Bitmine’s $480M Ethereum Shift Signals Altcoin Rotation as $19B Market Liquidation Unfolds

0

0

After a $19 billion liquidation event that rocked crypto markets, signs are pointing to the altcoin rotation signal becoming a reality. Bitcoin’s dominance has dropped to around 60% and Ethereum has led the market recovery with Bitmine’s $480 million ETH accumulation making headlines.

Altcoins like ADA and DOGE rose 10% in 24 hours. Analysts believe capital is fleeing battered positions and looking for opportunity in altcoins.

Crash Reset: $19B Wiped, Sentiment Shattered

The recently recorded crash was indeed brutal. $19 billion in leveraged positions were liquidated across the crypto market, one of the largest single-day events in history.

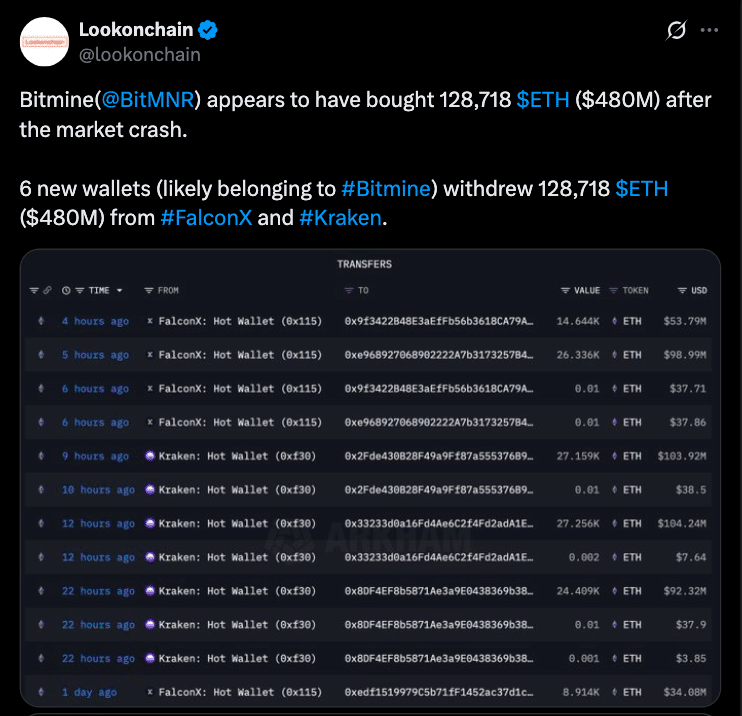

The selloff was triggered by a surprise US announcement of 100% tariffs on Chinese software exports. Bitmine’s actions; moving 128,718 ETH out of FalconX and Kraken, were spotted shortly after the crash.

This accumulation happened while the crash was taking $ETH down 15.6%. The crash crushed sentiment and left many traders overexposed to volatility.

Also read: Altcoin Season Signals Flash as Bitcoin Dominance Weakens

Rotation Mechanics: From $BTC to Alts

After the crash however, market watchers noticed the rotation began. Bitcoin dominance dropped from previous highs to 58.5% suggesting that means capital is starting to rotate out of $BTC and into riskier assets. Falling $BTC share tends to coincide with altcoin rotation signal phases.

In this case, the drop in dominance means sellers in Bitcoin are reallocating capital into altcoins that were oversold.

Ethereum often leads these rotations. Its early rebound and Bitmine’s accumulation is seen as validation. Meanwhile, altcoins like ADA and DOGE rose 10% in the same time frame, suggesting that interest is back.

As dominance softens, more room opens up for capital to move into more altcoin names.

According to Joao Wedson, CEO of Alphractal, “funds exiting Bitcoin and liquidated positions are flowing fast into other altcoins.”

Bitmine’s $480M ETH Accumulation

Bitmine’s move is the biggest institutional move post-crash. The firm reportedly bought 128,718 ETH ($480 million) via 6 new wallets moving funds from FalconX and Kraken. This brings their ETH holdings to 2.96 million, about 2.5% of ETH’s supply. The timing and size of this purchase are strong buy signals.

It should be noted that this wasn’t panic buying, even though it was during the chaos when everyone was selling. Some see Bitmine’s aggressive dip buying as a flag for more flows to follow. Experts say the move may be the institutional confirmation of altcoin rotation in play.

Dominance Shift

Bitcoin’s dominance decline is not isolated. Sources report that $BTC’s share has been in the 58-60% zone since late September 2025 and it is seen as a calculated allocation into altcoins. Others say that $BTC dominance has retreated from previous highs, setting up altcoin reentry.

Also, TOTAL2 (total altcoin market cap excluding BTC) is into new territory, showing market breadth is expanding beyond Bitcoin. Some technicals, like MACD crossovers on TOTAL2, are considered momentum indicators for altcoin strength.

Weaker BTC dominance and institutional accumulation in Ethereum is the structural setting for altcoins to thrive.

Also read: Top Altcoin Predictions 2025–2027: Ethereum, BNB, XRP, Solana, and Tron Stay in Focus

Conclusion

Based on the latest research, after a $19 billion liquidation event, the crypto market is showing early signs of altcoin rotation activation. With Bitcoin dominance weakening, altcoins rising and Bitmine buying $480 million worth of ETH, capital is looking for riskier opportunities.

If the rotation holds and deepens, the market may see an altcoin advance beyond relief rallies.

Stay up to date with expert analysis and price predictions by visiting our crypto news platform.

Summary

After a $19 billion market crash, Bitcoin dominance slipped to 58.5% and the market is seeing early signs of altcoin rotation. Ethereum joined other alts to lead the rebound with Bitmine buying $480 million worth of ETH. Altcoins like ADA and DOGE surged 10 %. These moves indicate capital is reallocation into alts and new momentum may be emerging.

Glossary

Altcoin Rotation Signal – A pattern where market capital flows from Bitcoin into other cryptocurrencies, often when $BTC dominance declines.

Dominance (BTC.D) – A metric that shows Bitcoin’s market share relative to the total crypto market.

TOTAL2 – Market capitalization of all cryptocurrencies excluding Bitcoin.

Dip-buying – Buying assets when they have dropped sharply.

Institutional Accumulation – Large purchases of assets made by big funds, treasuries or institutional entities.

Frequently Asked Questions About Altcoin Rotation

Why does a drop in Bitcoin dominance matter?

Because when $BTC’s share goes down, it means capital is flowing into other assets, making alts more attractive and signaling rotation.

Is Bitmine’s $ETH buy confirmed?

Yes, blockchain data shows 128,718 ETH ($480 million) withdrawn from exchanges and sent to six wallets linked to Bitmine.

Is this an altcoin season?

Not necessarily. But the conditions like dominance decline, accumulation, altcoin strength are good signs of rotation.

What can kill this rotation?

A change in macro conditions; rate rises, geopolitical shocks or big $BTC rallies could redirect capital back into Bitcoin.

Read More: Bitmine’s $480M Ethereum Shift Signals Altcoin Rotation as $19B Market Liquidation Unfolds">Bitmine’s $480M Ethereum Shift Signals Altcoin Rotation as $19B Market Liquidation Unfolds

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.