Robinhood’s Tokenized Stock Plan Threatens NYSE Fees, Galaxy Says

0

0

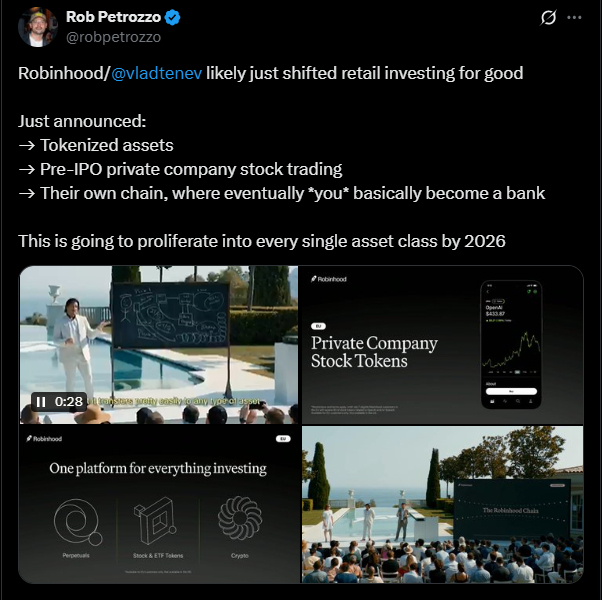

Robinhood Markets is rolling out blockchain-based stock tokens, a move analysts say could siphon trading volume – and fee revenue – from the New York Stock Exchange.

On June 30 Robinhood launched tokens for 200+ U.S. stocks and ETFs for its EU customers, including shares of Nvidia, Apple and Microsoft.

These commission-free tokens trade nearly round-the-clock (five days a week) now, and Robinhood plans full 24/7 trading when its own “Robinhood Chain” (an Ethereum-compatible Layer-2 on Arbitrum) goes live.

In a July 5 research report, Galaxy Digital warns that shift could drain the deep pools of liquidity on traditional venues.

Robinhood’s token engine lets users trade “real market” stocks as on-chain derivatives, bypassing regular exchange hours.

Galaxy notes this could “shift trading volume away from traditional exchanges like the NYSE, undermining their core revenues from trading fees and market data”.

Robinhood’s 24/5 Token Trading

At a Paris event this week, CEO Vlad Tenev detailed Robinhood’s plan. The firm has partnered with Arbitrum to issue tokens backed 1:1 by custodial shares at a U.S. broker-dealer.

EU users can buy or sell these tokens at the actual market price of the underlying stock. The tokens began trading nearly 24/5 on Robinhood’s platform.

By year‑end Robinhood aims to issue “thousands” of stock tokens and to expand trading fully 24/7. (Robinhood’s US-listed shares jumped nearly 10% on the news.)

Under the design, actual stock ownership stays with the broker‑dealer and Robinhood mints or burns tokens on blockchains for each trade.

Users can self-custody tokens or plug into DeFi, unlocking features (like using shares as collateral or auto-dividends) that traditional equities can’t provide.

Robinhood’s tokenization push includes more than 200 U.S. equities and ETFs, such as Nvidia, Apple, and Microsoft, made available to European traders.

These tokenized assets are currently tradable around the clock on weekdays (24/5), with the company aiming to enable full 24/7 trading once its proprietary Layer-2 blockchain goes live.

As of May 2025, Robinhood reported approximately 25.9 million funded accounts, with equity trading volume for the month reaching $180.5 billion — a 108% year-over-year increase.

In contrast, traditional exchanges like those operated by Intercontinental Exchange (ICE), which includes the New York Stock Exchange (NYSE), brought in around $5.0 billion in net revenue in 2024, with the bulk derived from trading fees and market data services.

Meanwhile, Coinbase’s Base — a rollup chain using a similar infrastructure to Robinhood’s upcoming network — currently generates about $150,000 in daily sequencer fees, all retained by Coinbase.

Galaxy Digital Flags Liquidity Drain

In its report, Galaxy Digital argues Robinhood’s token plan could “directly challenge the deep concentration of liquidity” on incumbent exchanges.

By moving even a slice of trading off traditional venues, Robinhood “could shift trading volume away” from places like the NYSE and “erode the exchanges’ activity and core revenue streams, which rely on trading fees and the sale of market data.”

In other words, every stock transaction that occurs on Robinhood’s chain is one fewer trade (and fee) on a venue like NYSE Arca or Nasdaq.

Galaxy notes that under Robinhood’s architecture, Robinhood itself would capture all trading fees. Because it controls the sequencer and holds the tokenized assets, Robinhood would collect every trading spread and fee on its network.

By contrast, incumbent exchanges must share a portion of fees with regulators, market makers and data distributors.

The report points out that Coinbase’s Base rollup already nets roughly $150k per day in on-chain fees – revenue that goes straight to Coinbase.

Robinhood’s model “allows the company to monetize the full ‘tokenization stack’ from offchain trading to onchain utility,” Galaxy writes.

This is significant because stock exchanges earn most of their profit from transaction fees and data. Intercontinental Exchange (ICE), which owns the NYSE, reported about $5.0 billion in net exchange revenue for 2024.

Even a modest shift in volume could dent such figures. Galaxy emphasizes that if multiple brokerages adopt similar tokenization, the impact could be immense: traditional exchanges might be left “custodians of a less functional version of the same assets,” the report warns.

Regulatory Outlook and Reactions

Robinhood’s stock tokens are currently only available to European users. The U.S. Securities and Exchange Commission has so far not blessed this model.

Indeed, the U.S. securities industry lobby (SIFMA) has urged the SEC to bar tokens from trading outside the normal U.S. trading system (Regulation NMS).

It remains unclear whether SEC approval will be required once Robinhood or others extend token trading to U.S. accounts.

Robinhood’s CEO hinted the company will eventually launch its own blockchain (hence the Arbitrum-based rollup) and pursue 24/7 trading, but regulators have yet to sign off on that plan.

Outside the U.S., the token push has already stirred publicity. Robinhood is even offering tokens for private-company shares (like OpenAI and SpaceX), although OpenAI quickly noted those tokens are not actual equity in its company.

Separately, other exchanges are watching closely: last month Kraken began offering U.S. stock tokens to non-U.S. users, and Coinbase is developing its own stock-perpetual-futures products.

The post Robinhood’s Tokenized Stock Plan Threatens NYSE Fees, Galaxy Says appeared first on The Coin Republic.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.