Chainlink (LINK) Eyes $20 After Surge: Price Forecast and Market Analysis

0

0

Chainlink (LINK), one of the leading decentralized oracle networks, has recently broken out of a key technical pattern, signaling renewed bullish momentum. As the broader crypto market steadies after recent volatility, LINK has emerged as a token to watch, thanks to surging development activity, strategic partnerships, and an encouraging technical setup. This article explores the current state of Chainlink, provides detailed price forecasts, and analyzes what could be next for LINK holders.

Current Market Overview

As of March 26, 2025, LINK is trading at $15.48, marking a 2.28% increase over the last 24 hours and a 10.99% gain over the past week. The token’s market capitalization stands at $9.70 billion, with 24-hour trading volume hovering around $376 million.

This upward move is partially attributed to broader optimism in altcoins, but LINK’s breakout from a descending channel signals that strong fundamentals may drive its rally.

Chainlink Technical Analysis: Bullish Signals Are Strengthening

LINK has successfully breached a descending channel that formed in February 2025. The breakout coincides with the token surpassing its 200-day Exponential Moving Average (EMA), often seen as a strong trend reversal indicator.

The Relative Strength Index (RSI) has climbed above the neutral 50 mark, suggesting increased buying interest. Meanwhile, the MACD (Moving Average Convergence Divergence) is now in positive territory, further reinforcing bullish sentiment.

If momentum continues, LINK may retest resistance around $19.30 and the psychological barrier of $20.00 in the short term.

On-Chain Metrics: Social Dominance and Development Rising

Chainlink’s on-chain data is painting a bullish picture. According to Santiment, LINK’s social dominance has surged, indicating it is gaining traction in crypto discussions. Increased social presence often precedes speculative rallies.

Meanwhile, development activity on the LINK network is also spiking. GitHub repositories linked to Chainlink have seen more commits and contributors since early March, suggesting continued upgrades and innovation.

A significant drop in LINK’s exchange supply further points to investor accumulation, reducing sell pressure on centralized platforms.

Institutional Adoption: ADGM Partnership as a Growth Catalyst

One of the most notable recent developments is Chainlink’s partnership with the Abu Dhabi Global Market (ADGM). The collaboration is focused on expanding blockchain-based tokenization and financial services infrastructure in the UAE.

This move introduces LINK’s oracle technology to a wider range of institutional and enterprise use cases. ADGM-registered companies will gain direct access to Chainlink’s decentralized infrastructure, potentially accelerating real-world adoption.

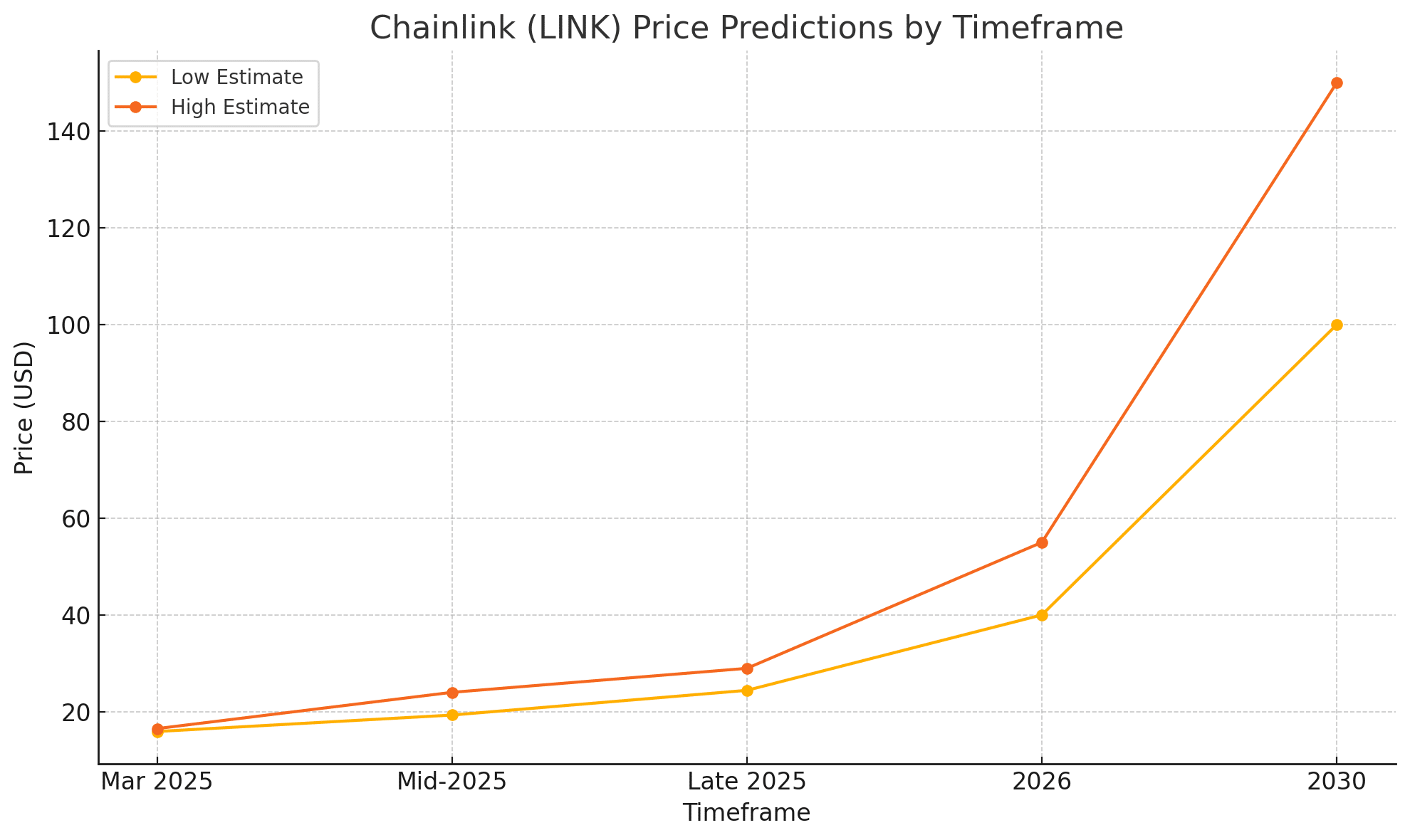

LINK Price Prediction: Short-Term to Long-Term Forecasts

Based on technical analysis and fundamental insights, analysts have laid out optimistic projections for LINK across multiple timeframes:

LINK Price Prediction Table

| Timeframe | Forecasted Price Range | Source | Notes |

|---|---|---|---|

| March 2025 | $15.90 – $16.50 | CoinCodex | Continued short-term breakout expected |

| Mid-2025 | $19.30 – $24.00 | CryptoTimes | Resistance at $20 psychological level |

| Late 2025 | $24.41 – $28.96 | Changelly | Bullish scenario based on institutional growth |

| 2026 | $40.00 – $55.00 | CoinPedia | Strong growth predicted amid ecosystem maturity |

| 2030 | $100.00 – $150.01 | Benzinga | Long-term projection driven by DeFi adoption |

These forecasts are speculative and depend heavily on broader market conditions, regulatory developments, and Chainlink’s continued integration into decentralized and institutional platforms.

Conclusion

Chainlink’s current trajectory is fueled by a mix of strong technical signals, positive on-chain metrics, and real-world institutional adoption. The $20 level stands as the next psychological resistance, and a successful breach could open doors to $25 and beyond.

However, the crypto market is inherently volatile. Investors should approach LINK with cautious optimism, combining technical analysis with broader market awareness and fundamental research.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

What is Chainlink (LINK)?

Chainlink is a decentralized oracle network that connects smart contracts with real-world data, APIs, and traditional banking systems, enabling them to execute based on external conditions.

Why is LINK gaining attention in 2025?

LINK’s price has surged due to a technical breakout, increased development activity, accumulation by investors, and its growing presence in institutional finance through partnerships like ADGM.

Is Chainlink a safe investment?

While LINK has strong fundamentals, the crypto market remains unpredictable. Investors should research thoroughly and consider diversifying their portfolios to manage risk.

Glossary

Oracle Network: A system that supplies external data to blockchain smart contracts, allowing them to interact with real-world events.

EMA (Exponential Moving Average): A weighted moving average that gives greater importance to recent price data is often used to spot trend reversals.

RSI (Relative Strength Index): A technical indicator measuring the speed and change of price movements; values above 70 indicate overbought conditions, below 30 oversold.

MACD (Moving Average Convergence Divergence): A momentum indicator that shows the relationship between two moving averages of a token’s price.

Social Dominance: The share of social media and crypto community discussions related to a specific token, often used as a sentiment indicator.

Sources

Disclaimer:

The information provided in this article is for educational and informational purposes only and should not be considered financial or investment advice. Cryptocurrency markets are highly volatile, and readers should conduct their own research or consult a licensed financial advisor before making any investment decisions.

Read More: Chainlink (LINK) Eyes $20 After Surge: Price Forecast and Market Analysis">Chainlink (LINK) Eyes $20 After Surge: Price Forecast and Market Analysis

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.