Bybit & Block Scholes Report: BTC Options Flipped Put-Call Skew After ATH

0

0

BitcoinWorld

Bybit & Block Scholes Report: BTC Options Flipped Put-Call Skew After ATH

Dubai, United Arab Emirates, July 14th, 2025, Chainwire

Bybit, the world’s second-largest cryptocurrency exchange by trading volume, has released its latest crypto derivatives analytics report with Block Scholes, outlining BTC’s solid price action in the previous week with positive movements all around from ETH to altcoins.

Key Insights:

- Price Surge Uplifted Option Interest and Funding Rates: Perpetual trading volume on Bybit hit a monthly high at $11.1B by the end of the week after a lackluster July thus far, following BTC’s breakthrough to $115k on July 9. Following weeks of fluctuation, overall funding rates for assets, including BTC, turned consistently positive, with BTC suffering only 8 hours of negative funding rates a day before its ATH over Trump’s tariff remarks.

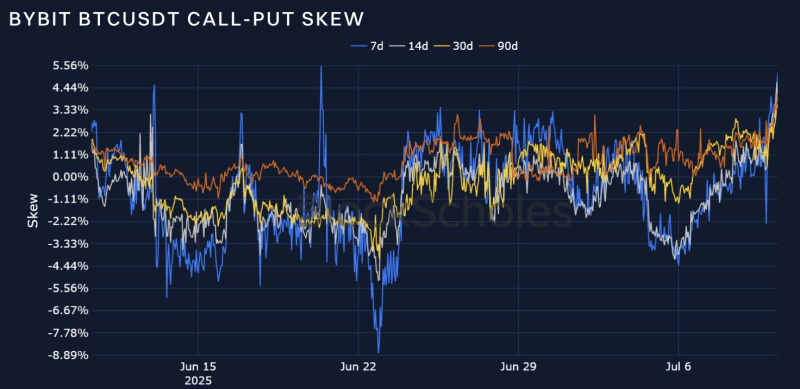

- BTC Options Reversed Course: BTC’s options market sentiment underwent a dramatic reversal at the price surge on July 9th, with put-call skew flipping from a 2% premium favoring downside protection to a 5% premium on upside calls, indicating traders are increasingly positioning for further BTC price appreciation despite the asset’s already substantial gains.

Source: Bybit and Block Scholes

Source: Bybit and Block Scholes

- Altcoins Outperformed BTC: Notably, altcoins demonstrated competitive gains against BTC, with ETH and XRP each surging over 6% compared to BTC’s relatively modest gains to its new ATH of $112K—just $29 above the May peak. While BTC options maintained rangebound implied volatility between 26-35%, the altcoin rally highlighted shifting market dynamics, though SOL lagged with only a 2% weekly gain despite strong ecosystem fundamentals, including record-breaking Q2 revenue of $271M that outpaced all other Layer 1 and Layer 2 networks.

For detailed insights, readers may download the full report.

#Bybit / #TheCryptoArk / #BybitLearn

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 70 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open, and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: media@bybit.com

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

Contact

Head of PR

Tony Au

Bybit

tony.au@bybit.com

This post Bybit & Block Scholes Report: BTC Options Flipped Put-Call Skew After ATH first appeared on BitcoinWorld and is written by chainwire

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.