Chainlink Price Surge: Will LINK Reach $30 After 39% Weekly Gain?

0

0

Chainlink price has recently experienced a significant surge, gaining 39% in the past week. As the cryptocurrency reached the $24.60 mark, traders and analysts have begun to speculate whether Chainlink is setting up for another aggressive rally.

The recent price action has sparked optimism in the market, with many expecting more bullish moves in the near future. As the broader cryptocurrency market shows signs of recovery, Chainlink price surge stands out, making it a focal point for investors and traders alike.

Chainlink’s Resistance and Technical Indicators

Despite the impressive rally, Chainlink price remains 55% below its all-time high of $52.88, which was reached in May 2021. Currently trading at around $24.00, Chainlink faces significant resistance at the $24 level, which has acted as a barrier during previous rallies.

Technical indicators are also supporting the bullish outlook for Chainlink price. The Relative Strength Index (RSI) is currently in the mid-60s, indicating that there is still room for growth before the market enters overbought territory.

Additionally, rising trading volume is another positive sign, suggesting that more participants are entering the market, which could lead to further price increases.

Analyst Predictions and Market Sentiment

Crypto analyst Johnny, a much-followed social media commentator, thinks Chainlink price might be gearing up another rally. He added to it that the new trend in the market indicates a bullish prospect to the cryptocurrency since several traders were waiting to see the next major development.

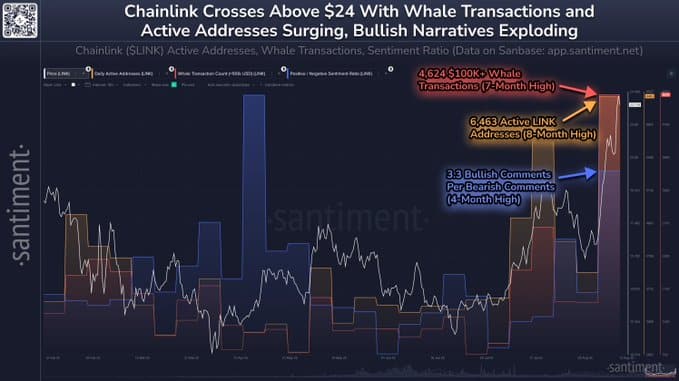

Santiment also shows that Chainlink is seeing the most bullish sentiment it has seen post-February 1st, showing a high degree of confidence in the market.

The hype about Chainlink is not only formed on social media influencers. Chainlink witnessed a 52 % rise in the last 30 days as per the last data, which has led the analysts to forecast future growth in prices of Chainlink.

Specifically, analysts are concerned about the potential of Chainlink going up to $25.50, which will generate a liquidation risk of some $61 million on short positions.

Institutional Buying and Whale Activity

In addition to retail traders, Chainlink has also seen significant buying activity from institutional investors. Large investors, often referred to as “whales,” have been accumulating LINK tokens, contributing millions of dollars to their holdings. This surge in institutional interest is a key factor driving the recent price rally.

Furthermore, Chainlink’s staking mechanism has added to the buying pressure. Stakers can lock up their LINK tokens in exchange for a yield of about 4.32%. This staking process removes tokens from circulation, helping maintain upward pressure on the asset’s price.

Chainlink’s Role in Tokenization of Real-World Assets

One of the main drivers behind Chainlink price potential for explosive growth is its role in the tokenization of real-world assets (RWAs). This sector, now valued at over $25 billion, is growing rapidly.

Chainlink’s decentralized oracle network is critical in bringing real-world data onto the blockchain. Chainlink facilitates the secure transfer of value across traditional financial markets, including tokenized assets like equities, real estate, and commercial debt.

As the adoption of tokenized assets continues to accelerate, Chainlink’s infrastructure is becoming more essential for the seamless operation of decentralized finance (DeFi). By bridging the gap between traditional finance and blockchain technology, Chainlink is positioned to capture a significant share of the growing RWA market.

Strategic Partnerships Fueling Chainlink’s Growth

Chainlink has also been entering strategic alliances that continue to establish the company in the cryptocurrency and the mainstream financial market. A standout partnership has been with the US-headquartered Fortune 500 company called Intercontinental Exchange (ICE).

This collaboration will introduce foreign exchange data and precious metals on the blockchain that will widen the outreach of Chainlink in the financial sector.

| Month | Minimum Price | Average Price | Maximum Price | Potential ROI |

|---|---|---|---|---|

| August | $23.68 | $24.18 | $24.67 |

9.2%

|

| September | $14.90 | $20.32 | $25.73 |

13.8%

|

| October | $16.33 | $16.63 | $16.92 |

-25.1%

|

| November | $15.30 | $15.93 | $16.56 |

-26.7%

|

| December | $15.02 | $20.93 | $26.83 |

18.7%

|

The co-founder of Chainlink, Sergey Nazarov, stressed that the tokenization of the assets will also stimulate the flow of capital in the conventional markets. Such collaboration, as well as other forthcoming ones highlight the relevance of Chainlink as a critical infrastructure on a dynamic blockchain ecosystem.

What’s Next for Chainlink?

Chainlink price is gaining traction since Chainlink remains on its momentum; a close eye is kept on the $24 resistance angle. In the event that LINK manages to breach this ceiling and proceed with its bull run, analysts reckon that it may aim at the $30 level.

Chainlink has a bullish outlook due to increasing institutional interest, the success of the staking mechanism and the strategic partnership deals that Chainlink has. Another aspect that is likely to ensure long-term growth by Chainlink is the inclusion of the asset in the tokenization of real-world assets.

Conclusion

The recent rally and very high price of Chainlink price has brought considerable buzz to the crypto world, as analysts are already forecasting an additional increase of this asset in the following months. A high-potential technical indicator and the backing of institutions assure Chainlink that it will accelerate further in the future.

Moreover, it plays a critical role in the tokenization of real-world assets, which further reinforces its chances to succeed in the long-term perspective. The resistance point of $24 is a point to monitor, as in case it is successfully overcome, this will likely mark the beginning of a new bullish cycle of LINK.

Also read Chainlink Whales Add $97M in LINK: Price Targets $95

Summary

Chainlink price has gained 39% over the last week, and expectations of a surge in the price once more are high as it currently trades at $24.60. Analysts observe bullish momentum, and the critical resistance is at $24. Effective breakouts may see LINK going to $30.

It is growing on the basis of institutional interest and a healthy staking mechanism, and it is a critical aspect in the tokenization of real-world assets. Together with its powerful technical signals and a list of close ties with partners, Chainlink stands a chance of becoming vast and returning to the prices it had once before, taking its position within the blockchain gamut.

Frequently Asked Questions (FAQs)

1- Why is Chainlink seeing a surge in price?

The surge is attributed to growing institutional interest, the adoption of its staking mechanism, and its strategic positioning in the expanding tokenized real-world asset market.

2- What is the significance of the $24 resistance level for Chainlink?

The $24 resistance level has been a key barrier during previous rallies. If Chainlink can break above this level, analysts believe it could quickly reach the $30 target.

3- How does Chainlink’s staking mechanism work?

Chainlink’s staking system allows users to lock up LINK tokens, securing the network and earning a yield. This reduces the circulating supply of LINK, creating upward buying pressure on the price.

4- What role does Chainlink play in the tokenization of real-world assets?

Chainlink acts as the decentralized oracle infrastructure for tokenizing real-world assets like equities, treasuries, and real estate, enabling capital movement across markets.

Appendix: Glossary of Key Terms

Chainlink (LINK): A decentralized oracle network that enables smart contracts to securely interact with real-world data.

Oracle: A system that provides external data to blockchain networks for smart contract execution.

Tokenization: The process of converting real-world assets into digital tokens on a blockchain.

Staking: The act of locking up cryptocurrency to support network security and earn rewards.

RSI (Relative Strength Index): A technical analysis indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

Whales: Large investors who hold substantial amounts of cryptocurrency.

Real-World Assets (RWAs): Physical or financial assets that are tokenized on the blockchain, such as real estate or commodities.

References

Cointelegraph – cointelegraph.com

FXLeaders – fxleaders.com

Cryptopotato – cryptopotato.com

Read More: Chainlink Price Surge: Will LINK Reach $30 After 39% Weekly Gain?">Chainlink Price Surge: Will LINK Reach $30 After 39% Weekly Gain?

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.