Stellar Comeback? XLM Flashes Breakout Signals Despite 25% Crash

0

0

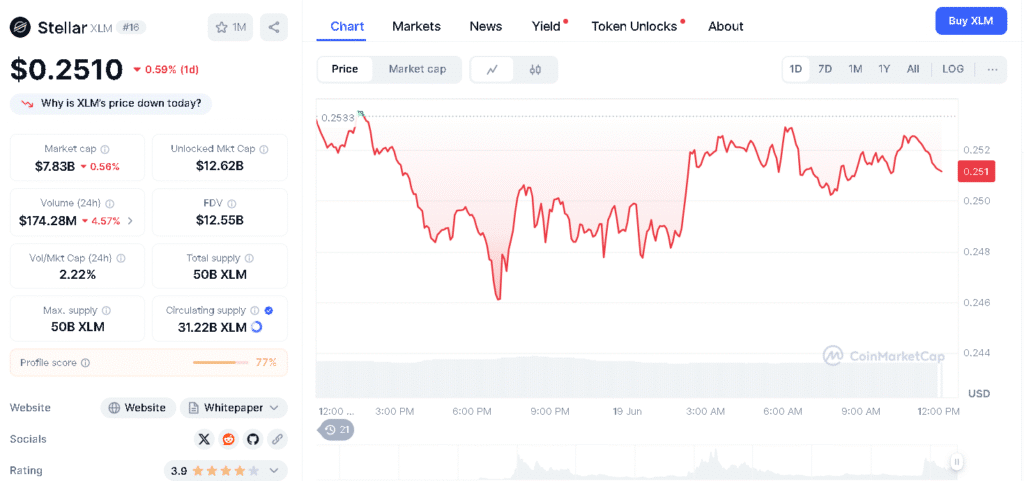

According to sources, the XLM price has shown strong resilience even after falling by 25% in recent weeks, and now it is trading just below the important $0.25 level.

While some traders have stepped back because of global tensions, key on-chain data and trading signals are showing a shift in market sentiment. Now, instead of focusing on the drop, investors wonder if Stellar is getting ready for a strong breakout.

A Breakout Brewing Beneath the Surface

Technical indicators are now suggesting that a potential trend reversal might happen soon. The XLM price is moving inside a falling wedge pattern, which is often seen as a sign that prices might go up.

There is also a bullish divergence forming in the Relative Strength Index (RSI), which indicates that downward momentum might be weakening. Crypto analyst Ethan Ward said that momentum is slowly growing.

He explained that when the XLM price keeps falling but the RSI starts moving higher, it usually means that a breakout might happen soon. Recently, the XLM price has shown small signs of recovery from its earlier losses.

Derivatives Market Signals Growing Optimism

CoinGlass data shows that XLM funding rates have moved into the positive range. Open interest has also gone up, which means that more trades are getting involved again.

This change suggests that, even though the XLM price is still moving carefully, traders’ interest is growing once more.

Market participants are closely watching the XLM liquidation heatmap. Currently, the XLM price is staying near a low-liquidity zone.

If the price stays above this area, experts say it might be a strong base for a bounce. But if it falls below, it might trigger a long squeeze, which might send the prices lower.

Most traders believe the XLM price might soon recover. Futures trader Karan Sehgal said people are feeling positive, but the price still needs a strong reason, like important news or a big change, to rise steadily.

| Metrics | Value | Source |

| Current Price | $0.2510 | CoinMarketCap |

| 24 Hour Trading Volume | $174.28M | CoinMarketCap |

| Resistance Level | $0.27–$0.28 | CryptoTicker |

| Open Interest | $613M | Blockchain magazine |

| All Time High | $0.9381 | CoinMarketCap |

Macros Could Tip the Balance

The XLM price is currently trading around $0.2516. A lot of the uncertainty around the XLM price is not about charts or trading, but it is also due to global political tensions.

Markets are now closely paying attention to the situation between Iran and Israel. Recently, former U.S. President Donald Trump gave Iran a strong warning, which has raised hopes for a diplomatic resolution.

Analysts believe that, if the situation is resolved, it could reduce stress in global markets and help risky assets like Cryptocurrencies, like Stellar, to recover.

At the same time, traders are closely watching the latest FOMC meeting. If the central banks decided to lower interest rates, it might give altcoins like XLM an extra boost.

On-Chain Metrics Support a Rebound Case

Data from Santiment shows a positive shift in how people feel about XLM. Lately, there have been more positive messages than negative ones.

This has pushed overall sentiment into the bullish zone. At the same time, Stellar is performing well and is handling hundreds of millions of transactions smoothly.

The recent discussion about adding PayPal’s PYUSD stablecoin to the Stellar network might be a big step forward. If it happens, it would make XLM even more useful for cross-border payments, particularly for small and medium businesses.

There are also speculations about a potential partnership with the developer-focused company EasyA, which might lead to new ideas and growth for Stellar.

Conclusion

Even though the XLM price has dropped 25%, some investors see a chance of recovery. With improving charts, trading activity, and Sentiments, XLM might bounce back.

Whether the XLM price could reclaim previous highs or continue to struggle will depend on geopolitical resolutions and market conditions. For now, traders should stay alert but careful.

FAQs

1. What is the current XLM price based on the latest market figure?

Around $0.2516.

2. How much did XLM drop recently?

About 25%.

3. What does a positive funding rate mean for XLM?

More market participants expect a price surge.

4. What’s the key support zone for XLM?

Near the low-liquidity area around $0.25.

5. Could geopolitical issues affect XLM?

Yes, tensions like Iran-Israel impact the market mood.

Glossary

Bullish Divergence: When momentum rises while price falls, it is seen as an early recovery sign.

RSI: A momentum tracker; rising RSI during a dip may signal strength.

Liquidity Zone: A price area with low trading depth that can trigger sharp moves.

Open Interest: Total active futures positions—higher numbers mean growing market activity.

Long Squeeze: Forced sell-off by over-leveraged buyers during sudden drops.

Funding Rate: A fee in futures trading that turns positive when buyers gain confidence.

Sources

Read More: Stellar Comeback? XLM Flashes Breakout Signals Despite 25% Crash">Stellar Comeback? XLM Flashes Breakout Signals Despite 25% Crash

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.