Cardano price prediction 2024-2030: Will Cardano reach $1?

1

0

Key takeaways

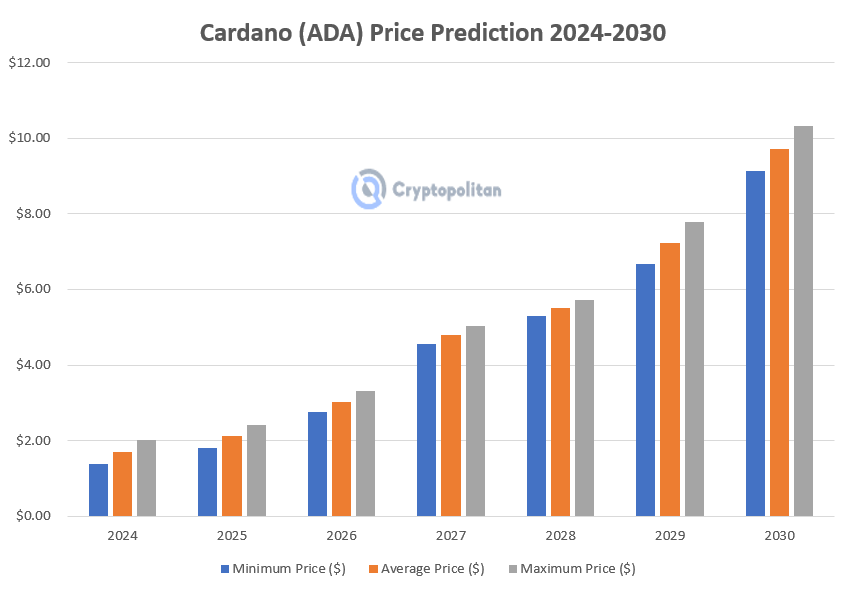

- The Cardano price prediction shows it will reach a high of $0.55 in 2024.

- In 2027, we expect ADA/USD to reach $5.03.

- Cardano can hit $10.32 in 2030 if the platform grows and adoption increases.

Cardano was founded by Charles Hoskinson, one of the original Ethereum founders. While the development of the Cardano platform began in 2015, it went live in 2017, along with the associated cryptocurrency ADA.

Hoskinson aimed to address blockchains’ three main challenges: scalability, sustainability, and interoperability.

After the halving event of Bitcoin earlier this year, experts are speculating on whether Cardano can retrace up and retest its all-time high in 2025. Speculations about an upcoming bull run are further driving investment into ADA.

At the same time, many crypto enthusiasts and investors (both short-term and long-term) ask, “Will ADA hit $100 in 2030?” and whether it can retrace back to $3.09 (the all-time high).

Overview

| Cryptocurrency | Cardano |

| Token | ADA |

| Price | $0.3483 |

| Market Cap | $12,514,077,199 |

| Trading Volume | $228,149,445 |

| Circulating Supply | 35,946,231,264 ADA |

| All-time High | $3.09 |

| All-time Low | $0.02 |

| 24-hour High | $0.3483 |

| 24-hour Low | $0.3352 |

Cardano price prediction: Technical analysis

| Metric | Value |

| Volatility | 10.25% |

| 50-day SMA | $0.383705 |

| 14-Day RSI | 42.67 |

| Sentiment | Bearish |

| Fear & Greed Index | 30 (Fear) |

| Green Days | 12/30 (40%) |

Cardano price analysis: ADA retests support at $0.327 and rebounds

TL;DR Breakdown

- The ADA price has rebounded after testing the support line at $0.327.

- The next target is the EMA 50 line on the daily timeframe.

- Market’s sentiment today is in the green, and ADA may break out of the descending triangle in the next few days.

The Cardano price analysis on 20 August shows that ADA/USD has rebounded after testing the $0.327 support line and now gears to test the EMA 50 line on the daily chart. Earlier, on 5 August, it bottomed out at $0.2756 and has since retraced the dip.

ADA price analysis 1-day chart: ADA bounces back from the support line and gears to test the EMA 50 line

The strong support line at $0.326 has been confirmed as the chart bounced back up after testing it. Earlier, the market bottomed at $0.2756, where it experienced huge buy pressure, resulting in a retracement. ADA has had quite a lot of buying volume today as its price ran from a low of $0.3352 to $0.3480.

The RSI on the daily chart is at 46, suggesting that the market is slightly overbought. Hence, we can expect some slight correction in the shorter time frame. Since the market is in the green today, we can expect the price to retest the EMA 50 line over the next few intervals.

Cardano 24-hour price movement: ADA/USD breaks above EMA 50

On the shorter time frame, Cardano has already broken above EMA 50 and formed a support. After breaking above that line, it formed a sharp red wick to $0.3352 and bounced back from there. This suggests that the EMA 50 line can now act as the support.

The RSI on the 1-hour chart is heavily overbought at 62.88. The market is expected dip slightly eventually. However, if the buying volume keeps coming in, ADA might break above the descending triangle pattern which has formed over the last few months.

What to expect from Cardano price analysis?

Cardano’s short-term price movement suggests it will likely retest EMA 50 on the larger time frames, and break above the descending triangle over the next few days.

ADA technical indicators: Levels and action

Daily simple moving average (SMA)

| Period | Value ($) | Action |

| SMA 3 | 0.336828 | BUY |

| SMA 5 | 0.335144 | BUY |

| SMA 10 | 0.336092 | BUY |

| SMA 21 | 0.352736 | SELL |

| SMA 50 | 0.383705 | SELL |

| SMA 100 | 0.409922 | SELL |

| SMA 200 | 0.49328 | SELL |

Daily exponential moving average (EMA)

| Period | Value ($) | Action |

| EMA 3 | 0.333608 | BUY |

| EMA 5 | 0.335296 | BUY |

| EMA 10 | 0.340492 | BUY |

| EMA 21 | 0.355606 | SELL |

| EMA 50 | 0.381055 | SELL |

| EMA 100 | 0.413207 | SELL |

| EMA 200 | 0.442845 | SELL |

Cardano price analysis conclusion

Cardano seems to have a bearish outlook, and investors are fearful. This is because the recovery to its previous prices seems to be very slow, and it lacks significant positive momentum even on green days. However, it is expected to retest the support region between $0.31 and $0.33 in the short term and possibly continue its run downward before a retracement.

Why is Cardano Down?

Cardano is down because the market’s conditions are somewhat bearish, and all the other altcoins are also struggling. It recently broke below its resistance level at $0.405; however, it has already found strong support at the $0.317 mark. As of 4 August, Cardano is gearing up to retest this support line a few times and continue its course according to the market’s overall sentiments.

Is Cardano a good investment?

Cardano offers a scalable smart contracts platform that uses a unique, highly energy-efficient PoS consensus algorithm. It has a growing user base and enables exciting applications like RWA (real-world asset tokenization), which is expected to gain massive attention in the near future.

Since ADA is the native token that powers the Cardano ecosystem, it is certainly a good long-term investment. Even though its market is currently down, there is no reason why it can’t recover to its previous levels in the future.

Will Cardano Recover?

Yes, Cardano is likely to recover near the end of this year. Based on our price analysis, it will reach a potential high of $2.02 and go up to $2.42 in 2025. Based on the market’s sentiment and platform updates, it can reach its all-time highs in the long term.

Will Cardano Reach $2?

Yes, Cardano can reach $2 by the end of this year. Although, the last time it touched that level was in November 2021. As of 2024, if the bull market returns in full swing, there is no reason why Cardano can’t touch $2.

Will Cardano Reach $3?

Given the large number of old buyers waiting to cut losses and new sellers buying in on recent bottoms, Sol will likely face considerable resistance as it heads towards $3. However, with bulls in full swing, $3 is a realistic target.

Will Cardano Reach $5?

Since the all-time high of Cardano was around $3, breaking this point would require significant bullish momentum. While it is possible, the overall bearish sentiments regarding Cardano’s past performance can cause a lot of resistance. Hence, it is not likely to reach $5 before 2027-2028.

Does Cardano have a good long-term future?

Yes, Cardano does have a good long-term future since many crypto investors believe that this coin is extremely undervalued right now, and overshadowed by other bigger giants like Solana and Ethereum. However, since the Cardano platform continues to improve, ADA/USD has a good future in the long term.

Recent news/opinion on Cardano

- Deadalus users can now access version 6.0.0 for mainnet, which is required to cross the Chang hard fork that’s upcoming.

Cardano price prediction August 2024

Based on the current price action, there is not likely to be much upward momentum in Cardano in August 2024. Its price has recently formed strong support at $0.31. Currently, the ADA/USD market has taken a bearish turn, which means that it might retest these levels soon.

Market conditions are expected to be slightly bullish over the next few months, so ADA may retrace back to $0.42 and retest it in August. However, given that ADA has retraced significantly from its all-time high of $3.09, sell pressure remains high as many early investors cut their losses on the way up.

| Cardano Price Prediction | Potential Low | Potential Average | Potential High |

| Cardano Price Prediction August 2024 | $0.31 | $0.44 | 0.55 |

Cardano price prediction 2024

The market is expected to take a bullish turn by the end of this year. Based on these speculations, we can expect that ADA/USD will somewhat recover and may also break above the local top at $0.512 that it created on 21 April. However, the overall investor confidence in Cardano isn’t very high at the moment.

However, if we are confirmed to be in a bull run and new retail enters the crypto market in Q4 of 2024, we can expect Cardano to retest its previous all-time high. Breaking through that point would, however, require a lot of buying pressure.

| Cardano Price Prediction | Potential Low | Potential Average | Potential High |

| Cardano Price Prediction 2024 | $0.30 | $1.16 | $2.02 |

Cardano price predictions 2025-2030

| Year | Minimum Price | Average Price | Maximum Price |

| 2025 | $1.81 | $2.11 | $2.42 |

| 2026 | $2.76 | $3.03 | $3.30 |

| 2027 | $4.56 | $4.79 | $5.03 |

| 2028 | $5.29 | $5.51 | $5.73 |

| 2029 | $6.68 | $7.23 | $7.79 |

| 2030 | $9.12 | $9.72 | $10.32 |

Cardano price prediction 2025

In 2025, ADA’s average price could be about $2.11. Its minimum and maximum prices can be expected at $1.81 and $2.42, respectively.

Cardano price prediction 2026

Entering 2026, ADA’s potential price is expected to rise, after which it may range between $2.76 and $3.30. During this period, the average price will fluctuate around $3. However, since it would be near Cardano’s all-time high, it can face significant resistance from early investors breaking even.

Cardano price prediction 2027

Looking at Cardano’s past performance and assuming that it follows the crypto market trends, we can expect ADA/USD to break above the previous all-time high and potentially hit $5.03. Cardano’s price prediction for 2027 projects a minimum price of $4.56 and an average price of $4.79

Cardano price prediction 2028

In 2028, ADA/USD is expected to continue its rally upward after four full years of Bitcoin halving. At this point, its price can hit a maximum price of $5.73 an average price of $5.51 and a minimum price of $5.29.

Cardano price forecast 2029

Based on the current market projection, ADA can be valued at a minimum of $6.68, forming strong support. At this point, it may continue its upward rally and get elevated to $7.79. However, the average price is expected to be around $7.23.

Cardano (ADA) price prediction 2030

ADA/USD in 2030 is expected to soar to the $10 mark. However, this would require the Cardano ecosystem to achieve significant growth and the overall structure of the crypto market to turn bullish. In 2030, the price of ADA is forecasted to be around a minimum value of $9.12, maximum value of $10.32 and an average trading value of $9.72.

Cardano market price prediction: Analysts’ ADA price forecast

| Firm Name | 2024 | 2025 |

| Coincodex | $0.44 | $2.19 |

| DigitalCoinPrice | $0.92 | $1.07 |

| Changelly | $0.506 | $1.05 |

Cryptopolitan’s Cardano (ADA) price prediction

Even though the current ADA/USD market struggles with a lot of sell pressure, Cryptopolitan’s overall outlook in the long term is positive, especially because it has affordable fees and an ecosystem that supports smart contracts. Our Cardano price forecast suggests that it can recover to its previous all-time high of $3.09 and potentially break above in the coming years.

Cardano historic price sentiment

- Cardano was founded in 2015 and went live in 2017. It initially gained investor support and popularity for being affordable and environmentally friendly due to its unique PoS mechanism called Ouroboros.

- In 2021, Cardano implemented the smart contract feature with the Alonzo update. This update came on the ADA test network and brought the interoperability and scalability that was promised to the users earlier.

- The ADA price reached its all-time high during the bullish cycle of 2021 when it hit $3.09. However, its price started plummeting at the beginning of September 2021 and reached a low of $0.220 in June 2023.

- It then formed a local high at $0.810 on 14 March 2024 before dipping again to $0.401 in April 2024 due to heavy selling pressure as early investors rushed to cut their losses.

- From 13 April 2024, Cardano has been trading between $0.52 and $0.401, with strong support at the $0.4 mark. It has retested this zone twice and rejected it, which suggests that recovery may be possible once this consolidation period ends.

- In May 2024, Cardano made a local top at $0.51 and rebounded lower after retesting this resistance level.

- ADA is traded within the range of $0.317 and $0.423 in July after forming a local bottom at $0.317.

- In August, it is has formed strong support at the $0.33 mark and it now expected to retrace back towards the upside.

1

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.