Ripple (XRP) Large Accumulation Raises Eyebrows as Price Attempts to Breakout

0

0

If recent trends are anything to go by, then Ripple (XRP) may experience another price boom. Technical patterns do not just drive this prediction; external factors, as well as substantial accumulation of the token, increase the odds.

XRP price rallied to a monthly high of $0.63 on July 18. While it has erased part of those gains, holders seem to be positioning themselves for another hike.

Major Ripple Investors Scoop Up in Billions

When XRP’s price bounced some weeks back, it had an incredible level of on-chain activity. Later on, the surge in interaction subsided. However, at press time, Santiment shows rising activity again — this time from the cryptocurrency’s major stakeholders.

According to the on-chain analytic information portal, XRP holders who own between 1 million and 10 million tokens have added to their balances in the last seven days.

For instance, on July 16, this cohort bought a total of 3.72 billion tokens. At press time, that number had increased to 3.87 billion.

Read More: XRP ETF Explained: What It Is and How It Works

XRP Balance of Addresses. Source: Santiment

XRP Balance of Addresses. Source: Santiment

Usually, when these large holders do things like this, other smaller investors who track their activity tend to follow a similar path, thereby providing buying pressure for the crypto.

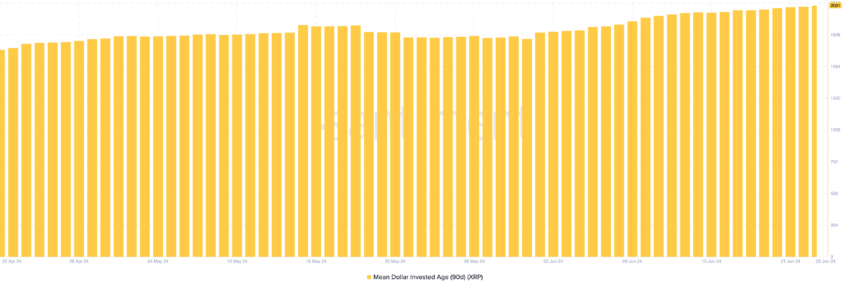

Therefore, if the accumulation continues, XRP could retest $0.63. Furthermore, the Mean Dollar Invested Age (MDIA) is another metric supporting this potential.

In simple terms, the MDIA tracks the average age of assets that have remained in the same wallets for some time. As of this writing, Ripple’s 90-day MDIA continues to climb.

When this happens, it implies that investments in an asset have continued to remain in their previous location while increasing the chances of a bullish breakout. That is the case with XRP.

XRP 90-Day Mean Dollar Invested Age. Source: Santiment

XRP 90-Day Mean Dollar Invested Age. Source: Santiment

If the reading had declined, it would have meant that long-term holders were moving dormant coins back into circulation, nullifying XRP’s possibility of jumping.

XRP Price Prediction: Rebound to $0.63 Likely

The 4-hour XRP/USD chart shows the formation of a symmetrical triangle. A symmetrical triangle appears when two converging trend lines connect a series of lower highs (LH) and higher lows (HL).

This pattern could move in two directions. Historically, a breakout is imminent if the price breaks above the last lower high.

However, a breakdown occurs if the price slips below it. For XRP, it is the former; hence, the price of XRP is likely to return to $0.63.

Regardless of the bullish potential, it is important to note that the Chaikin Money Flow (CMF), which tracks positive or negative liquidity inflow, has yet to support price prediction. Should the CMF reverse upwards, XRP’s price may move toward $0.63 or beyond.

Read More: Everything You Need To Know About Ripple vs SEC

XRP 4-Hour Analysis. Source: TradingView

XRP 4-Hour Analysis. Source: TradingView

Ripple’s potential settlement with the U.S. SEC is another factor that could impact the upside. Five days ago, Ripple CEO Brad Garlinghouse said he was optimistic about the resolution.

If things go as planned, the development could benefit XRP’s price. However, if any of the parties renege on the ongoing discussion, XRP’s price could drop to $0.57.

0

0