continued market volatility and potential DOGE reaccumulation phases.

TRX Triangle Structure Nears Resolution

TRON price forecast | Source: TradingView

On the 4-hour chart, TRX is consolidating inside a descending triangle with support at $0.2670 and resistance pressing from above. Price action has compressed near $0.2732, and traders are watching for a breakout above $0.2760 or a breakdown below $0.2650 for directional confirmation.

Momentum indicators suggest growing bullish pressure. The RSI is around 48.10 and showing early bullish divergence, while MACD is flat but leaning positive. These signals reflect gradual accumulation as bears weaken.

TRX continues to hold higher lows on the daily chart, maintaining a long-term diagonal uptrend. Key support is holding between $0.2535 and $0.2620. A successful move above $0.2950 could open upside toward $0.3250 and $0.3545 based on weekly Fibonacci levels.

TRON’s Success Highlights Solaxy’s Early-Stage DeFi Potential

TRON’s momentum reflects a broader shift toward assets with real-world utility. For those exploring early-stage potential, Solaxy is gaining serious attention.

Positioned as Solana’s first layer-2 chain, Solaxy blends high scalability with Web3 innovation, offering eco-friendly infrastructure and rewarding tokenomics designed for the next generation of decentralized finance.

The post TRX Flips DOGE While TRON Races #8 Fueled by USDT Volume, IPO Momentum appeared first on Coinspeaker.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.