James Wynn’s Bitcoin Short Position Reaches $1B As He Turns Ultra Bearish

0

0

James Wynn is making a U-turn with his Bitcoin gamble. After closing his $1.2B BTC long position, he opened a massive Bitcoin short position of $1 Billion. As per the latest data, he has closed all his short positions at a a massive loss of $15 Million.

James Wynn Bets Against A Bitcoin Rally With $1B Short

Earlier today James Wynn turned bearish with a $111.8 million short position on 1,038 BTC hours after closing his previous long position. According to an X post by Whale Insider, the Hyperliquid high-risk trader faces liquidation at $149,1000 with a 40X leverage.

The perpetual futures trade follows the closing of a $1.2 billion Bitcoin long position over the weekend. James Wynn faced liquidation at $105K, with experts like CrediBULL Crypto betting against the high-risk trader.

Barely 24 hours ago, James Wynn predicted Bitcoin price to climb as high as $121,000, setting a new all-time high this week. However, the new short position signals a changing stance by James Wynn, with the cryptoverse keen on wrapping their head around the move.

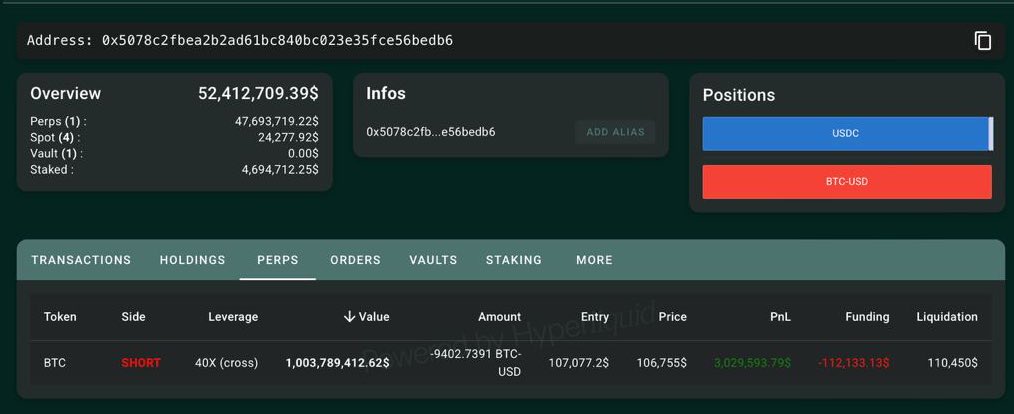

Latest reports show that James Wynn is increasing his short position, raising the stakes in a massive gamble. His short position has risen to a staggering $1 billion on $9,402 BTC with a liquidation price of $110,450. Consequently, James Wynn is betting against a near-term BTC rally given his aggressive short position.

James Wynn’s aggressive bet indicates belief in a near-term Bitcoin correction after an impressive run. At the moment, Bitcoin is trading at just under the $107K mark, down by 4.5% since setting its all-time high.

As per the latest twitter data, the trader has finally winded all his Bitcoin short positions but has suffered a huge loss. He lost nearly $15 million in the process. His combined losses at this point resulting from his trading in last 24 hrs stands at $27.9 Million.

The steady decline could result in steep profits for James Wynn, but the threat of a short squeeze hangs uneasily over the short position.

Why Is The Hyperliquid Trader Betting Against BTC?

James Wynn is hinging his bet against Bitcoin on technicals, hinting at a short-term price decline for the largest cryptocurrency. He argues that there is a significant pile-up of downward pressure for Bitcoin, and a breakout above $108K is unlikely.

“From a TA standpoint, convince me we are going higher in the short term i.e within 24-48 hours,” wrote James Wynn on X. “Post your charts and good reasoning for me to try and counter your thesis.”

The trader notes that low trading volumes, an undersold 4-hour chart, and an underwhelming 50-day moving average point to a near-term correction.

On the fundamentals side of things, an unsavoury macroeconomic report is dousing Wynn’s previous enthusiasm. Bitcoin price tumbled by 4% after Trump’s 50% tariff news, as traders lost nearly $700 million in leveraged positions.

Furthermore, there is fear that Bitcoin is overbought at the $107K zone since BTC set a new ATH. However, speculation is growing that the crypto trader’s short position is an attempt to shake out longs and re-enter at lower prices.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.