Bitcoin Whales Accumulate as Retail Investors Exit, Hinting at Bullish Reversal

0

0

Highlights:

- Large Bitcoin wallets rise as whales buy the dip during the recent market correction.

- Retail investors exit positions, showing fear, while whales accumulate more Bitcoin holdings.

- Santiment suggests this divergence could signal a bullish reversal in Bitcoin’s price trend.

In the last ten days, the number of big Bitcoin wallets has gone up. At the same time, small retail wallets have dropped. This opposite trend is often a bullish sign. On Thursday, Santiment, a market data platform, shared this change on X. Santiment has noticed that big and small Bitcoin holders are acting differently as the price drops.

In the past ten days, whale wallets with at least 10 BTC have increased by 231. This shows big holders are buying the dip. But smaller wallets with 0.001 to 10 BTC have gone down by 37,465, meaning small holders are selling in fear. This means large holders still trust Bitcoin, but small investors are scared because of the recent drop. In the past, this type of behavior often came before a price rise. Santiment said this could help bring back a positive trend in the crypto market.

Bitcoin's elite vs. mortal wallets are moving in two different directions as its market value sits just north of $104.3K.

Wallets with 10+ $BTC: +231 Wallets in 10 Days (+0.15%)

Wallets with 0.001 to 10 $BTC: -37,465 Wallets in 10 Days (+0.15%)

When large wallets… pic.twitter.com/uhZf6rPYvq

— Santiment (@santimentfeed) June 19, 2025

Glassnode also shared a similar view, noting that while the number of Bitcoin transactions has decreased, the average size of each transaction has grown. This means that even with fewer transactions, total settlement volumes are rising. The trend suggests that larger players—like institutions or wealthy individuals—are now leading on-chain activity.

Despite #Bitcoin’s elevated price, a clear divergence has emerged between market valuation and network activity. In this report, we explore activity across both on and off-chain markets, and examine how network metrics have changed this cycle.

Discover more in the latest Week… pic.twitter.com/vLhL7sllKK

— glassnode (@glassnode) June 19, 2025

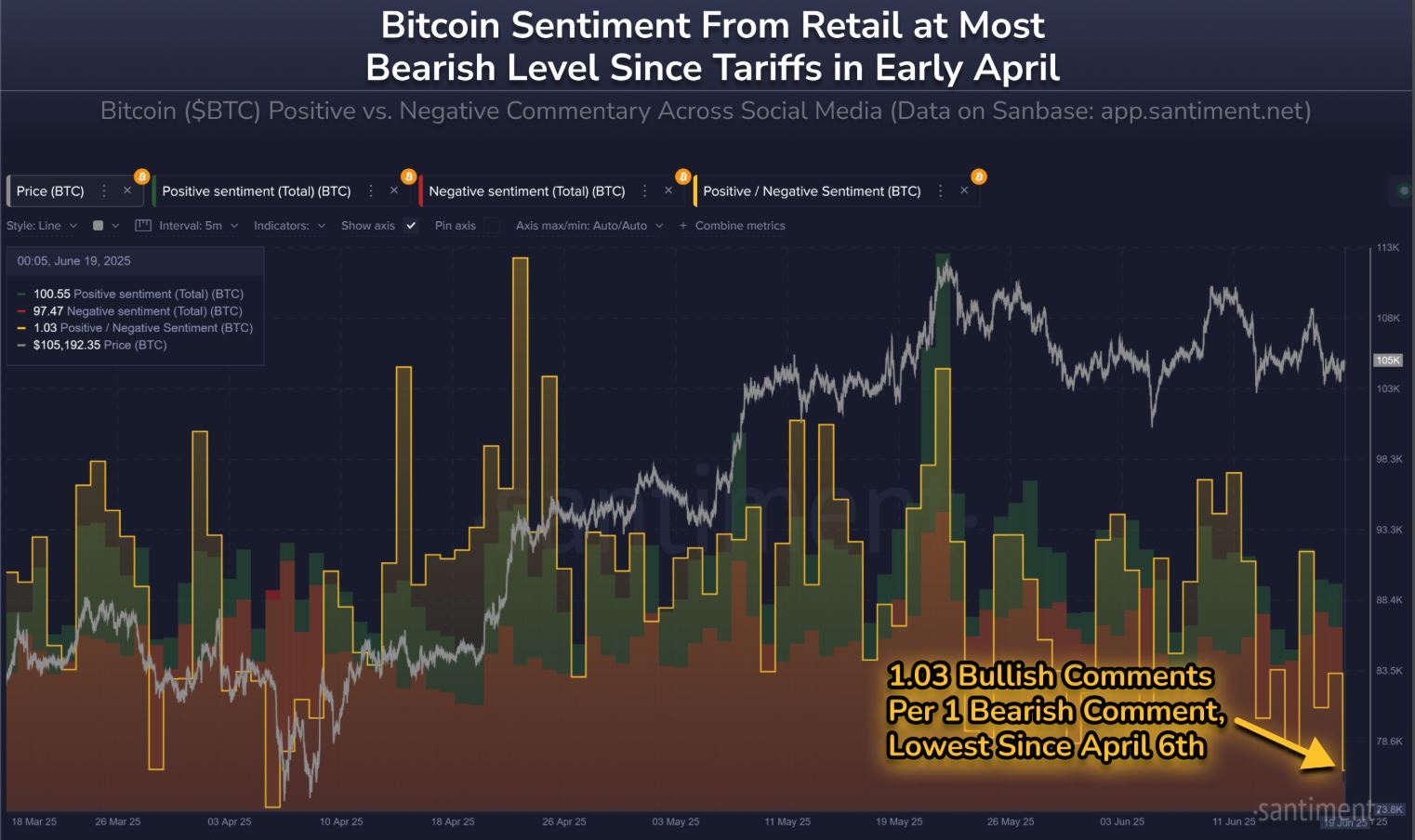

Trader Sentiment Turns Bearish as Fear & Greed Index Slips to Neutral

Brian Quinlivan, marketing director at the crypto research platform Santiment, said on Thursday that social media data shows only 1.03 bullish comments for every bearish one. This hasn’t happened since the fear around tariffs on April 6. Quinlivan explained that this is usually a positive signal, as markets tend to move against the crowd’s expectations.

Meanwhile, the Crypto Fear & Greed Index dropped to 54 on Friday, changing the mood from “Greed” to “Neutral.” This index uses different signals to measure how traders feel. It looks at Google searches, surveys, price moves, social media, market share, and how prices change quickly. The average Crypto Fear & Greed Index score from June 9 to 15 was 61, reflecting a “Greed” sentiment. A month earlier, the index averaged 70, also showing strong “Greed” in the market.

Bitcoin Holds Strong Amid Geopolitical Tensions

Bitcoin stayed strong last week, even with rising tension between Iran and Israel. Also, spot Bitcoin ETFs—mainly BlackRock’s IBIT—saw more inflows, showing growing interest from big investors. At the time of writing, BTC was trading at $105,951, showing a 1% gain over the last 24 hours.

In addition, an analysis by Coinvo predicts that Bitcoin could surge to $290,000 by the end of 2025, assuming market conditions align as expected. The analysis is based on how Bitcoin followed an upward trendline in its last two cycles. They believe it might follow the same path again this time.

What comes next for #BTC ? (Currently $104k)

— Matthew Hyland (@MatthewHyland_) June 18, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.