Uniswap Price Forecast – Will UNI Reach $10 as Bulls Breach Key Resistance?

0

0

Highlights:

- The price of Uniswap has broken resistance and risen 2% to $8.32 in the past 24 hours.

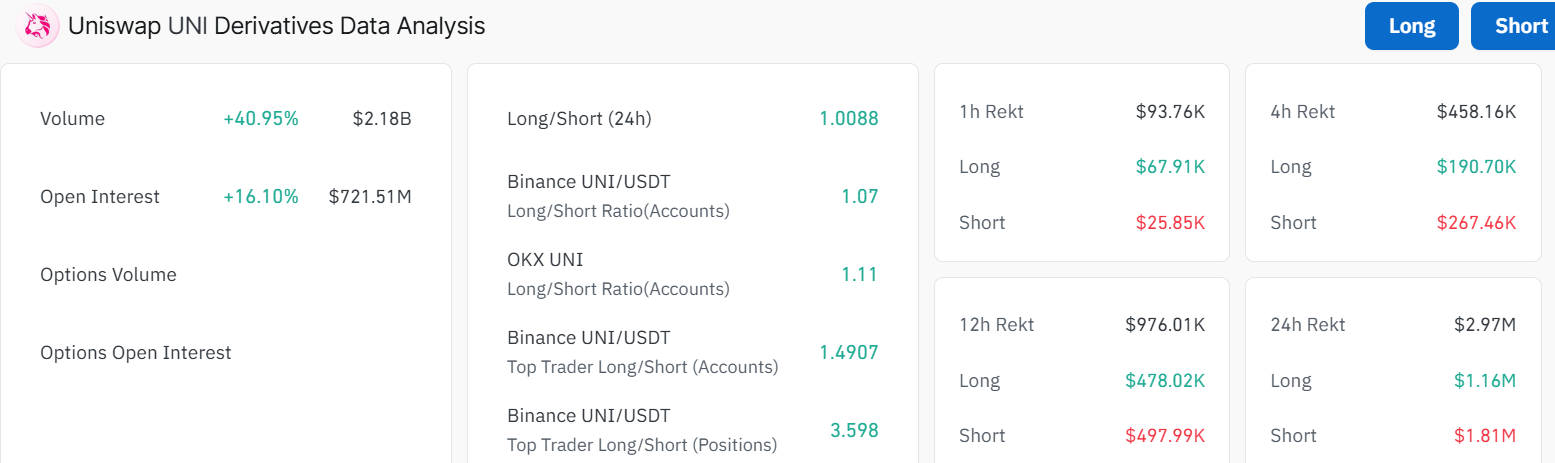

- UNI’s derivatives market shows increased activity, with volume up 40.95% and open interest rising by 16.10%.

- Analysts predict a potential rise to $10 if support at $6.15 holds.

The Uniswap price has broken above the resistance zone, up 2% to $8.32, showing traces of recovery. However, its daily trading volume has dropped 4% to $864M, signalling a drop in market activity. Currently, UNI is boasting a 31% surge in the past week and a 16% increase in a month, indicating bolstered bullish momentum.

Uniswap Price Technical Outlook

Meanwhile, the bulls have established a strong support at $6.15, giving the bulls hind wings for further upside. If the bullish grip strengthens, the bulls may overcome the $9.27 resistance mark, opening the doors for further upside. According to a well-known crypto analyst, Ali Martinez, the Uniswap price may be poised for a rally to $10 as it has broken out with momentum.

#Uniswap $UNI is breaking out with momentum and now has its sights set on $10! pic.twitter.com/PClvcLBe3a

— Ali (@ali_charts) June 11, 2025

The Relative Strength Index (RSI) of 68.26 shows UNI is approaching the overbought region. However, more bullishness may be witnessed in the market. The Moving Average Convergence Divergence (MACD) indicates positive developments, as it is situated above the signal line.

If the bulls keep dominating the market, UNI could be poised for a rally to $10, only if they overcome the key barrier at $9.27. On the downside, if the $9.27 resistance proves too strong, the Uniswap price may drop to $7.72, $6.69, and $6.15 support zones. In the meantime, the buy signal from the MACD calls for traders and investors to buy more UNI.

Bullish Market Sentiment and UNI Derivatives Data

The derivatives market UNI is attributed to the confidence that the institutional and retail traders are gaining. The volume has soared by 40.95% to 2.18 billion within the past 24 hours. Additionally, the open interest has increased by 16.10%, indicating that an increasing number of traders are wagering their bets on the future price action of UNI.

The Long/Short ratio is 1.00, which shows that the balance between long and short positions is good, but the preference is given to long positions slightly. This positive energy is reflected in the increasing euphoria in the market as traders remain bullish on the Uniswap price.

UNI Price Key Support and Resistance Levels to Watch

At this moment, UNI is in a crucial stage, according to market analysts. This comes as it has managed to escape a protracted downtrend. Professor Moriarty, a famous analyst in the field of cryptocurrencies, has emphasized that it is necessary to hold support at the level of $6.15 to validate a potential rise to $10.3 and beyond.

After several failed attempts, $UNI finally broke through a strong multi-month downtrend and a key resistance zone

If $UNI can retest and hold this level as solid support, we could be looking at a move toward $10.3, and possibly higher

Keep watching

pic.twitter.com/wAH2IqipKh

— Professor Moriarty (@Moriarty_web3) June 11, 2025

All in all, the increasing volume of trading and open interest depicts that there is a substantial demand for UNI. The token might be gaining momentum and may experience a more prolonged price increase in the long-term perspective. Furthermore, the institutional interest, as revealed by the derivatives data, demonstrates that the ecosystem of UNI is most likely to grow even bigger.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.